MRS Oil Nigeria Plc 2013 9 Months Results ↓

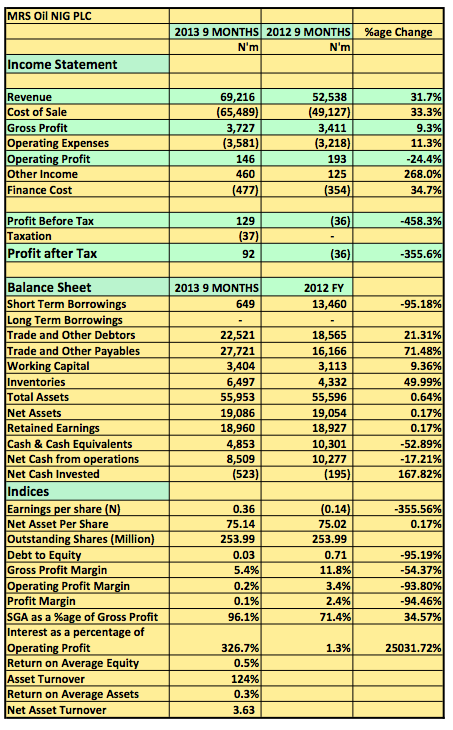

MRS Oil Plc released its 2013 9 months financial statements showing a YoY revenue growth of 32% to N69billion (2012 9 months: N52.5billion). Gross Profit also rose 9% YoY to N3.7billion in the period under review. Operating profit for the 9months results however dipped YoY to N146billion (2012 9 Months: N193billion). The company ended the period with a pre-tax profit of N129billion reversing the N36million loss it posted same period 2012. [upme_private]

Results for Q1-Q3 2013

Analysis – Key Highlights

- The rise in revenue for this year compared to last was mainly driven by rising sale of PMS (fuel). PMS sales rose 37% to N51.4billion as at September 30, 2013 compared to N37.9billion a year before.

- There were also considerable increases in other products such as Diesel, Aviation fuel, Kerosene, Lubricants etc.

- Despite rising sales, Gross Profit margins continue to dip as rise in cost of sale continued its increase this year. Cost of sale has risen from N15billion Q1 to N28billion Q2 only just dropping to N22billion in Q3. The company provided no breakdown of cost of sale or gave no guidance to why it has been on an increase all year round.

- The rise in Cost of sale was basically the reason for low profit margins as its impact cascaded all the way to bottom line.

- At 5.4% its Gross Profit margin is way below the industry average of about 11% (not taking MRS into consideration).

- The company’s debt to equity is still very low despite taking in additional N300million in overdraft in Q3 this year. This probably resulted in a high net finance cost of N316million between in the quarter July-September 2013.

- Without the other income of N460million this year, MRS could have posted a loss. It earned about N206million in income from use of its Storage Facilities in the period under review

- MRS Oil still has good fundamentals. It has a strong working capital, very low debt and comfortable retained earnings. However, this may all be in jeopardy if its rising cost of sale is not put in check.

- Its share price rose to N43.21 on release of the result and is currently trading at (at time of this blog post) N47.63 a 10% rise. Its Price Earnings Ratio is 59x however it still trades at a 37% discount to Book Value per share. A huge chunk of its Net Book Value is represented by Land and Building of about N14.4billion and Plant and Machinery N9.9billion

- Investors probably believe the result this year is a blip and that MRS can actually improve bottom line if its deploys its resources better.

- MRS profits was down 66% at the end of 2012 compared to 2011. There are currently no indications that this trend is about to change. I will be surprised of the post profits above N200million this year. Remember, they only posted profits in the second quarter of the this year. Q1 and Q2 have all been losses.

- MRS is in our watch list as we continue to monitor its results.

MRS Oil Plc released its 2013 9 Months Interim Results in the website of the NSE[/upme_private]