Egypt has joined the Africa Finance Corporation (AFC), the continent’s leading infrastructure solutions provider, as the first North African sovereign shareholder.

This was disclosed in a statement obtained from AFC by Nairametrics. According to the statement, the country becoming the first North African shareholder in the Corporation will further diversify AFC’s expand equity investor base.

An AFC Member State, Egypt’s equity commitment and its imminent representation on the AFC Board of Directors enhances the Corporation’s pan-African spread of shareholders and diversified Board and management, which now includes governments, development finance institutions and institutional investors.

Countries onboarded in 2022: In 2022 alone, AFC onboarded Sierra Leone, the Democratic Republic of Congo, Cote d’Ivoire, South Africa’s Public Investment Corporation, and the pension funds of Mauritius and Seychelles as shareholders. Other sovereign shareholders include Ghana, Gabon, Togo and Guinea.

Boost to regional trade: Nairametrics gathered that as the largest North African economy, Egypt’s investment leads the way for other countries and investors from the region to join AFC’s shareholders and use its platform to boost regional trade and co-investment opportunities.

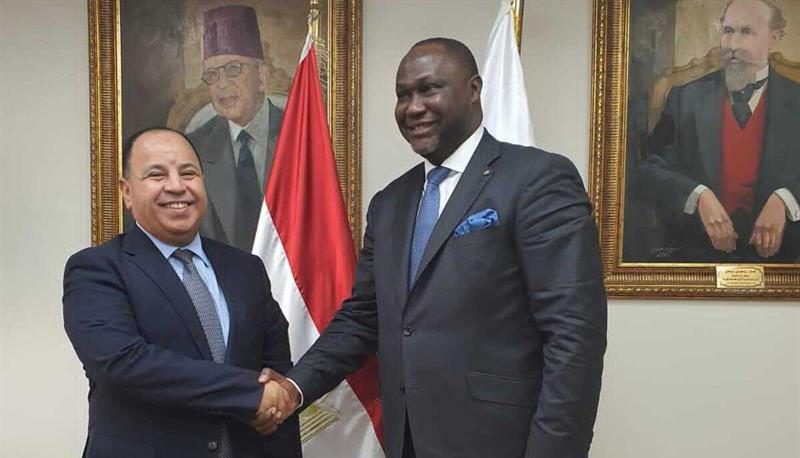

- Egypt’s Minister of Finance, H.E. Dr Mohamed Maait, said: “This equity investment is a testament to our confidence in AFC’s role as a trusted partner in delivering transformational impact in Egypt and overall in Africa. We look forward to boosting our partnership with the Corporation as we work together to develop the key infrastructure projects in the pipeline.”

Credit rating: A growing and diversified shareholder base alongside profitable returns and consistent dividends are behind AFC’s A3 investment-grade credit rating, which the Corporation leverages to fulfil its mandate to close Africa’s infrastructure and industrial financing gap.

With a membership of 39 countries now and total investments of $11.5 billion over 16 years, the Corporation continues to deliver on its promise to support sustained robust growth and development in Africa.

Focus on development: AFC focuses on developing and financing sustainable investments in the core sectors of power, natural resources, heavy industry, transport and telecommunications, with a strategy of adding value to exports and creating jobs through the development of industrial ecosystems.

The Corporation is committed to making Africa pivotal in the global race to net zero by reducing global shipping through localised production—including in minerals critical to battery production—while preserving Africa’s carbon sinks through optimal utilization of transition fuels and simultaneously developing its formidable renewable energy resources.

Identified projects: AFC has already identified an immediate project pipeline worth over $1 billion in critical infrastructure across key sectors in Egypt, including renewable energy, natural gas, heavy industries, technology, telecoms, banking and finance. That is in addition to US$265 million of existing investments by AFC in Egypt.

- “We welcome Egypt as a highly valued member of our core shareholders, helping us to maximise the impact of investments in systemic solutions within Egypt and across the continent,” AFC President & CEO Samaila Zubairu said. “We look forward to expanding our collaboration to elevate Egypt’s economy through delivering resilient infrastructure, in line with our mandate of catalysing economic growth, value accretion, and industrial development for all African countries.”

The Backstory: AFC was established in 2007 to be the catalyst for private sector-led infrastructure investment across Africa. AFC’s approach combines specialist industry expertise with a focus on financial and technical advisory, project structuring, project development, and risk capital to address Africa’s infrastructure development needs and drive sustainable economic growth.

Sixteen years on, AFC has developed a track record as the partner of choice in Africa for investing and delivering on instrumental, high-quality infrastructure assets that provide essential services in the core infrastructure sectors of power, natural resources, heavy industry, transport, and telecommunications. AFC has invested US$11.5 billion in 36 countries across Africa since its inception.