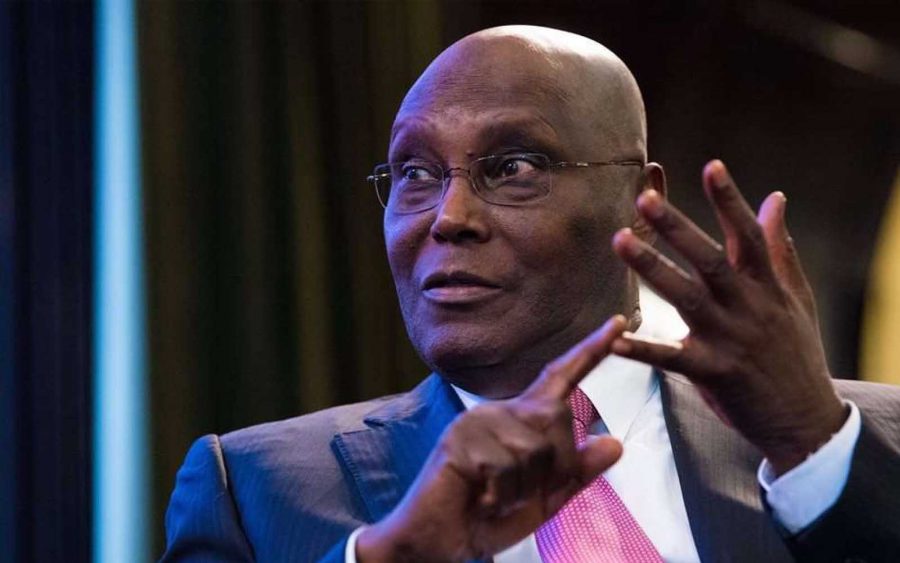

Former Vice President, Atiku Abubakar says that the plan to prohibit cryptocurrency transactions by the CBN will restrict the inflow of capital into Nigeria.

Atiku disclosed this in a social media statement on Saturday afternoon titled, “We Need To Open Up Our Economy, Not Close It.”

“The number one challenge facing Nigeria is youth unemployment. In fact, it is not a challenge, it is an emergency. It affects our economy and is exacerbating insecurity in the nation,” Atiku said.

READ: Cryptos likely to gain at least 1000% very soon

Atiku urged that Nigeria needs jobs as the economy recovers to pre-pandemic levels, citing the NBS report that foreign capital inflow into Nigeria is at a four year low, having plummeted from $23.9 billion in 2019 to just $9.68 billion in 2020.

He added that introducing policies like the prohibition of crypto during this period will also restrict more capital inflows, and he calls for regulation of the industry, not prohibition, citing that “there is already immense economic pressure on our youths.”

“Already, the nation suffered severe economic losses from the border closure and the effects of the COVID19 pandemic.

“This is definitely the wrong time to introduce policies that will restrict the inflow of capital into Nigeria, and I urge that the policy to prohibit the dealing and transaction of cryptocurrencies be revisited.

“It is possible to regulate the sub-sector and prevent any abuse that may be damaging to national security. That may be a better option, than an outright shutdown,” he urged.

Atiku urged that the FG must create jobs and expand the economy and reduce bottlenecks towards investments.

READ: Recession: Nigeria must stop borrowing for anything other than essential needs – Atiku

What you should know

- Nairametrics reported that the Central Bank of Nigeria notified Deposit Money Banks, Non-Financial Institutions, other financial institutions against doing business in crypto and other digital assets.

- In a circular dated 5th February 2021 and distributed to regulated financial firms, the apex bank of Africa’s largest economy warned and reminded local financial institutions against having any transactions in crypto or facilitating payments for crypto exchanges.