The Nigerian currency, Naira, ended the month of June with a slight depreciation against the US dollar at the Investors and Exporters (I&E) window.

According to data from FMDQ Securities Exchange, the Naira closed at N769.25 to a dollar on Friday, June 30, 2023, a 0.82% drop compared to N763 to a dollar on Tuesday, June 27, 2023.

According to a recent report by Bank of America analysts, the Nigerian naira has undergone a significant shift in its valuation after the foreign exchange reform that enabled the naira to float freely. The report, dated June 28, stated that the naira has changed from being overvalued to undervalued, implying a potential for appreciation in the future.

The daily currency update tracked and compiled from FMDQ Exchange according to Nairametrics, a leading financial news platform in Nigeria, revealed that the naira experienced a significant depreciation against the dollar on Monday, as it opened at N758.56 and closed at N769.25.

The naira also fluctuated within a wide range of N461.50 and N841 to a dollar during the day, indicating high volatility in the currency market.

The foreign exchange market witnessed an increase in its daily turnover on Wednesday, as it reached $263.45 million, up by 7.25% from the previous day’s figure of $245.65 million.

According to the Central Bank of Nigeria (CBN), the country’s foreign exchange reserves experienced a slight decrease on Tuesday, 27th June 2023, dropping from $34.22 billion on Monday to $34.19 billion. This represents a 0.09% decline in the external reserves, which are vital for maintaining the stability of the naira and facilitating international trade.

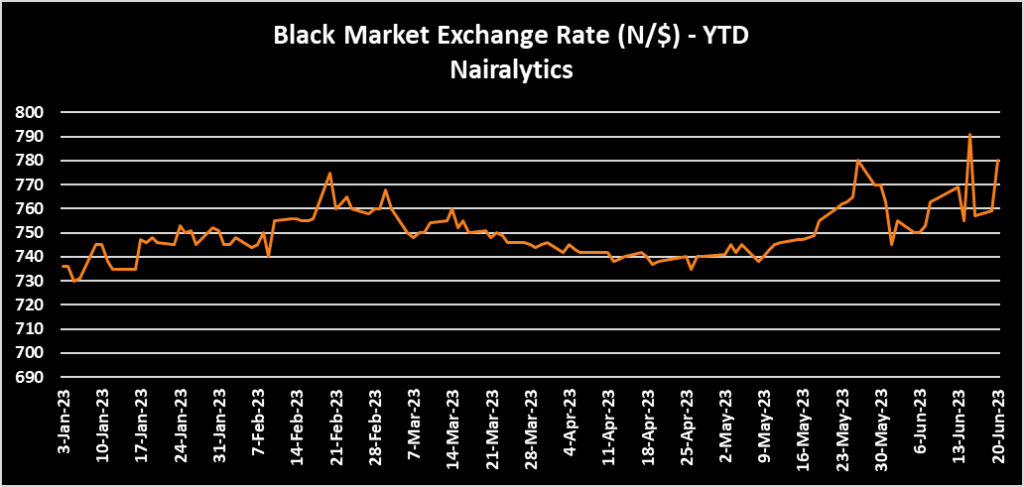

The black-market exchange rate of the Naira to the US Dollar remained unchanged at N770/$1, according to BDC traders’ reports. This was the same rate as the previous day’s trading session, indicating a stable trend for the Naira.

Similarly, the Naira maintained its value against the Euro, exchanging at an average rate of N840/€1 on June 30, 2023, showing no change from the previous day’s session.

On June 30, 2023, the Naira gained value against the British Pound, closing at an average rate of N995/£1. This was a 0.50% improvement from the previous day, when the Naira exchanged at N1000/£1.

The FX rate for cryptocurrency P2P Exchange market showed a marginal increase of 0.04% on Friday 30, June 2023, closing at N773.29/$1. This was a slight improvement from the previous trading session, when it was N773.61/$1.

The debt market size of the exchange increased slightly to N38.44 trillion on Friday 30th June 2023, compared to N38.52 trillion on Tuesday 27th June 2023.

The Money market overnight rate, which reflects the cost of borrowing funds for one day, dropped to 2% on Friday 30th June 2023. This was a decrease of 14 basis points compared to the rate of 2.14% on Tuesday 27th June 2023, while the Open Repo rate, which measures the cost of borrowing short-term funds, remained unchanged at 1.36% in the latest trading session, indicating that the liquidity conditions in the market were stable.

Naira appreciates against the US dollar, trades at N767/$1 on June 23, 2023

In our close of the week currency update, we bring you the latest developments in the Nigerian Naira’s exchange rates against major currencies. As of Friday, June 23, 2023, the Naira showcased notable appreciation against the US Dollar, while experiencing slight fluctuations with the British Pound and Euro.

According to reports from BDC traders, the Naira strengthened against the US Dollar, trading at an average exchange rate of N767/$1 on the black market. This marks a significant increase of 0.65% compared to the previous day’s trading session where the Dollar traded at N772/$1.

In a similar vein, the Naira saw a slight appreciation against the British Pound, with an average exchange rate of N970/£1 on June 23, 2023. This indicates a 0.51% increase from the previous day’s trading session where the Naira traded at N970/£1.

However, the Naira experienced a 0.61% depreciation against the Euro, trading at an average exchange rate of N830/€1 on June 23, 2023. This contrasts with the previous trading session where the Naira traded at N825/€1.

It is important to understand that currency fluctuations are a natural occurrence in the global foreign exchange market. Factors such as economic indicators, geopolitical events, and market sentiment contribute to the dynamic nature of currency valuations. Staying informed about these factors is crucial for investors and individuals involved in currency trading to make well-informed decisions.

Furthermore, it is worth noting that black-market exchange rates can vary significantly across different locations within the country. These variations arise due to factors such as survey timing, supply and demand dynamics, purchasing power, and other relevant economic considerations.

Breakdown of the currency rates as of June 23, 2023 is given as below:

Naira/Dollar (NGN/USD)

- Buy rate – N763/$1

- Sell rate – N767/$1

Naira/Pound (NGN/GBP)

- Buy rate – N952/£1

- Sell rate – N970/£1

Naira/Euro (NGN/EUR)

- Buy rate – N815/€1

- Sell rate – N830/€1

However, at the cryptocurrency P2P Exchange market, the FX rate experienced a slight appreciation, trading at a minimum of N774.66/$1 on Friday 23, June 2023. This represents a 0.53% increase from the last trading session when it recorded N778.80/$1. These figures are according to data obtained from a P2P exchange platform.

Breakdown of the peer-to-peer rates is given below:

Naira/Dollar (NGN/USD)

- Buy rate – N772.00/$1

- Sell rate – N774.66/$1

Exchange market closes at N765.13/$1 at official market on 22nd June 2023

The official exchange market ended the trading day on 22nd June 2023 with the naira at N765.13 per US dollar. This was a slight decrease from the previous day’s rate of N763.17 per dollar.

In a major policy shift, the Central Bank of Nigeria (CBN) unified all foreign exchange (FX) market segments under the Investors and Exporters (I&E) window on June 14, 2023. This means that the official, parallel and other market rates would no longer exist, and all transactions would be done at the I&E rate. This move was aimed at improving FX liquidity and transparency in the country.

This is according to Nairametrics daily currency update, based on data tracked and compiled from FMDQ Exchange.

On Thursday 22nd June 2023, the I&E forex exchange window recorded a 1.66% drop in the opening rate of the naira against the dollar. The exchange rate was N753.5/$1, compared to N741.21/$1 in the previous session.

The Nigeria naira recorded the highest rate of N801 to a dollar within the day’s trading, this represents a 1.72% decline from the previous day’s rate of N815/$1. The IEFX exchange market recorded a 6.24% appreciation in the lowest rate, which closed at N466.32/$1 from N476/$1 in the previous session.

Trading volume surged by 112.4% on Thursday at the official Investors and Exporters window, where $204.84 million was traded, compared to $96.44 million in the previous session.

The country’s foreign exchange reserves, which are assets held by the central bank in foreign currencies, bonds and other securities, declined slightly by 0.12% to $34.45 billion on Tuesday, 20th June 2023. This was a drop of $40 million from the previous day’s level of $34.49 billion.

Other indices

- The exchange’s debt market size rose marginally to N38.54 trillion on Thursday 22nd June 2023, from N38.5 trillion on Wednesday 21st June 2023.

- The Money market overnight rate fell sharply by 2.9 percentage points to 9% on Wednesday 20th June 2023, from 11.9% on the previous day. The Open Repo rate decreased significantly by 2.67 percentage points and reached 8.83% today. This is a sharp contrast to the previous session’s rate of 11.5%.

- The S&P Sovereign Bond index recorded a N635.7 index level on Wednesday 21st June 2023. The index grew by 1.89%, 3.91% and 3.49% for the month, quarter and year respectively.

- On Wednesday, 21st June 2023, the NAFEX rate experienced a notable decline of 0.72%, closing at N732.79/$1. This was a sharp contrast to the previous day’s rate of N727.58/$1, which was recorded on Tuesday 20th June 2023.

- The Nigerian Inter-Bank Offered (O/N) rate for overnight lending was 11.96% on Wednesday, 21st June 2023. The longer-term rates for 1-month, 3-month and 6-month lending were 12.43%, 13.18% and 13.65%, respectively.

- The Nigerian Inter-Bank Treasury Bills True Yields (NITTY) showed a mixed trend on Wednesday, 21st June 2023. The shortest tenor (1-month) recorded a slight decline to 3.74%, while the longer tenors (3-month to 12-month) increased to 4.79%, 6.11%, 7.94% and 8.66%, respectively.

Naira depreciates to N763.17/$1 at official market on 21st June 2023

The US Dollar gained more value against the Nigeria naira at the I&E forex market on Wednesday, 21st June 2023. The exchange rate was N763.17 per dollar. The exchange rate of the naira to the dollar fell by 0.87% to close at N763.01 on Wednesday. This was lower than the previous day’s closing rate of N756.61 per dollar.

The Nigerian naira hit a record low on the official forex market on Wednesday 14th June 2023, after the Central Bank of Nigeria (CBN) announced a full liberalization of the exchange rate regime. The CBN said it would allow banks to trade the naira against the dollar and other foreign currencies at any rate they choose, without any intervention or restriction. The move was aimed at improving liquidity and transparency in the forex market, but it also triggered a sharp depreciation of the naira, which fell by more than 20% in one day.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The I&E forex exchange window opened at N741.21/$1 on Wednesday 21st June 2023, showing a 5.62% decline from N701.75/$1 in the previous session.

An exchange rate of N815 to a dollar was the highest rate recorded within the day’s trading which is 4.35% lower than the rate of N781/$1 that was recorded in the previous day/s session, while the lowest rate at the IEFX exchange market closed at N476/$1 from N465/$1 that was recorded in the last trading session.

However, the official Investors and Exporters window saw a 28.28% decline in trading volume on Wednesday, with only $96.44 million changing hands. This was a significant drop from the previous session’s $134.47 million. As of Monday, 19th June 2023, the nation’s external reserves had dropped to $34.49 billion, a slight decrease from $34.59 billion on Friday, 16th June 2023.

Other indices

- The debt market size of the exchange as of Wednesday 21st June 2023 was N38.5 trillion, which was 1.56% higher than the debt market size of N37.91 trillion on Tuesday, 20th June 2023.

- On Wednesday 20th June 2023, the Money market overnight rate dropped by 20 basis points to 11.9%, compared to 12.1% in the previous trading session. The Open Repo rate fell by 10 basis points to 11.5%, compared to 11.6% in the previous session.

- The S&P Sovereign Bond index, which tracks the performance of government bonds issued by 22 countries, stood at N634.92 index level on Tuesday 20th June 2023. The growth rates for this month, quarter and year are 1.77%, 3.79% and 3.36% respectively. This is a summary of the performance indicators for the period under review.

- The NAFEX rate, which reflects the official exchange rate of the naira to the dollar, fell by 6.97% to N727.58/$1 on Tuesday, 20th June 2023. This was a significant drop from N680.2/$1 recorded on the previous day, Monday 19th June 2023.

- The overnight tenor rate for the Nigerian Inter-Bank Offered (O/N) was 11.95% on Tuesday, 20th June 2023. The rates for the 1-month, 3-month and 6-month tenors were 12.55%, 13.50% and 14.13%, respectively.

- The 1-month tenor rate of the Nigerian Inter-Bank Treasury Bills True Yields was 3.47% on Tuesday, 20th June 2023. The rates for the 3-month, 6-month and 8.55% tenors were 4.70%, 6.19% and 8.55%, respectively.

Exchange rate appreciates to N756.61/$1 at I&E window on 20th June 2023

The exchange rate between the Nigeria naira and the US Dollar strengthened to close at N756.61/$1 on Tuesday, 20th June 2023 at the Investors and Exporters (I&E) foreign exchange window, representing an 1.79% appreciation from the close of N770.38/$1 that was recorded in the previous day trading session.

On Wednesday 14th June 2023, the CBN officially unified all segments of the forex market, allowing banks to freely trade the national currency against the dollar and other global currencies at any rate, thereby resulting in the local currency plunging to all-time low on the official foreign exchange market.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

Trading at the IEFX exchange market opened at N701.75/$1 on Tuesday 20th June 2023, an 0.25% appreciation from N703.5/$1 that was recorded in the last trading session.

The highest rate at the IEFX exchange market during the intra-day trading recorded a gain of 2.25% to close at N781/$1 on Tuesday 20th June 2023 compared to the closing rate of N799/$1 that was recorded in the last trading session, with a forward rate of N704.89/$1.

The lowest rate at the IEFX exchange market closed at N465/$1 on Tuesday 20th June 2023, from N461/$1 that was recorded in the last trading session, with a forward rate of N704.89/$1.

However, the I&E forex window recorded a total turnover of $134.47 million at the close of trading on Tuesday 20th June 2023, which is 72.33% higher than the $78.03 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $34.59 billion as of Friday, 16th June 2023, from $34.62 billion recorded as of Thursday, 15th June 2023.

Other indices

- DEBT: The exchange debt market size as of Tuesday 20th June 2023 stood at N37.91 trillion, a depreciation of 0.71% from the debt market size of N38.18 trillion recorded on Monday, 19th June 2023.

- The Money market overnight rate stood at 12.10% on Tuesday 20th June 2023, same rate it recorded in the previous trading session. Likewise, the Open Repo stood at 11.60%, the same rate that was recorded in the last trading session.

- The S&P Sovereign Bond index stood at N634.68 index level on Monday 19th June 2023 from 633.96 points recorded in the last trading day. This brings the month-to-date growth to 1.73%, the quarter-to-date growth to 3.75% while the year-to-date growth to 3.32%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate stood at N680.2/$1 on Monday, 19th June 2023, a 0.98% appreciation from N686.96/$1 that was recorded on Friday 16th June 2023.

- NIBOR: The Nigerian Inter-Bank Offered overnight (O/N) tenor rate stood at 12.06% as of Monday, 19th June 2023. 1-month tenor (12.59%), 3-month (13.31%), while the 6-month tenor stood at 13.99%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 3.26%, on Monday, 19th June 2023.

- 3-month – 4.77%

- 6-month – 6.04%

- 9-month – 7.46%

- 12-month – 8.56%

Naira fell to N770.38/$1 at Official market on 19th June 2023

The Nigeria Naira weakened against the US Dollar at the Investors and Exporters (I&E) foreign exchange window to close at N778.38/$1 on Monday, 19th June 2023. This signifies a significant depreciation of 16.19% compared to the close of N663.04/$1 that was recorded in the last trading session on Friday.

The CBN officially unified all segments of the forex market on Wednesday 14th June 2023, allowing banks to freely trade the national currency against the dollar and other global currencies at any rate.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The IEFX exchange market recorded an opening indicate rate of N703.5/$1 on Monday 19th June 2023, an appreciation of 1.26% from N712.5/$1 that was recorded on Friday 16th June 2023.

The highest rate at the IEFX exchange market during the intra-day trading closed at N799/$1 on Monday 19th June 2023. This represents a 1.01% depreciation from the closing rate of N791/$1 that was recorded in the last trading session, with a forward rate of N712.14./$1.

The lowest rate at the IEFX exchange market closed at N461/$1 on Monday 17th June 2023, same rate that was recorded in the last trading session, with a forward rate of N712.14./$1.

However, the sum of $78.03 million was transacted at the official market on Monday 19th June 2023, which is 74.98% lower than the $311.83 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $34.59 billion as of Friday, 16th June 2023, from $34.62 billion recorded as of Thursday, 15th June 2023.

Other indices

- DEBT: The exchange debt market size as of Monday 19th June 2023 is N38.18 trillion, a 4.57% appreciation from the debt market size of N36.51 trillion recorded on Friday, 16th June 2023.

- The Money market overnight rate stood at 12.10% on Monday 19th June 2023, same rate it recorded in the previous trading session. Likewise, the Open Repo stood at 11.60%, the same rate that was recorded in the last trading session.

- The S&P Sovereign Bond index stood at N634.68 index level on Monday 19th June 2023 from 633.96 points recorded in the last trading day. This brings the month-to-date growth to 1.73%, the quarter-to-date growth to 3.75% while the year-to-date growth to 3.32%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate stood at N686.96/$1 on Friday, 16th June 2023, a depreciation of 4.67% compared to N656.28/$1 that was recorded on Thursday 15th June 2023.

- NIBOR: The Nigerian Inter-Bank Offered overnight (O/N) tenor rate stood at 11.75% as of Friday, 16th June 2023. 1-month tenor (12.13%), 3-month (12.75%), while the 6-month tenor stood at 13.63%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 3.84%, on Friday, 16th June 2023.

- 3-month – 4.52%

- 6-month – 5.85%

- 9-month – 7.43%

- 12-month – 8.66%

Naira appreciates to N663.04/$1 at Official market on 16th June 2023

The exchange rate between the Nigeria Naira and the US Dollar appreciated at the Investors and Exporters (I&E) foreign exchange window to close at N663.04/$1 on Friday, 16th June 2023, representing a rise of 5.58% from the close of N702.19/$1 that was recorded in the last trading session.

Follwing the promise of President Bola Tinubu to unify the multiple exchange rate, the Central Bank of Nigeria directed Deposit Money Banks to remove the rate cap on the naira at the Investors and Exporters’ window to allow for a free float of the national currency against the dollar and other global currencies.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The IEFX exchange market recorded an opening indicate rate of N712.5/$1 on Friday 16th June 2023, an 8.20% depreciation from N658.5/$1 that was recorded on Thursday 15th June 2023.

The highest rate at the IEFX exchange market during the intra-day trading closed at N791/$1 on Friday 16th June 2023, same rate that was recorded in the last trading session.

The lowest rate at the IEFX exchange market closed at N461/$1 on Friday 16th June 2023, same rate that was recorded in the last trading session.

Notably, the forex turnover increased significantly by 340.81% to $311.83 million at the official market on Friday 16th June 2023, from the $70.74 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $34.62 billion as of Thursday, 15th June 2023, from $34.66 billion recorded as of Wednesday, 14th June 2023.

Other indices

- DEBT: The exchange debt market size as of Friday 16th June 2023 is N36.51 trillion, a depreciation of 1.67% from the debt market size of N37.13 trillion recorded on Thursday, 15th June 2023.

- The Money market overnight rate stood at 12.10% on Friday 16th June 2023, same rate it recorded in the previous trading session. Likewise, the Open Repo stood at 11.60%, the same rate that was recorded in the last trading session.

- The S&P Sovereign Bond index stood at N633.96 index level on Friday 16th June 2023 from 634.1 points recorded in the last trading day. This brings the month-to-date growth to 1.61%, the quarter-to-date growth to 3.63% while the year-to-date growth to 3.20%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate stood at N656.28/$1 on Thursday, 15th June 2023, a depreciation of 7.55% from N610.2/$1 that was recorded on Wednesday 14th June 2023.

- NIBOR: The Nigerian Inter-Bank Offered overnight (O/N) tenor rate stood at 11.96% as of Thursday, 15th June 2023. 1-month tenor (12%), 3-month (12.87%), while the 6-month tenor stood at 13.55%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 4.21%, on Thursday, 15th June 2023.

- 3-month – 4.98%

- 6-month – 6.01%

- 9-month – 7.77%

- 12-month – 8.86%

Exchange rate at I&E window depreciates to N702.19/$1 on 15th June 2023

The Nigeria Naira depreciated against the US Dollar at the Investors and Exporters (I&E) foreign exchange window to close at N702.19/$1 on Thursday, 15th June 2023. This represents a 5.75% fall from the close of N664.04/$1 recorded in the last trading session.

Following the promise of President Bola Tinubu to unify the multiple exchange rate, the Central Bank of Nigeria directed Deposit Money Banks to remove the rate cap on the naira at the Investor’s and Exporters’ window to allow for a free float of the national currency against the dollar and other global currencies.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The IEFX exchange market recorded an opening indicate rate of N657.5/$1 on Thursday 15th June 2023, signifying a significant depreciation of 38.97% compared to N473.83/$1 that was recorded on Wednesday 14th June 2023.

The highest rate at the IEFX exchange market during the intra-day trading closed at N791/$1 on Thursday 15th June 2023, same rate that was recorded in the last trading session.

The lowest rate at the IEFX exchange market closed at N461/$1 on Thursday 15th June 2023, same rate that was recorded in the last trading session.

However, the sum of $70.74 million was transacted at the official market on Thursday 15th June 2023, which is 63.41% lesser than the $193.33 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $34.69 billion as of Tuesday, 13th June 2023, from $34.81 billion recorded as of Friday, 9th June 2023.

Other indices

- DEBT: The exchange debt market size as of Thursday 15th June 2023 is N37.13 trillion, an appreciation of 1.53% in contrast to the debt market size of N36.57 trillion recorded on Wednesday, 14th June 2023.

- The Money market overnight rate stood at 12.10% on Thursday 15th June 2023, from 12.20% that was recorded in the previous trading session. Likewise, the Open Repo stood at 11.60%, a drop of 10% from the 11.70% that was recorded in the last trading session.

- The S&P Sovereign Bond index stood at N634.10 index level on Thursday 15th June 2023 from 634.72 points recorded in the last trading day. This brings the month-to-date growth to 1.63%, the quarter-to-date growth to 3.65% while the year-to-date growth to 3.23%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate stood at N610.2/$1 on Wednesday, 14th June 2023, a significant depreciation of 28.73% from N474/$1 that was recorded on Tuesday 13th June 2023.

- NIBOR: The Nigerian Inter-Bank Offered overnight (O/N) tenor rate stood at 12.4% as of Wednesday, 14th June 2023. 1-month tenor (13.75%), 3-month (14.49%), while the 6-month tenor stood at 15.13%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 4.13%, on Wednesday, 14th June 2023.

- 3-month – 5.13%

- 6-month – 6.30%

- 9-month – 7.87%

- 12-month – 9.03%

Naira devalues to N664.04/$1 at official market on 14th June 2023

The exchange rate between the Nigeria Naira and the US Dollar recorded a significant downturn at the Investors and Exporters (I&E) window to close at N664.04/$1 on Wednesday, 14th June 2023, following the Central Bank of Nigeria authorization for commercial banks to freely trade foreign exchange at any rate.

The Central Bank of Nigeria (CBN) granted commercial banks and dealers in the forex market the green light to sell forex freely which is at a market-determined rate on Wednesday morning.

This is in line with the promise of President Bola Tinubu to unify the multiple exchange rate in the market. The Naira-to-dollar rate closed at N664.04/$1 at the I&E exchange market, representing a massive dip of 40.78% from the close of N471.67/$1 that was recorded in the last trading session on Tuesday 13th June 2023.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The highest rate recorded at the IEFX exchange market closed at N791/$1 during the intra-day trading on Wednesday 14th June 2023. This signifies a significant depreciation of 65.83% compared to N477/$1 it recorded in the last trading session, with a forward rate of N500/$1.

An opening indicate rate of N473.83/$1 was recorded the IEFX exchange market on Wednesday 14th June 2023, from N473.5/$1 that was recorded on Tuesday 13th June 2023.

The lowest rate at the IEFX exchange market closed at N461/$1 on Wednesday 14th June 2023, compared to N460/$1 that was recorded in the last ten trading days with a forward rate of N476/$1.

Forex turnover, however, increased by 68.44% to $193.33 million at the official market on Wednesday 14th June 2023 from the $114.78 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $34.69 billion as of Tuesday, 13th June 2023, from $34.81 billion recorded as of Friday, 9th June 2023.

Other indices

- The Money market overnight rate dropped by 10 basis points to stand at 12.20% on Wednesday 14th June 2023, from 12.30% that was recorded on Tuesday 13th June 2023. Also, the Open Repo, having dropped by 20 basis points, stood at 11.70%, compared to the 11.90% that was recorded in the last trading session.

- The S&P Sovereign Bond index stood at N634.72 index level on Wednesday 14th June 2023 from 631.68 points recorded in the last trading day. This brings the month-to-date growth to 1.73%, the quarter-to-date growth to 3.75% while the year-to-date growth to 3.33%.

- DEBT: The exchange debt market size as of Tuesday 13th June 2023 is N33.54 trillion, a 0.95% depreciation from the debt market size of N33.86 trillion recorded last week Friday, 9th June 2023.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate stood at N474/$1 on Tuesday, 13th June 2023, an 0.55% depreciation from N471.4/$1 it recorded on Friday 9th June 2023.

- NIBOR: The Nigerian Inter-Bank Offered overnight (O/N) tenor rate stood at 12.7% as of Tuesday, 13th June 2023. 1-month tenor (11.95%), 3-month (12.65%), while the 6-month tenor stood at 13.24%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 3.69%, on Tuesday, 13th June 2023.

- 3-month – 4.86%

- 6-month – 6.11%

- 9-month – 7.58%

- 12-month – 8.51%

Exchange rate at official market closes flat at N464.67/$1 on 7th June 2023

The Nigeria naira traded flat against the US Dollar at the Investors and Exporters (I&E) window to close at N464.67/$1 on Wednesday, 7th June 2023. This is the same closing rate that the exchange recorded in the last five trading sessions since the last day in May 2023.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The IEFX exchange market recorded an opening indicate rate of N464.79/$1 on Wednesday 7th June 2023, from N464.96/$1 that was recorded on Tuesday 6th June 2023.

The highest rate during the intra-day trading at the IEFX exchange market closed at N476/$1 on Wednesday 5th June 2023, same rate it recorded in the last five trading days, with a forward rate of N491.25/$1.

The lowest rate at the IEFX exchange market stood relatively at the same rate of N460/$1 that has been recorded in the last six trading days with a forward rate of N467/$1 on Wednesday 7th June 2023.

However, the sum of $140.31 million was transacted at the official market on Wednesday 7th June 2023, which is 24.57% lower than the $186.02 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $34.95 billion as of Monday, 5th June 2023, from $35.02 billion recorded as of Friday, 2nd June 2023.

Other indices

- The Money market overnight rate stood at 12%, the same rate it recorded in the last two trading days. Similarly, the Open Repo rate stood at 11.62%, the same rate it recorded in the last two trading days since Monday 5th June 2023.

- DEBT: The exchange debt market size as of Wednesday 7th June 2023 is N33.45 trillion, same rate that was recorded in the last two trading days since the beginning of the week on 5th June 2023.

- The S&P Sovereign Bond index stood at N628.88 index level on Wednesday 7th June 2023 from 628.92 points recorded in the previous trading session. This brings the month-to-date growth to 0.80%, the quarter-to-date growth to 2.80% while the year-to-date growth to 2.38%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate stood at N464.6/$1 on Tuesday, 6th June 2023, an appreciation of 0.17% from N465.37/$1 that was recorded on Monday 5th June 2023.

- NIBOR: The Nigerian Inter-Bank Offered overnight (O/N) tenor rate stood at 12.19% as of Tuesday, 6th June 2023. 1-month tenor (13.17%), 3-month (14.13%), while the 6-month tenor stood at 14.74%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 3.23%, on Tuesday, 6th June 2023.

- 3-month – 3.93%

- 6-month – 5.61%

- 9-month – 7.12%

- 12-month – 7.795%

Naira retains closing rate of N464.67/$1 at official market on 5th June 2023

The exchange rate at the Investors and Exporters (I&E) window between the naira and the US dollar remained flat to close at N464.67/$1 on Monday, 5th June 2023. This represents the same closing rate that the exchange recorded in the last four trading sessions from the last day in May 2023.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The opening indicative rate recorded a marginal depreciation of 0.02% to close at N464.7/$1 on Friday 2nd June 2023 at the IEFX exchange market, from N464.61/$1 that was recorded on Thursday 1st June 2023.

The highest rate during the intra-day trading at the IEFX exchange market closed at N467/$1 on Monday 5th June 2023, same rate it recorded in the last five trading days, with a forward rate of N480.77/$1.

The lowest rate at the IEFX exchange market remains unchanged as it closed at the same rate of N460/$1 that has been recorded in the last five trading days with a forward rate of N467/$1 on Monday 5th June 2023.

Forex turnover, however decreased by 21.66% to $77.48 million at the official market on Monday 5th June 2023, compared to the $98.90 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.02 billion as of Friday, 2nd June 2023, which signifies an 0.21% depreciation from $35.09 billion recorded as of Tuesday, 30th May 2023.

Other indices

- The Money market overnight rate stood at 12%, thereby increasing by 12 basis points on Monday 5th June 2023, from 11.88 that was recorded in the previous trading session. Likewise, the Open Repo rate rose by 12 basis points to stand at 11.62%, compared to 11.5% recorded on 2nd June 2023.

- DEBT: The exchange debt market size as of Monday 5th June 2023 is N33.45 trillion. This signifies an increase of 0.24% from the debt market size of N33.37 trillion recorded in the previous trading session.

- The S&P Sovereign Bond index stood at N627.56 index level on Monday 5th June 2023 from 625.49 points recorded in the previous trading session. This brings the month-to-date growth to 0.59%, the quarter-to-date growth to 2.58% while the year-to-date growth to 2.16%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate stood at N465.44/$1 on Friday, 2nd June 2023, from N465.46/$1 that was recorded on Thursday 1st June 2023.

- NIBOR: The Nigerian Inter-Bank Offered overnight (O/N) tenor rate stood at 12.18% as of Friday, 2nd June 2023, from 12.22% recorded in the previous trading day. 1-month tenor (11.25%), 3-month (11.85%), while the 6-month tenor stood at 12.62%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 2.97%, on Friday, 2nd June 2023.

- 3-month – 3.97%

- 6-month – 5.32%

- 9-month – 6.98%

- 12-month – 8.37%

Naira trades flat to N464.67/$1 at Official market on 1st June 2023

The Nigeria naira traded flat against the US dollar at the Investors and Exporters (I&E) window to close at N464.67/$1 on Thursday, 1st June 2023, which is same as the closing rate it recorded in the previous day trading session.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The IEFX exchange market recorded an opening indicative rate of N464.64/$1 on Thursday 1st June 2023, an 0.12% depreciation from N464.1/$1 that was recorded on Wednesday 31st June 2023.

The highest rate during the intra-day trading at the IEFX exchange market closed at N467/$1 on Thursday 1stJune 2023, same rate it recorded in the last trading session, with a forward rate of N480.64/$1.

The lowest rate at the IEFX exchange market remains unchanged as it closed at the same rate of N460/$1 that has been recorded in the last two trading days with a forward rate of N480.64/$1 on Thursday 1st June 2023.

However, a total of $250.98 million was transacted at the official market on Thursday 1st June 2023, which is 53.28% higher from the $163.74 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.09 billion as of Tuesday, 30th May 2023, from $35.15 billion recorded as of Friday, 26th May 2023.

Other indices

- The Money market overnight rate dropped by 31 basis points to stand at 11.94% on Thursday 1st June 2023, from12.25 that was recorded in the previous trading session. Similarly, the Open Repo rate fell by 50 basis points to stand at 11.25%, from 11.75% recorded on 31st May 2023.

- DEBT: The exchange debt market size as of Thursday 1st June 2023 is N33.38 trillion, same as the debt market size of N33.38 trillion recorded in the previous trading session.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate stood at N465.32/$1 on Wednesday, 31st May 2023, a marginal depreciation of 0.04% compared to N465.13/$1 that was recorded on Tuesday 30th May 2023.

- NIBOR: The Nigerian Inter-Bank Offered overnight (O/N) tenor rate stood at 12% as of Wednesday 31st May 2023, from 12.4% recorded in the previous trading day. 1-month tenor (11.7%), 3-month (12.57%), while the 6-month tenor stood at 13.29%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 2.62%, on Wednesday 31st May 2023.

- 3-month – 3.92%

- 6-month – 5.52%

- 9-month – 6.83%

- 12-month – 8.44%

- The S&P Sovereign Bond index stood at 623.90 index level on Wednesday 31st May 2023 from 623.75 points recorded in the previous trading session. This brings the month-to-date growth to 1.05%, the quarter-to-date growth to 1.98% while the year-to-date growth to 1.57%.

Exchange rate at official market depreciates to N463.67/$1 on 25th May 2023

The exchange rate between the naira and the US dollar recorded a marginal depreciation of 0.07% at the Investors and Exporters (I&E) window to close at N463.67/$1 on Thursday, 25th May 2023, compared to the closing rate of N463.33/$1 recorded in the previous trading session.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

An opening indicative rate of N463.85/$1 was recorded at the IEFX exchange market on Thursday 25th May 2023, from N464.29/$1 that was recorded on Wednesday 24th May 2023.

The highest rate during the intra-day trading at the IEFX exchange market closed at N467/$1 on Thursday 25th May 2023, same rate it recorded in the last trading session.

The lowest rate at the IEFX exchange market remains unchanged as it closed at the same rate of N460/$1 that has been recorded in the last two trading weeks with a forward rate of N472/$1 on Thursday 25th May 2023.

However, a total of $157.56 million was transacted at the official market on Thursday 25th May 2023, which is 104.62% higher than the $77 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.18 billion as of Tuesday, 23rd May 2023, from $35.19 billion recorded as of Monday, 22nd May 2023.

Other indices

- The Money market overnight rate stood at 11.50% on Thursday 25th May 2023, same rate its recorded in the previous trading session. Meanwhile, the Open Repo rate increased by 13 basis points to stand at 11.25%, from 11.12% recorded on 24th May 2023.

- DEBT: The exchange debt market size as of Thursday 25th May 2023 is N33.45 trillion, an appreciation of 0.39% compared to the debt market size of N33.32 trillion recorded in the previous trading session.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate stood at N465.13/$1 on Wednesday, 24th May 2023, a marginal depreciation from N465.08/$1 that was recorded on Tuesday 23rd May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 11.6% for the overnight (O/N) tenor as of Wednesday 24th May 2023, from 12.67% recorded in the previous trading day. 1-month tenor (11.7%), 3-month (12.43%), while the 6-month tenor stood at 13.43%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 2.84%, on Wednesday 24th May 2023.

- 3-month – 4.23%

- 6-month – 5.55%

- 9-month – 6.90%

- 12-month – 8.29%

- The S&P Sovereign Bond index stood at 620.49 index level on Wednesday 24th May 2023 from 620.26 points recorded in the previous trading session. This brings the month-to-date growth to 0.50%, the quarter-to-date growth to 1.43% while the year-to-date growth to 1.01%.

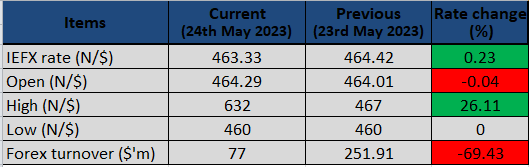

Naira improves against US dollar at official market on 24th May 2023

The Nigerian naira appreciated against the US dollar at the Investors and Exporters (I&E) window to close at N463.33/$1 on Wednesday, 24th May 2023, representing an 0.23% rise from the closing rate of N464.42 to a dollar recorded in the previous trading session.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

An opening indicative rate of N464.29/$1 was recorded at the IEFX exchange market on Wednesday 24th May 2023, from N463.1/$1 that was recorded on Tuesday 23rd May 2023.

The highest rate during the intra-day trading at the IEFX exchange market retraced back to N467/$1 on Wednesday 24th May 2023, compared to the highest rate of N632, since the beginning of the year, that was recorded in the last trading session.

The lowest rate at the IEFX exchange market closed at the same rate of N460/$1 that has been recorded in the last two trading weeks with a forward rate of N472/$1.

Forex turnover, however, decreased by 69.43% to $77 million at the official market on Wednesday 24th May 2023, from the $251.91 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.189 billion as of Monday, 22nd May 2023, from $35.198 billion recorded as of Friday, 19th May 2023.

Other indices

- The Money market overnight rate stood at 11.50% on Wednesday 24th May 2023, same rate its recorded in the previous trading session. Meanwhile, the Open Repo rate stood at 11.12%, recording a rise of 12 basis points from 11% recorded on 23rd May 2023.

- DEBT: The exchange debt market size as of Wednesday 24th May 2023 is N33.32 trillion, a 1.09% increase in the debt market size of N32.96 trillion recorded on Tuesday.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate stood at N465.08/$1 on Tuesday, 23rd May 2023 from N465.1/$1 that was recorded on Monday 22nd May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 12.67% for the overnight (O/N) tenor as of Tuesday 23rd May 2023, from 15.06 recorded in the previous trading day. 1-month tenor (11.8%), 3-month (12.58%), while the 6-month tenor stood at 13.58%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 3.34%, on Tuesday 23rd May 2023.

- 3-month – 4.67%

- 6-month – 5.94%

- 9-month – 7.47%

- 12-month – 9.23%

- The S&P Sovereign Bond index stood at 620.26 index level on Tuesday 23rd May 2023 from 620.16 points recorded in the previous trading session. This brings the month-to-date growth to 0.47%, the quarter-to-date growth to 1.39% while the year-to-date growth to 0.97%.

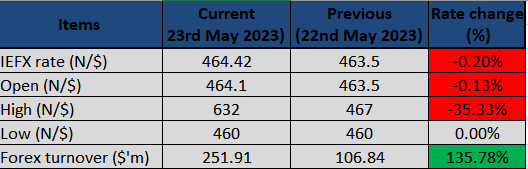

Exchange rate at official market closes at N464.42/$1 on 23rd May 2023

The exchange rate between the Nigerian naira and the US dollar recorded a depreciation of 0.20% at the Investors and Exporters (I&E) window. On Tuesday, May 23, 2023, the rate closed at N464.42/$1, compared to the previous day’s rate of N463.5/$1.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The exchange recorded an opening indicative rate of N464.10/$1 at the IEFX exchange market on Tuesday 23rd May 2023, a depreciation of 0.13% from N463.5/$1 that was recorded on Monday 22nd May 2023.

The highest rate of N632/$1 was recorded during the intra-day trading on Tuesday 23rd May 2023 at the IEFX exchange market, which is the highest it has recorded since the beginning of the year.

The lowest rate stood at N460/$1, the same rate that was recorded in the last ten trading sessions, since Tuesday 9th May 2023, with a forward rate of N449.92/$1.

However, the sum of $251.91 million was transacted at the official market on Tuesday 23rd May 2023, which is significantly higher by 135.78% from the $106.84 that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.198 billion as of Friday, 19th May 2023, a marginal appreciation of 0.05% from $35.178 billion recorded as of Thursday, 18th May 2023.

Other indices

- The Money market overnight rate dropped by 212 basis points to 11.50% on Tuesday 23rd May 2023, from 13.62% that was recorded in the previous trading session. Also, the Open Repo rate stood at 11.00%, recording a drop of 188 basis points from 12.88% recorded on 22nd May 2023.

- DEBT: The exchange debt market size as of Tuesday 23rd May 2023 is N32.96 trillion, a 2% rise in the debt market size recorded on Monday.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate stood at N464.10/$1 on Monday, 22nd May 2023 from N464.80/$1 that was recorded on Friday 19th May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 15.06% for the overnight (O/N) tenor as of Monday 22nd May 2023. 1-month tenor (13.6%), 3-month (14.33%), while the 6-month tenor stood at 14.74%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 3.74%, on Monday 22nd May 2023.

- 3-month – 5.39%

- 6-month – 6.74%

- 9-month – 7.72%

- 12-month – 9.61%

- The S&P Sovereign Bond index stood at 620.16 index level on Monday 22nd May 2023 from 619.03 points recorded in the previous trading session. This brings the month-to-date growth to 0.45, the quarter-to-date growth to 1.37 while the year-to-date growth to 0.96%.

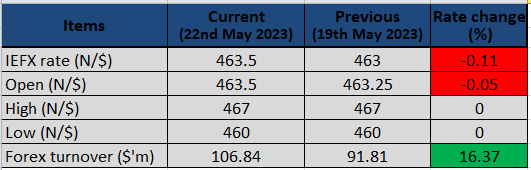

Naira strengthens against US dollar at official market to N462.25/$1

The rate of exchange between the naira and the US dollar recorded a depreciation of 0.11% at the Investors and Exporters (I&E) window to close at N463.5/$1 on Monday, 22nd May 2023, from N463 to a dollar that was recorded last week Friday.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The exchange recorded an opening indicative rate of N463.5/$1 at the IEFX exchange market on Monday 22nd May 2023, a marginal depreciation of 0.05% from N463.25/$1 that was recorded on Friday 19th May 2023.

The exchange recorded a highest rate of N467/$1 during the intra-day trading on Monday 22nd May 2023, same rate as recorded in the last two previous trading sessions, and with a forward rate of N479.79/$1.

The lowest rate stood at N460/$1, the same rate that was recorded in the last nine trading sessions, since Tuesday 9th May 2023, with a forward rate of N467/$1.

However, forex turnover increased by 16.37% to $106.84 million at the official market on Monday 22nd May 2023, from the $91.81 that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.178 billion as of Thursday, 18th May 2023, a marginal depreciation of 0.05% from $35.196 billion recorded as of Wednesday, 17th May 2023.

Other indices

- The Money market overnight rate dropped by 200 basis points to 13.62% on Monday 22nd May 2023, from 15.62% that was recorded in the previous trading session. Also, the Open Repo rate stood at 12.88%, recording a drop of 200 basis points from 14.88% recorded on 19th May 2023.

- DEBT: The exchange debt market size as at Monday 20th May 2023 is N32.94 trillion, same debt market size recorded last week Friday.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate stood at N464.8/$1 on Friday, 18th May 2023 from N465.07/$1 that was recorded on Thursday 18th May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 16.45% for the overnight (O/N) tenor as of Friday 19th May 2023. 1-month tenor (13.83%), 3-month (14.64%), while the 6-month tenor stood at 15.17%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 4.25%, on Friday 19th May 2023.

- 3-month – 5.76%

- 6-month – 7.04%

- 9-month – 8.27%

- 12-month – 9.62%

- The S&P Sovereign Bond index stood at 619.03 index level on Friday 19th May 2023 from 618.51 points recorded in the previous trading session. This brings the month-to-date growth to 0.27%, the quarter-to-date growth to 1.19% while the year-to-date growth to 0.77%.

Naira trades flat at official market to N463/$1 on 19th May 2023

The exchange rate between the naira and the US dollar remained relatively steady at the Investors and Exporters (I&E) window to close at N463/$1 to a dollar on Friday, 19th May 2023, same rate as recorded in the previous trading day.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

An opening indicative rate of N463.25/$1 was recorded at the IEFX exchange market on Friday 19th May 2023, a marginal appreciation of 0.09% from N463.67/$1 that was recorded on 18th May 2023.

The exchange recorded a highest rate of N467/$1 during the intra-day trading on Friday 19th May 2023, same rate as recorded in the previous trading sessions, and with a forward rate of N476.72/$1.

The lowest rate stood at N460/$1, same rate that was recorded in the last nine trading sessions, since Tuesday 9th May 2023, with a forward rate of N463/$1.

However, the sum of $91.81 million was transacted at the official market on Friday 19th May 2023, which is 11.92% lesser from the $104.24 that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.196 billion as of Wednesday, 17th May 2023, from $35.194 billion recorded as of Tuesday, 16th May 2023.

Other indices

- The Money market overnight rate stood at 15.62% on Friday 19th May 2023, having recorded a drop of 250 basis points, compared to 18.12% that was recorded in the previous trading session. Likewise, the Open Repo rate dropped by 262 basis points to stand at 14.88% from 17.50% recorded on 18th May 2023.

- DEBT: The exchange debt market size as at Friday 19th May 2023 is N32.94 trillion, same debt market size recorded in the previous day’s trading session.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate closed at N465.07/$1 on Thursday, 18th May 2023 from N465.04/$1 that was recorded on Wednesday 17th May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 18.8% for the overnight (O/N) tenor as of Thursday 18th May 2023. 1-month tenor (14.99%), 3-month (15.86%), while the 6-month tenor stood at 16.30%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 4.34%, on Thursday 18th May 2023.

- 3-month – 5.65%

- 6-month – 6.75%

- 9-month – 8.27%

- 12-month – 10.07%

- The S&P Sovereign Bond index stood at 618.51 index level on Thursday 18th May 2023 from 618.22 points recorded in the previous trading session. This brings the month-to-date growth to 0.18%, the quarter-to-date growth to 1.10% while the year-to-date growth to 0.69%.

Naira strengthens at official market to N463/$1 on 18th May 2023

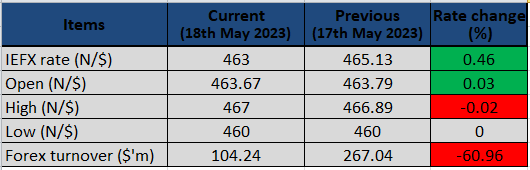

The exchange rate between the Naira and US dollar at the Investors and Exporters (I&E) window recorded an upturn of 0.46% after three days of consecutive depreciation to close at N463 to a dollar on Thursday, 18th May 2023.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The exchange recorded an opening indicative rate of N463.67/$1 on Thursday 18th May 2023, a marginal appreciation of 0.03% compared to N463.79/$1 that was recorded on 17th May 2023.

The highest rate of N467 to a dollar was recorded at the IEFX exchange market during the intra-day trading on Thursday 18th May 2023, from N466.89/$1 that was recorded in the previous trading sessions, and with a forward rate of N476.72/$1.

The lowest rate stood at N460/$1, same rate that was recorded in the last eight trading sessions, since Tuesday 9th May 2023, with a forward rate of N463/$1.

However, the forex turnover decreased by 60.96% to $104.24 million at the official market on Thursday 18th May 2023 from the $267.04 that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.196 billion as of Wednesday, 17th May 2023, from $35.194 billion recorded as of Tuesday, 16th May 2023.

Other indices

- The Money market overnight rate dropped by 13 basis points to 18.12% on Thursday 18th May 2023, from 18.25% that was recorded in the previous trading session. Likewise, the Open Repo rate stood at 17.50%, having dropped by 38 basis points from 17.88% recorded on 17th May 2023.

- DEBT: The exchange debt market size as at Thursday 18th May 2023 is N32.94 trillion. This is a significant appreciation of 1.57% from the debt market size of N32.43 trillion recorded in the previous day’s trading session.

- The S&P Sovereign Bond index stood at 618.22 index level on 17th May 2023 from 617.72 points recorded in the previous trading session. This brings the month-to-date growth to 0.13%, the quarter-to-date growth to 1.06% while the year-to-date growth to 0.64%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate depreciated by 0.10% to close at N465.04/$1 on Wednesday, 17th May 2023 from N464.58/$1 that was recorded on Tuesday 16th May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 18.25% for the overnight (O/N) tenor as of Wednesday 17th May 2023. 1-month tenor (16.73%), 3-month (17.16%), while the 6-month tenor stood at 17.33%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 4.41%, on Wednesday 17th May 2023.

- 3-month – 5.80%

- 6-month – 6.73%

- 9-month – 8.09%

- 12-month – 9.48%

Official market rate drops to N465.13/$1 on 17th May 2023

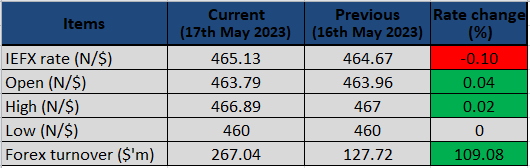

Naira depreciated by 0.10% against the US dollar at the Investors and Exporters (I&E) window to close at N465.13/$1 on Wednesday, 17th May 2023, compared to the closing rate of N464.67/$1 it recorded in the previous trading session.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

An opening indicative rate of N463.79/$1 was recorded at the IEFX exchange market on Wednesday 17th May 2023, from N463.96/$1 that was recorded on 16th May 2023.

The exchange recorded it highest rate during the intra-day trading at N466.89/$1, on Wednesday 17th May 2023, from N467 to a dollar that was recorded in the last five trading sessions, and with a forward rate of N472/$1 while the lowest rate stood at N460/$1, same rate that was recorded since last week Tuesday 9th May 2023, with a forward rate of N458.95/$1.

Notably, the sum of $267.04 million was transacted at the official market on Wednesday 17th May 2023, which is 109.08% higher than the $127.72 that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.194 billion as of Tuesday, 16th May 2023, from $35.192 billion recorded as of Monday, 15th May 2023.

Other indices

- The Money market overnight rate improved by 413 basis point to 18.25% on Wednesday 17th May 2023, from 14.12% recorded in the previous trading session. Likewise, the Open Repo rate increased by 450 basis point to stand at 17.88% on 17th May 2023.

- DEBT: The exchange debt market size as at Wednesday 17th May 2023 is N32.42 trillion, a marginal appreciation of 0.03% from the debt market size of N32.42 trillion recorded in the previous day’s trading session.

- The S&P Sovereign Bond index stood at 617.72 index level on 16th May 2023 from 619.21 points recorded on Monday, 15th May 2023. This brings the day-to-date growth to 0.24%, the quarter-to-date growth to 0.97% while the year-to-date growth to 0.56%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate reorded a marginal appreciation of 0.09% to close at N464.58/$1 on Tuesday, 16th May 2023 compared to N465/$1 that was recorded on Monday 15th May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 15.22% for the overnight (O/N) tenor as of Tuesday 16th May 2023. 1-month tenor (14.4%), 3-month (14.9%), while the 6-month tenor stood at 15.6%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 4.45%, on Tuesday 16th May 2023.

- 3-month – 5.46%

- 6-month – 6.04%

- 9-month – 7.75%

- 12-month – 9.40%

Naira falls against US dollar at official market to N464.67/$1 on 16th May 2023

The exchange rate at the Investors and Exporters (I&E) window between the naira and US dollar depreciated to close at N464.67/$1 on Tuesday, 16th May 2023. This rate represent a drop of 0.14% from the closing rate of N464/$1 it recorded in the previous trading session.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

An opening indicative rate of N463.96/$1 was recorded at the IEFX exchange market on Tuesday 16th May 2023, from N463.5 to a dollar that was recorded on 15th May 2023.

The highest rate, in the same vein, during intra-day trading stood at N467/$1, on Tuesday 16th May 2023, same rate that was recorded in the last five trading sessions, with a forward rate of N481.58/$1 while the lowest rate stood at N460/$1, same rate that was recorded since last week Tuesday 9th May 2023, with a forward rate of N475.06/$1.

However, forex turnover experienced a notable increase of 131.8% to $127.72 million at the official market on Tuesday 16th May 2023, from the $55.10 that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.192 billion as of Monday, 15th May 2023, from $35.188 billion recorded as of Friday, 12th May 2023. This represents a marginal appreciation of 0.01% from its 6-consecutive depreciations .

Other indices

- The Money market overnight rate stood at 14.12% on Tuesday 16th May 2023, a 25 basis points increase from 13.88% recorded in the previous trading session. Likewise, the Open Repo rate increased by 25 basis point to stand at 13.38% on 156h May 2023.

- DEBT: Debt securities size is valued at N32.42 trillion on Tuesday 15th May 2023, the debt size remained unchanged from the previous trading session, where it also stood at N32.42 trillion.

- The S&P Sovereign Bond index stood at 619.21 index level on 15th May 2023 from 618.47 points recorded on Friday, 12th May 2023. This brings the month-to-date growth to 0.29%, the quarter-to-date growth to 1.22% while the year-to-date growth to 0.80%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate depreciated by 0.11% to close at N465/$1 on Monday, 15th May 2023 from N464.5/$1 that was recorded on Friday 12th May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 14.19% for the overnight (O/N) tenor as of Monday 15th May 2023. 1-month tenor (14.7%), 3-month (15.65%), while the 6-month tenor stood at 16.54%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 3.73%, on Monday 15th May 2023.

- 3-month – 4.84%

- 6-month – 5.94%

- 9-month – 7.49%

- 12-month – 9.34%

Naira improves marginally against US dollar to N462.73/$1 on 11th May 2023

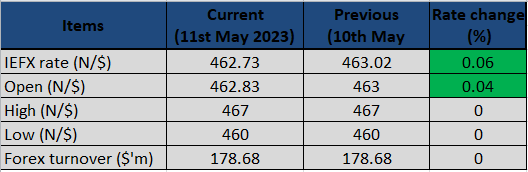

Naira recorded a marginal appreciation of 0.04% against the US dollar at the Investors and Exporters (I&E) window to close at N462.73/$1 on Thursday, 11th May 2023, compared to the closing rate of N463.02/$1 it recorded on Wednesday, 10th May 2023.

This is according to Nairametric’s daily currency update, tracked and compiled from FMDQ Exchange.

The exchange recorded an opening indicative rate of N462.83/$1 at the IEFX on Thursday 11th May 2023, from an opening rate of N463/$1 that was recorded on 109 May 2023.

The highest rate, in the same vein, during intra-day trading stood at N467/$1, same rate that was recorded in the previous trading session, while the lowest rate stood at N460/$1, same rate recorded on Wednesday 10th May 2023.

However, the sum of $178.68 million was transacted at the official market on Thursday 11th May 2023, which is the same sum of forex turnover that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.22 billion as of Wednesday, 10th May 2023, a marginal depreciation of 0.04% from $35.24 billion recorded as of Tuesday, 9th May 2023.

Other indices

- The Money market overnight rate stood at 11.38% on Wednesday 11th May 2023, same rate that was recorded in the previous trading session. The Open Repo rate stood at 11% on 11th May 2023, the same rate it recorded in the previous trading session.

- DEBT: Debt securities size is valued at N32.40 trillion on Thursday 11th May 2023, from N32.69 trillion recorded on Wednesday 10th May 2023.

- The S&P Sovereign Bond index stood at 617.56 index level on 10th May 2023 from 617.13 points recorded on Tuesday, 9th May 2023. This brings the quarter-to-date growth to 0.95% while the year-to-date growth to 0.53%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate appreciated marginally by 0.02% to close at N463/$1 on Wednesday, 10th May 2023 compared to N463.08 that was recorded on Tuesday 9th May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 11.25% for the overnight (O/N) tenor as of Wednesday 10th May 2023. 1-month tenor (11.55%), 3-month (12.55%), while the 6-month tenor stood at 13.15%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 3.87%, on Wednesday 10th May 2023.

- 3-month – 5.57%

- 6-month – 6.70%

- 9-month – 8.70%

- 12-month – 10.46%

Exchange rate at official market depreciates to N463.02/$1 on 10th May 2023

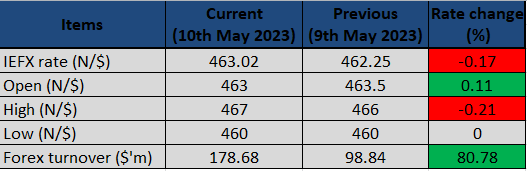

Exchange rate at official market depreciates to N463.02/$1 on 10th May 2023The exchange rate between the naira and the US dollar depreciated at the Investors and Exporters (I&E) window to close at N463.002/$1 on Wednesday, 10th May 2023. This represents a fall of 0.17% from the closing rate of N462.25/$1 it recorded on Tuesday, 9th May 2023.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The exchange recorded an opening indicative rate of N463/$1 at the IEFX on Wednesday 10th May 2023, from an opening rate of N463.7/$1 that was recorded on 9th May 2023.

The highest rate, in the same vein, during intra-day trading stood at N467/$1, from N466/$1 recorded in the previous trading session, while the lowest rate stood at N460/$1, same rate recorded on Tuesday 9th May 2023.

However, the sum of $178.68 million was transacted at the official market on Wednesday 10th May 2023, which is 80.78% higher from the $98.84 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.24 billion as of Tuesday, 9th May 2023, a marginal depreciation of 0.06% from $35.26 billion recorded as of Monday, 8th May 2023.

Other indices

- The Money market overnight rate increased by 6% to 11.38% on Wednesday 10th May 2023, from the 11.32% recorded in the previous trading session. The Open Repo rate stood at 11% on 10th May 2023, the same rate it recorded in the previous trading session.

- DEBT: Debt securities size is valued at N32.69 trillion on Wednesday 10th May 2023, from N32.68 trillion recorded on Tuesday 9th May 2023.

- The S&P Sovereign Bond index stood at 617.13 index level on 9th May 2023 from 617.68 points recorded on Monday, 8th May 2023. This brings the quarter-to-date growth to 0.88% while the year-to-date growth to 0.46%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate depreciated marginally by 0.08% to close at N463.08/$1 on Tuesday, 9th May 2023 from N462.71 that was recorded on Monday 8th May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 11.38% for the overnight (O/N) tenor as of Tuesday 9th May 2023. 1-month tenor (12.18%), 3-month (12.71%), while the 6-month tenor stood at 13.33%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 3.76%, on Tuesday 9th May 2023.

- 3-month – 5.50%

- 6-month – 6.83%

- 9-month – 8.63%

- 12-month – 10.57%

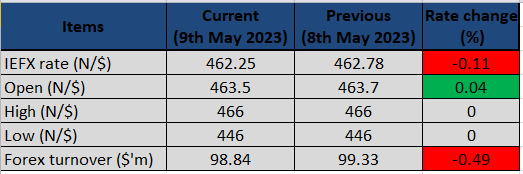

Naira strengthens against US dollar at official market to N462.25/$1 on 9th May 2023

Naira recorded an appreciation of 0.11% against the US dollar at the Investors and Exporters (I&E) window to close at N462.25/$1 on Tuesday, 9th May 2023, from the closing rate of N462.78/$1 that was recorded on Monday.

This is according to Nairametric’s daily currency update, tracked and compiled from FMDQ Exchange.

An opening indicative rate of N463.5/$1 was recorded at the IEFX on Tuesday 9th May 2023, from an opening rate of N463.7/$1 that was recorded on 8th May 2023.

Likewise, the highest rate during intra-day trading stood at N466/$1, with a forward rate of N463/$1, while the lowest rate stood at N446/$1 with a forward rate of N462/$1.

Forex turnover transacted at the official market on Tuesday 9th May 2023, decreased by 0.49% to $98.84 million from the $99.33 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.26 billion as of Monday, 8th May 2023, a marginal depreciation of 0.06% from $35.28 billion recorded as of Friday, 5th May 2023.

Other indices

- The Money market overnight rate stood at 11.32% on 9th May 2023, from the 11.34% recorded on Monday, 8th May 2023. The Open Repo rate stood at 11%, the same rate it recorded in the previous trading session.

- DEBT: Debt securities sized is valued at N32.68 trillion on Tuesday 9th May 2023, from N32.56 trillion recorded on Monday 8th May 2023.

- The S&P Sovereign Bond index stood at 617.68 index level on 8th May 2023 from 617.93 points recorded on Friday, 5th May 2023. This brings the month-to-date growth to 0.05%, the quarter-to-date growth to 0.97% and the year-to-date growth to 0.55%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate depreciated marginally by 0.01% to close at N462.71/$1 on Monday, 8th May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 11.45% for the overnight (O/N) tenor as of Monday 8th May 2023. 1-month tenor (12.37%), 3-month (13.15%), while the 6-month tenor stood at 13.95%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 3.88%, on Monday 8th May 2023.

- 3-month – 5.36%

- 6-month – 6.77%

- 9-month – 8.88%

- 12-month – 10.86%

Official market rate falls to N462.78/$1 on 8th May 2023

The exchange rate between the naira and the US dollar depreciated at the Investors and Exporters (I&E) window to close at N462.78/$1 on Monday, 8th May 2023, representing a fall of 0.12% from the closing rate of N462.23/$1 that was recorded last week Friday.

This is according to Nairametric’s daily currency update, tracked and compiled from FMDQ Exchange.

The exchange rate at the IEFX recorded an opening indicative rate of N463.7/$1 on Monday 8th May 2023, from an opening rate of N463.5/$1 recorded on 5th May 2023.

Likewise, the highest rate during intra-day trading stood at N466 to a dollar, with a forward rate of N478.61/$1, while the lowest rate stood at N446/$1 with a forward rate of N478.61/$1.

However, the sum of $99.33 million was traded at the official market on Monday 8th May 2023, which is 22.57% lower than the $128.29 million that exchanged hands in the previous session.

Meanwhile, the nation’s external reserves stood at $35.28 billion as of Friday, 5th May 2023, a marginal depreciation of 0.03% from $35.29 billion recorded as of Thursday, 4th May 2023.

Other indices

- The Money market overnight rate dropped by 4 basis points to stand at 11.34% on 8th May 2023, from the 11.38% recorded on Friday, 5th May 2023. The Open Repo rate stood at 11%, the same rate it recorded in the previous trading session.

- DEBT: Debt securities sized is valued at N32.56 trillion on Monday 8th May 2023, the same rate as recorded on Friday 5th May 2023.

- The S&P Sovereign Bond index stood at 617.93 index level on 5th May 2023 from 617.7 points recorded on Thursday, 4th May 2023. This brings the month-to-date growth to 0.13%, the quarter-to-date growth to 1.01% and the year-to-date growth to 0.59%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate depreciated marginally by 0.02% to close at N462.67/$1 on Friday, 5th May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 11.47% for the overnight (O/N) tenor as of Friday 5th May 2023. 1-month tenor (11.48%), 3-month (12.24%), while the 6-month tenor stood at 13.04%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 4.62%, on Friday 5th May 2023.

- 3-month – 5.77%

- 6-month – 6.76%

- 9-month – 8.52%

- 12-month – 10.49%

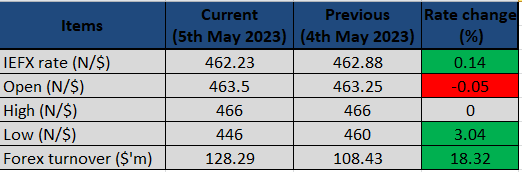

Exchange rate gains at official market on 5th May 2023, appreciating to N462.23/$1

Naira appreciated against the US dollar at the Investors and Exporters (I&E) window to close at N462.23/$1 on Friday, 5th May 2023. This represents an improvement of 0.14% from the closing rate of N462.88 to a dollar recorded in the previous trading session.

This is according to Nairametric’s daily currency update, tracked and compiled from FMDQ Exchange.

The exchange rate at the IEFX recorded an opening indicative rate of N463.5/$1 on Friday 5th May 2023, from N463.25/$1 that was recorded on 4th May 2023.

Also, the highest rate during intra-day trading stood at N466 to a dollar, with a forward rate of N478.25/$1, while the lowest rate stood at N446/$1 with a forward rate of N478.25/$1.

Forex turnover, however, increased by 18.32% to $128.29 million at the official market on Friday 5th May 2023, from the $108.43 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.276 billion as of Wednesday, 3rd May 2023 from $35.278 billion recorded as of Tuesday, 2nd May 2023.

Other indices

- The Money market overnight rate stood at 11.38% on 5th May 2023, the same rate it recorded on Thursday, 4th May 2023. The Open Repo rate stood at 11%, the same rate it recorded in the previous trading session.

- DEBT: Debt securities are valued at N32.56 trillion on Friday 5th May 2023, from the N32.57 trillion that was recorded on Thursday 4th May 2023.

- The S&P Sovereign Bond index dropped to 617.70 index level on 4th May 2023 compared to 618.52 points recorded on Wednesday, 3rd May 2023. This brings the month-to-date growth to a negative valuation of 0.13%, the quarter-to-date growth to 0.97% and the year-to-date growth to 0.56%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate appreciated marginally by 0.07% to close at N462.58/$1 on Thursday, 4th May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 11.29% for the overnight (O/N) tenor as of Thursday 4th May 2023. 1-month tenor (12.33%), 3-month (13.11%), while the 6-month tenor stood at 13.60%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 4.68%, on Thursday 4th May 2023.

- 3-month – 5.69%

- 6-month – 6.63%

- 9-month – 8.28%

- 12-month – 10.28%

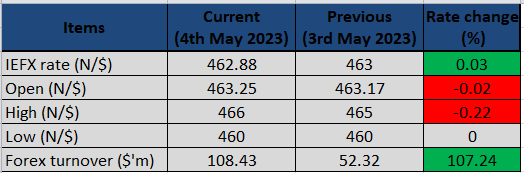

Naira appreciates to N462.88/$1 at official market on 4th May 2023

The exchange rate between the naira and the US dollar appreciated marginally by 0.03% at the Investors and Exporters (I&E) window to close at N462.88/$1 on Thursday, 4th May 2023, compared to the closing rate of N463 to a dollar recorded in the previous trading session.

This is according to Nairametric’s daily currency update, tracked and compiled from FMDQ Exchange.

The exchange rate at the IEFX recorded an opening indicative rate of N463.25/$1 on 4th May 2023, from N463.17/$1 it recorded on Wednesday.

Also, the highest rate during intra-day trading stood at N466 to a dollar, with a forward rate of N477.86/$1, while the lowest rate stood at N460/$1 with a forward rate of N473.72/$1.

Notably, the sum of $108.43 million was transacted at the official market on 4th May 2023, which significantly increased by 107.24% from the $52.32 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.28 billion as of Tuesday, 2nd May 2023 from $35.25 billion recorded as of Friday, 28th April 2023.

Other indices

- The Money market overnight rate dropped by 12 basis points from 11.50% recorded on 3rd May 2023, to 11.38% on Thursday, 4th May 2023. The Open Repo rate stood at 11%, same rate as recorded on Wednesday 3rd May 2023.

- DEBT: Debt securities is valued at N32.57 trillion on Thursday 4th May 2023, same as recorded on Wednesday 3rd May 2023.

- The S&P Sovereign Bond index rose to 618.52 index points on 3rd May 2023 compared to 618.2 points recorded on Tuesday, 2nd May 2023. This brings the month-to-date growth to 0.18%, the quarter-to-date growth to 1.11% while the year-to-date growth to 0.69%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate fell marginally by 0.06% to close at N462.90/$1 on Wednesday, 3rd May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 11.38% for the overnight (O/N) tenor as of Wednesday 3rd May 2023. 1-month tenor (12.79%), 3-month (13.96%), while the 6-month tenor stood at 14.44%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 4.05%, on Wednesday 3rd May 2023.

- 3-month – 5.51%

- 6-month – 6.53%

- 9-month – 8.24%

- 12-month – 9.80%

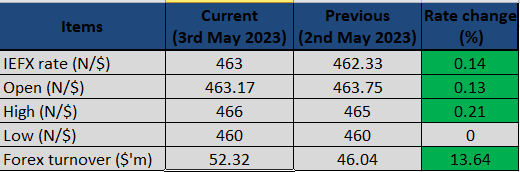

Official exchange rate depreciates to N463/$1 on 3rd May 2023

Naira depreciated by 0.14% against the US dollar at the Investors and Exporters (I&E) window to close at N463/$1 on Wednesday, 3rd May 2023, from the closing rate of N462.33/$1 recorded in the previous trading session.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The exchange rate at the IEFX recorded an opening indicative rate of N463.17/$1 on 3rd May 2023, representing an appreciation of 0.13% in contrast to N463.75/$1 it recorded on Monday, 2nd May 2023.

Also, the highest rate during intra-day trading stood at N465/$1, with a forward rate of N467/$1, while the lowest rate stood at N460/$1 with a forward rate of N467/$1.

However, forex turnover increased by 13.64% to $52.32 million at the official market on Wednesday 3rd May 2023, from the $46.04 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.28 billion as of Tuesday, 2nd May 2023 from $35.25 billion recorded as of Friday, 28th April 2023.

Other indices

- The Money market overnight rate rose by 12 basis points from 11.38% recorded on Tuesday 2nd May 2023 to 11.50% on Wednesday, 3rd May 2023. The Open Repo rate stood at 11%, the same rate as recorded on Tuesday 2nd May 2023.

- DEBT: Debt securities are valued at N32.57 trillion on Wednesday 3rd May 2023, from N32.58 trillion recorded on Tuesday 2nd May 2023.

- The S&P Sovereign Bond index rose to 618.2 index points on 2nd May 2023 compared to 617.63 points recorded on Friday, 28th April 2023. This brings the month-to-date growth to 0.13%, the quarter-to-date growth to 1.05% and the year-to-date growth to 0.64%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate appreciated marginally by 0.02% to close at N462.63/$1 on Tuesday, 2nd May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 12% for the overnight (O/N) tenor as of Tuesday 2nd May 2023. 1-month tenor (13.2%), 3-month (14.13%), while the 6-month tenor stood at 14.5%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 4.41%, on Tuesday 2nd May 2023.

- 3-month – 5.88%

- 6-month – 6.91%

- 9-month – 8.52%

- 12-month – 10.00%