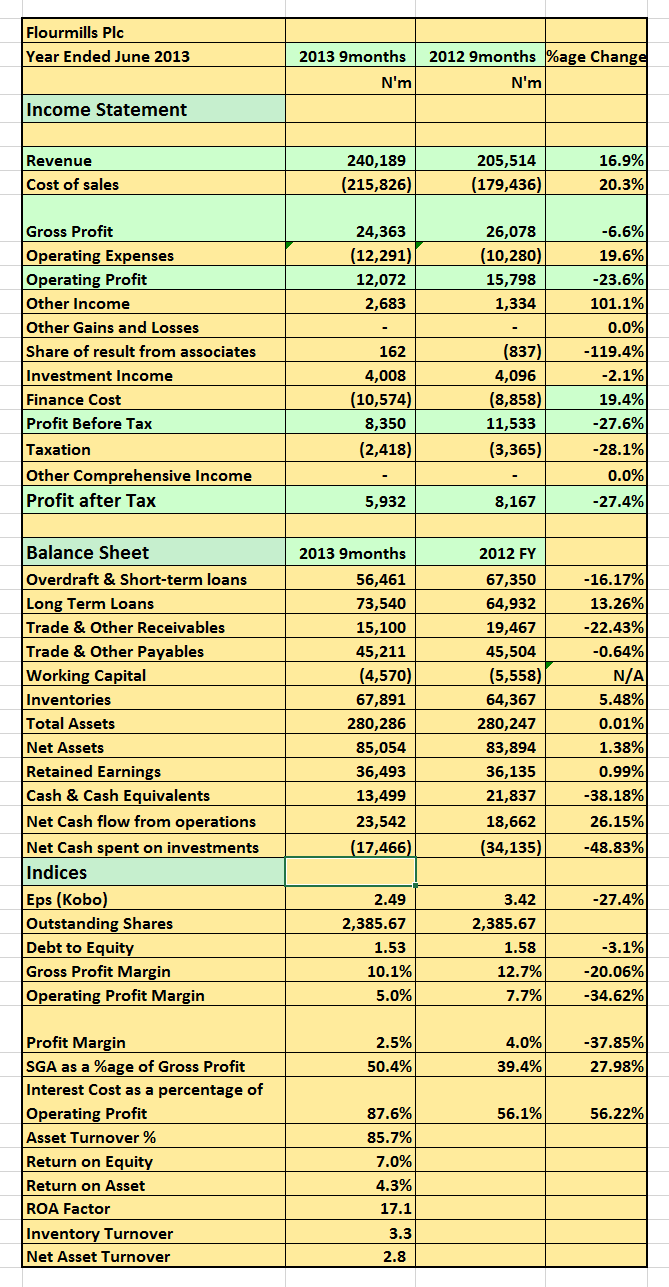

Flourmills PCL released its 2013 9 Months to December results showing a 17% rise in revenue year on year to N240billion. Gross profit however dropped 6.6% to N24billion. Pre-tax profits at the end of the period was N8.3billion a 28% drop compared to the year before.

Key Highlights & Observations

- Gross profit margin dropped this period to N24billion. A closer look reveals the company’s gross profit margin in the last 7 quarters hovered between 17% to 8%.

- This is an investor’s nightmare as it makes it difficult to predict trends in gross profit margins.

- For example, Wheat prices were relatively stable in 2013 and did in fact drop more than it rose. You then wonder what was making gross profit margin so volatile.

- I also observed the drop in operating profit margin this period compared to 12 months ago was reflective in all the quarters. On a QoQ basis operating expenses bit more of Gross Profit helping the company post a 24% drop all together. Badly hit was Q3 2013 (Sept – Dec) with the company posting a N2.7billion operating profit.

- Flourmills is also highly leveraged even though most of its loans are related party loans. Interest sliced off 87% of adjusted operating profit with the bulk of it (N5billion) occurring between Oct – Dec 2013.

- It is not in our style to invest in companies with such a high income and expense volatility. Though, one of the biggest companies in Nigeria by revenue there is little in here for a long term investor to be excited about….. except off course you bought the shares below intrinsic value.

- The company to be fair has embarked on a number of restructuring which include selling off loss making businesses and acquiring likely profitable ones.

- They have also raised equity and invested heavily in PP&E. Could all this yield fruit in the long term? Possibly. But for now a peek into its history gives me some concern.

- Flourmill’s profitability is mostly from Other Income and Investment Income which combined, contributed N10b in the FY results of March 2013. It has contributed N6billion already this year. Take that out and the rest is… You guessed right.

- One wonders what the Q4 result my look like? Will it be a loss (it lost N4.9billion in Q4 2013 to March) or will we see tepid profits. Who knows maybe PAT at the end of Full year may not be much different from N6billion posted in the first 9 months.

- Flourmills Plc is neither in our stock pick nor is it in our portfolio.

Flourmills PCL released its 2013 9 Months to December 2013 result in the website of the NSE