Nigerian companies across various sectors have ramped up their marketing and advertising budgets over the past three years.

From beverages to banking, these investments reflect the intense efforts by firms to maintain brand visibility, expand market share, and engage with consumers.

An analysis of the marketing and advertising expenditures from 2021 to 2023 reveals fascinating trends and growth patterns across industries.

Year-on-Year Growth Analysis

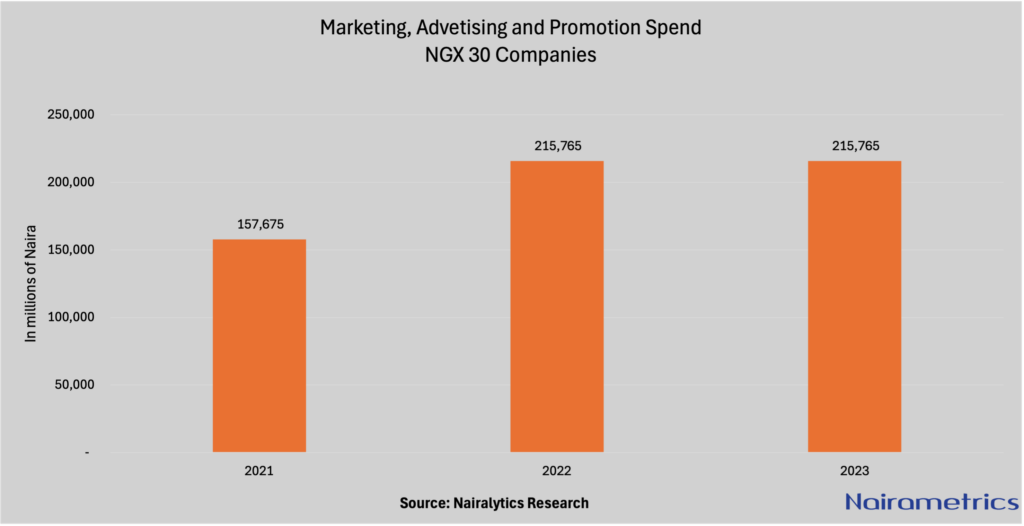

2021: The total marketing and advertising spend for the top companies amounted to approximately N163,872.69 million.

2022: This figure rose significantly to N222,709.27 million, indicating a robust 35.9% year-on-year growth as companies bounced back from the pandemic-induced economic challenges of 2020.

2023: While the total expenditure saw a slight decline compared to 2022, amounting to N235,642.48 million, the year-on-year growth from 2022 to 2023 was 5.8%, suggesting a more cautious approach to spending amidst economic uncertainties.

General Insights

Beverage and Banking Dominate: The top spenders were predominantly from the beverage and banking sectors, underscoring the importance of consumer engagement in these industries. Companies like Nigerian Breweries Plc, Guinness Nigeria Plc, and major banks led the charge with aggressive marketing campaigns.

Significant Yearly Fluctuations: Several companies saw significant year-on-year fluctuations in their marketing budgets. For example, Nigerian Breweries Plc, the perennial leader in marketing spend, saw a reduction in 2023 compared to 2022, reflecting possible shifts in strategic focus or economic pressures.

Emerging Spenders: New entrants like FBN Holdings and Fidelity Bank ramped up their advertising budgets considerably in 2023, signaling their intention to capture more market share in a competitive banking environment.

Sustained Commitment: Despite economic challenges, companies like UBA, Zenith Bank, and Access Bank maintained a consistent increase in their marketing spends over the years, highlighting their commitment to long-term brand equity.

10. GTCO

2021: N5,844.00 million

2022: N7,253.00 million

2023: N8,762.00 million

GTCO rounds out the top ten with a steady increase in marketing spend over the years. The bank’s focus on branding and customer engagement remains central to its growth strategy.

9. Zenith Bank

2021: N7,100million

2022: N8,787 million

2023: N11,450 million

Zenith Bank continued its upward trajectory in marketing expenditure, showing a strong commitment to maintaining its leadership position in the Nigerian banking industry.

8. Nestle Nigeria

2021: N5,108.80 million

2022: N4,613.94 million

2023: N14,350.53 million

Nestle Nigeria significantly increased its marketing spend in 2023, nearly tripling its 2022 budget. This surge reflects the company’s strategic efforts to reinforce its brand presence in the competitive FMCG sector.

7. International Breweries Plc

2021: N13,922.60 million

2022: N15,344.69 million

2023: N14,817.26 million

International Breweries Plc, another key player in the beverage sector, saw a slight decrease in its marketing budget in 2023. However, it remains a formidable force in the market with substantial investments in advertising.

6. UBA

2021: N8,747 million

2022: N11,022 million

2023: N18,859 million

UBA’s consistent year-on-year growth in marketing spend underscores the bank’s dedication to maintaining a strong brand presence and expanding its customer base across Nigeria and beyond.

5. Access Bank

2021: N9,496 million

2022: N13,976 million

2023: N19,800 million

Access Bank saw a significant boost in its marketing budget in 2023, indicating a strong focus on customer acquisition and retention in a fiercely competitive banking landscape.

4. Guinness Nigeria Plc

2021: N13,490.50 million

2022: N20,267.13 million

2023: N20,621.48 million

Guinness Nigeria Plc, a major player in the alcoholic beverages sector, maintained a strong presence in the market through sustained advertising efforts. Despite a small increase from 2022, the company’s commitment to marketing remains evident.

3. Fidelity Bank

2021: N5,824 million

2022: N21,883 million

2023: N22,818 million

Fidelity Bank continued its upward trend in marketing expenditure, with a slight increase from 2022. This consistent growth reflects the bank’s strategy to enhance brand awareness and customer loyalty.

2. FBN Holdings

2021: N10,461 million

2022: N12,133 million

2023: N32,333 million

FBN Holdings made a notable leap in 2023, nearly tripling its marketing budget compared to 2022. This significant increase highlights the company’s aggressive push to solidify its position in the competitive banking sector.

1. Nigerian Breweries Plc

2021: N40,530.11 million

2022: N57,068.80 million

2023: N51,324.46 million

Nigerian Breweries Plc remains at the top of the list, though its marketing spend dipped slightly in 2023. The company continues to lead the beverage industry with massive investments in brand promotions and consumer engagement across Nigeria.

Note: The data used in this analysis was sourced from the financial statements of companies listed on the NGX 30 Index of the Nigerian Exchange Plc. It is important to note that Nigerian companies report Marketing, Advertising, and Promotion Expenses differently in their financial statements. While some companies itemize these costs separately, others group them together under a single expense line. For consistency, Nairametrics has adopted the approach of combining these expenses into a single category for this report.