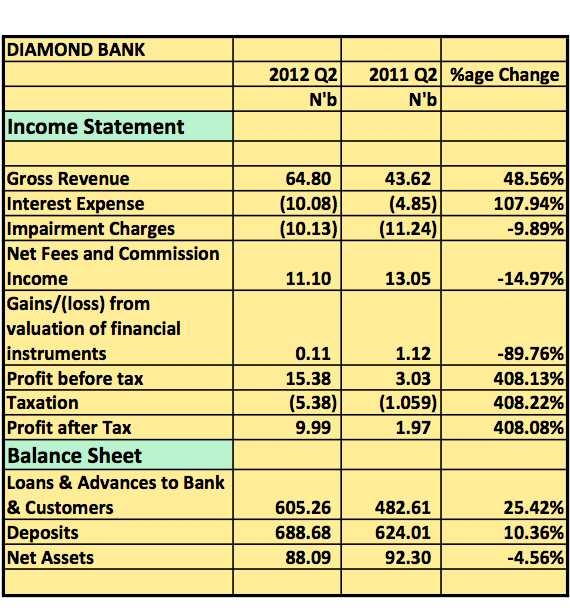

Continuing with my reports for the earnings season, Diamond Bank released its financial results for Q2 2012 and is widely hailed as a possible reversal of the bank’s fortunes which in the past year had dipped. The bank reported that its Q2 profit after tax had increased over 400% from N1.9b a year ago to N9b Q2 2012. See below;

Whilst the bank made huge strides in profitability its revenue grew by just 48.5%, still high by industry standards. Only very few banks will match this result at the end of this quarter when results trickle in. The bank has also seen a steady rise in share price over the last few months as this graph shows;

Diamond Bank – 13, July 2011 – 11, July 2012

The Bank is yet to attain its year high of N5.25 but is obviously on the path to getting there.

Bottom Line

Diamond Bank was badly bruised last year following its N6.5b loss for the year ended Dec 2011 so this result is surely a sign of progress. There is still enough to be worried about for any value investor seeking to invest in the bank on the long term. Net Assest is till 4.5% lower than where it was last year, deposits though increased is still below the N8oom to N1tr threshold which I believe is necessary if revenue from from Fees and Commissions are to compliment expenses from interest income and losses. Loans and advances also increased 25% this quarter from the same period last year, which shows the bank is aggressively lending. Whilst this is important for Interest Income to increase it often leads to more losses especially in an economy that still has many companies and individuals seeing their income dip. Losses and dip in income for companies and individuals respectively often lead lead to loan defaults exposing the banks to more losses, their achilles heel. However, for an investor seeking for quick returns, Diamond Bank is a significant buy opportunity. It appeared on my earlier blog as the top banking stock to watch for the second half of this year. Stanbic IBTC projected a N6 share price for the end of the year. A buy now, based on the report may provide a 200% return on share price. See more here ===>> Corporate Broadcast -DIAMONDBNK 11July2012b and IBTC Diamond Bank REPORT