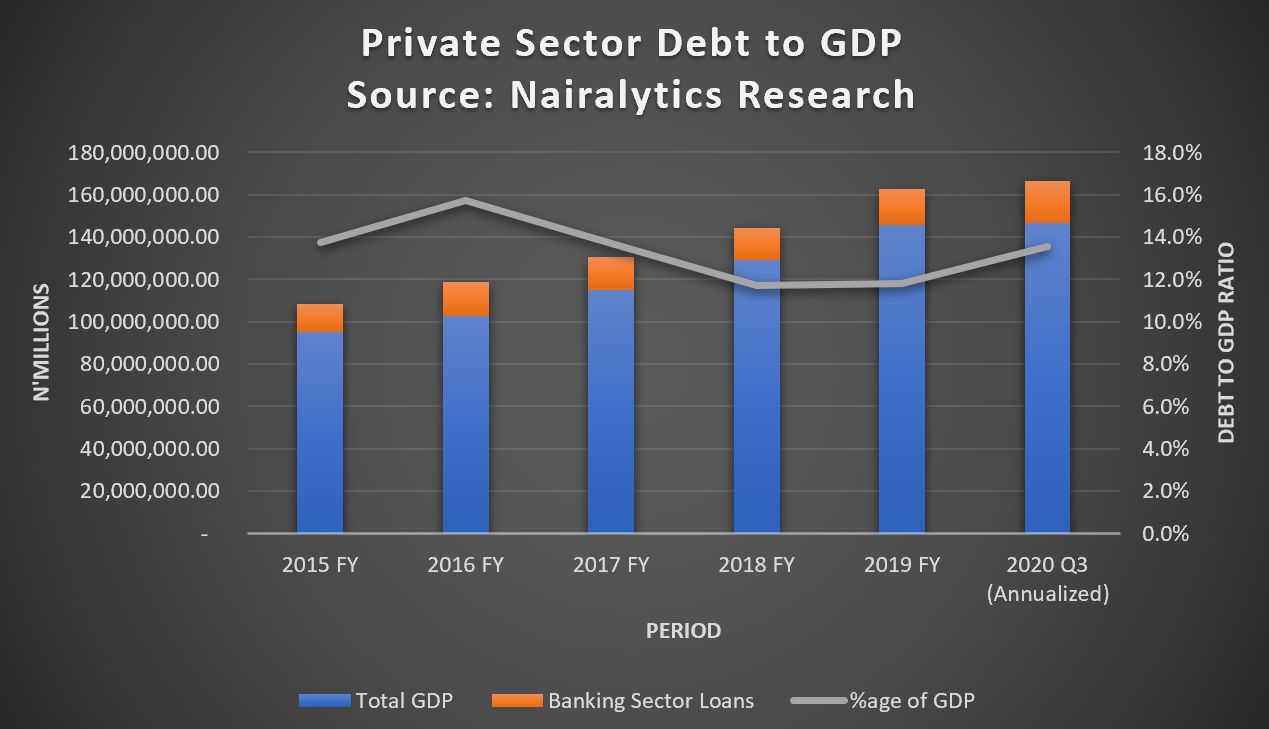

Nigeria’s private sector credit to GDP ratio rose to 13.5% as of the third quarter of 2020 a sharp rise from 11.8% reported at the end of 2019.

Private sector debt to GDP compares the total number of bank lending to the private sector with the gross domestic product of the country. Total private sector loans as of Q3 2020 is N19.86 trillion compared to a GDP of N146.69 trillion.

READ: Nigeria receives $1.46 billion capital inflows in Q3 2020, grows by 13%

Data from the National Bureau of Statistics reveal Nigeria’s Real GDP Growth rate contracted by 3.62% in the third quarter of 2020. However nominal GDP figures annualized from the 3rd quarter of 2020 are estimated at N146.69 trillion.

The sharp rise in the private sector debt to GDP ratio reflects increased lending by deposit money banks in the country. Despite the pandemic and the fall in crude oil prices, banks in Nigeria have been coerced by the central bank to increase lending to the private sector.

READ: Why Nigeria is in deep revenue problem, despite rise in oil price

Since May 2019 when the central bank introduced tough monetary policy measures such as increased Cas Reserve Ratios and Loan to deposit ratios (LDR), banks have been forced to increase lending to the private sector or face a sequester of their deposits.

READ: Nigeria’s oil sector contracts by 13.89%, as covid-19 plunges economy into recession

The CBN in its last monetary policy meeting recognized the impact of lending to the private sector declaring that “the MPC noted with pleasure, the CBN’s engagement with relevant stakeholders, particularly in the private sector, to hasten the recovery of growth. This engagement would involve collaboration towards job creation and provision of credit facilities to stimulate business activities for both corporates and individuals.”

READ: Nigeria’s records 6.1 percent tax to GDP as tax base for VAT rise to N23.7 trillion

Despite the rise recorded at the end of the quarter, it is still lower than the 15.7% recorded in 2016 and 13.7% in 2015. The cyclical nature of the ratios reflects the lack of correlation between banking sector lending and driving economic expansion for the country.

READ: Nigeria’s Pension Fund Asset Value Crosses the N9 trillion Mark

Why this matters

In most developed economies, the private sector debt to GDP ratio is over 100% due to the fact that their economies are mainly driven through private-sector loans.

- Since GDP is the total value of goods and services produced in a country, a high private sector debt to GDP ratio means the economy is able to expand through the aid of debt. Economists often refer to this as financialization.

- However, in frontier economies like Nigeria, the private sector debt to GDP ratio is often lower than 20% as most sectors in the economy are informal and lack banking sector credit. In Nigeria less than 0.5% of borrowers owe over 82% of loans, 2017 data from the NBS reveals.

- Out of the N19.86 trillion in private sector loans, 25.8% goes to the Oil and Gas sector while sectors like real estate, education, and information and communication were 3.4%, 0.4%, and 4.8% respectively.

- Nigeria’s low private-sector loan to GDP ratio means there is room for growth in terms of lending to the private sector. To attain economic maturity private sector credit will have to grow beyond 50% of GDP.

READ: Recession; proactive measures not cyclical factors can resuscitate economy