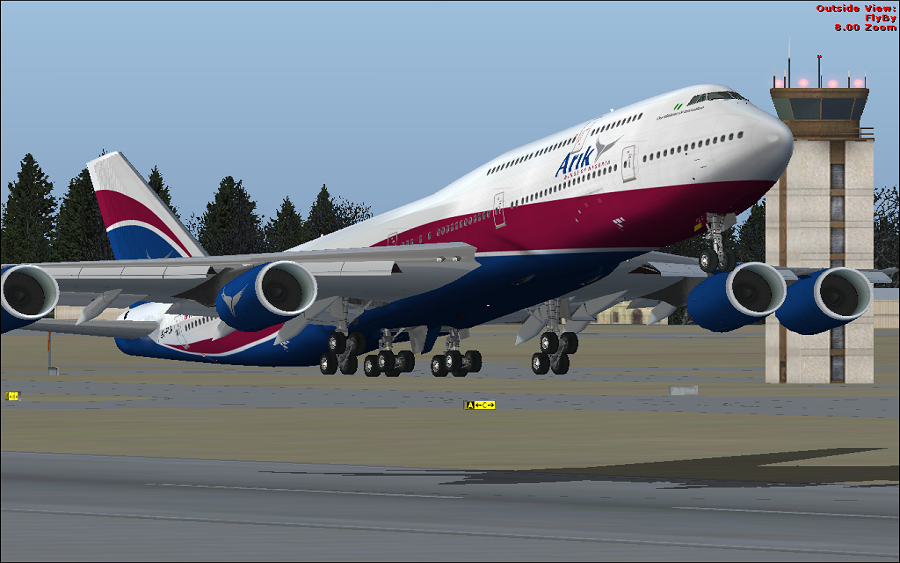

The proposed merger between Arik Air and Aero to form a national carrier has been disapproved by stakeholders in the aviation industry, who have asked the Nigerian Government to ignore the proposal.

According to Punch, an Aviation consultant, Chris Aligbe, in response to the Chief Executive Officer of AMCON, Ahmed Kuru, over his proposal to the National Assembly to merge Arik and Aero and use them to float a national carrier, disclosed that the proposed merger under the receivership of the Asset Management Corporation of Nigeria (AMCON) would promote confusion in the process of the Nigeria Air project.

Mr Chris Aligbe, who acknowledged that both Arik and Aero were performing too badly to form a new national carrier, stated that a merger of the two would only make for a failed Nigeria Air project. He added that any attempt to carry out the merger would only lead to a legal battle between the original owners of the airlines and the Nigerian Government.

“A healthy and virile establishment cannot be founded on the back of unhealthy and struggling entities; no sensible investor will invest in such establishment. Where no investors come, such a national carrier will exist on 100% government equity, just like the liquidated Nigeria Airways.

“There are still a few who believe that Aero and Arik are airlines that belong to the government. It is not true. If they were, they would be under aviation not AMCON that has no statutory responsibility on aviation but rather on debt collection.

“Any attempt to move outside this statute will occasion international litigations that could be unresolved for many years. This is because both the original owners and creditors will head to court to challenge the Federal Government,” Chris Aligbe said.

[READ MORE: Arik not equipped as national carrier, Aviation minister replies AMCON)

Meanwhile, Aligbe explained that the airlines business is much more difficult to run than other businesses, as it usually requires in-depth research and understanding to get it right.

“But stark realities of our national losses in terms of humongous capital flight of over $1.3bn annually on ticket sales alone by foreign airlines as well as the fact that countries like Uganda, Tanzania and Ghana, even Republic of Benin are set with the floatation of their national carriers with varying degrees of government equities have undermined the position of some stakeholders who hitherto argued that national carriers are now out of fashion,” said Chris Aligbe.