The Nigerian Senate has advised the Federal Government of Nigeria (FGN) to sanction the sale of its 40% stake in Electricity Distribution Companies (DisCos) to foreign investors.

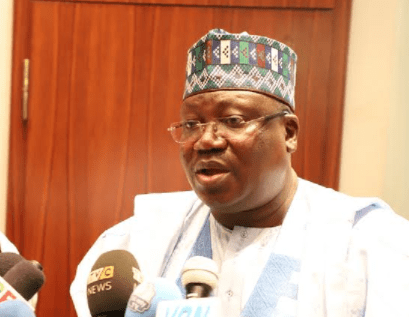

The Senate President, Ahmed Lawan revealed the Senate’s call in Abuja while receiving the Management Team of the Transmission Company of Nigeria (TCN) led by the Managing Director, Usman Mohammed.

The details: According to the Senate President, as stipulated in the Power Sector Privatisation Act 2005, the private investors should be allowed to invest and take ownership of the sector to put an end to the challenges being faced.

“The 40% holding of the Federal Government as stipulated in the Power Privatisation Act 2005 may also be more beneficial to the nation if it is sold to foreign investors with technical know-how.”

Speaking further, the Senate President stated that it is not in the interest of the government to keep disbursing bailout funds to DisCos without commensurate improvement in the power supply.

[READ ALSO:Pension Fund Assets hits N9.3 trillion as investment in FGN securities drops]

Meanwhile, Lawan went on to assure the TCN of the Senate’s support on its proposed recapitalization of DisCos and the Transmission Rehabilitation and Expansion Programme (TREP).

Earlier development: In 2013, the Federal Government embarked on partial privatisation of the power sector. After the privatisation of the 11 DisCos of the Nigeria Electricity Supply Industry (NESI), the Federal Government retained 40% of the equity in the DisCos and divested 60% to private investors.

- Six years down the line, Nigeria’s power sector is still facing several challenges.

- To tackle these challenges, the FG recently announced a move to raise $4.7 billion to recapitalise the Electricity Distribution Companies (DisCos) in partnership with some private investors, to upgrade power distribution equipment in the country.

- According to the report, FG is expected to inject $1.7 billion into the DisCos, while the private investors will pay up the balance that is proportional to their 60% equity in the companies.

Basically, DisCos collect funds from power consumers on behalf of other operators in the sector, but a recent report shows that DisCos’ debt to TCN had grown to about N270 billion.

Following the planned recapitalization process, the Managing Director of TCN, Dr Usman Gur Mohammed, disclosed that electricity tariffs might skyrocket. According to him, the private sector investors would not raise loans from commercial banks. As a result, they would need to earn their returns on investment by hiking tariffs.

Meanwhile, the Senate President has urged that the recapitalization and expansion programmes should be carried out with a holistic picture of how power supply challenges would be resolved once and for all.