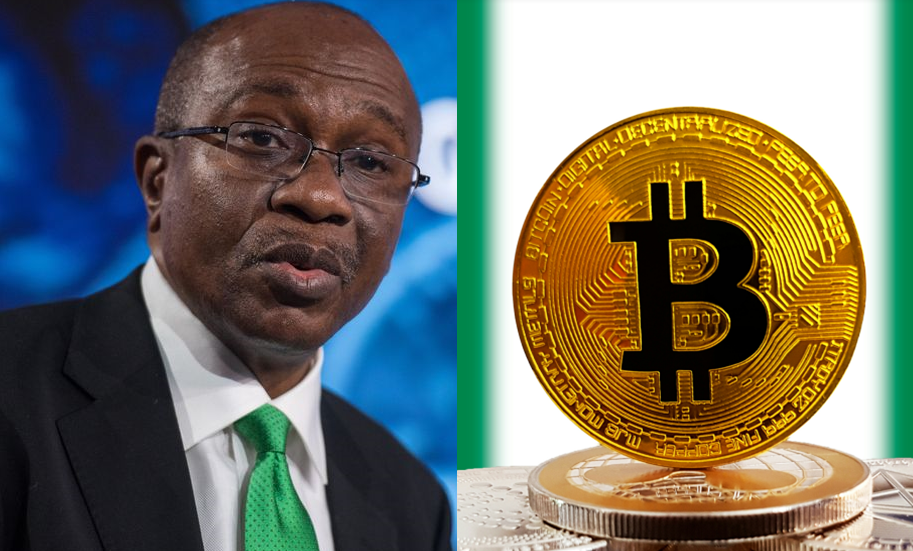

The Central Bank of Nigeria in a circular recently notified Deposit Money Banks, Non-Financial Institutions, other financial institutions against doing business in crypto and other digital assets.

The apex bank’s circular read in part:

“Accordingly, all DMBs, NBFIs and OFIs are directed to identify persons and/or entities transacting in or operating cryptocurrency exchanges within their systems and ensure that such accounts are closed immediately.”

“Please note that breaches of this directive will attract severe regulatory sanctions. This letter is with immediate effect.”

READ: How Crypto can curb Nigeria’s high unemployment rate

News of the CBN’s decision to prohibit banks from facilitating crypto-related transactions through the banking system has since gotten very harsh reactions on social media with many condemning the policy as a deliberate attempt by the government to impoverish young Nigerians who have been able to create wealth for themselves through crypto trading.

Some have also noted the lack of policy cooperation between financial regulators in Nigeria due, to the fact that the SEC had only a few months ago proposed a new set of rules that will regulate crypto-token or Crypto-coin investments when the character of the investment qualifies as securities transactions.

Crypto exchange, Binance had taken to Twitter to urge their Nigerian customers to “Withdraw your NGN as early as possible to avoid potential channel issues,” while also noting that the new CBN law is a “one step back” on crypto adoption in Nigeria.

READ: Atiku says crypto prohibition will restrict inflow of capital into Nigeria

Received notice from our channel partners that NGN deposits and withdrawals will be affected. Still confirming details on when/how. Please withdraw your NGN as early as possible to avoid potential channel issues. Will share more details as they become available. 🙏🙏🙏 https://t.co/Nr2ba4lfwI

— CZ 🔶 BNB (@cz_binance) February 5, 2021

Two step forward, one step back…

— CZ 🔶 BNB (@cz_binance) February 5, 2021

To demonstrate Binance’s importance in the Nigerian Crypto space, Nonso Obikili, an Economist stressed that Crypto transactions in Nigeria already dwarfed the daily transaction volume on the Nigerian Stock Exchange on Binance alone.

“How important is crypto in Nigeria? On binance today the value of BTC/NGN trades was worth N13.4bn. For context the volume of trade on the Nigerian stock exchange today was N5.6bn. And Binance is just one exchange,” Obikili stated.

READ: Ethereum breaks above $1,520 amid strong buying demand

How important is crypto in Nigeria? On binance today the value of BTC/NGN trades was worth N13.4bn. For context the volume of trade on the Nigerian stock exchange today was N5.6bn. And binance is just one exchange.

— Nonso Obikili (@nonso2) February 5, 2021

Still, on Binance, other crypto enthusiasts called for calm and urged Nigerians to change their Naira balance to USDT (Tether) stablecoin on the platform in a bid to be careful against CBN prohibited deposits.

Do not deposit naira again on Binance

Immediately swap your naira for USDT if you have naira balance

Do not sell your crypto assets in panic.

It's a global trading system that CANNOT be affected by Nigeria CBN policies.

Decentralized Finance is the future.

You can't stop it!

— Tosin Olugbenga (@TosinOlugbenga) February 5, 2021

On the policy side, Nigerians faulted the CBN directive, saying there is no logical reason to prohibit crypto enabled transactions, as the directive appears to contravene the Buhari-led administration’s promise to lift 100 million Nigerians out of poverty.

“They can’t claim crypto traders in Nigeria are faceless. You register with your BVN. You are verified based on KYC principles. This is nothing but a desperate attempt to ensure we are happy with “poverty alleviation” moves. Instead of the wealth innovation brings,” Japheth Omojuwa, a popular social media commentator noted.

READ: How Cryptocurrency is driving economic growth

They can’t claim crypto traders in Nigeria are faceless. You register with your BVN. You are verified based on KYC principles. This is nothing but a desperate attempt to ensure we are happy with “poverty alleviation” moves. Instead of the wealth innovation brings.

— JJ. Omojuwa (@Omojuwa) February 5, 2021

Nigeria can ban crypto trading overnight, but has been discussing on banning open grazing for almost a decade??

— Ebovi Wali 🗺️ (@ebovi_wali) February 5, 2021

In Nigeria

You do business- govt policies ruin it.

You do trade- govt close borders.

You do farming- herdsmen kill you.

You want dollars- govt hoards it.

You enter crypto- govt bans it.The destruction of the lives of young people in Nigeria is NOT a mistake.

It is well planned.— #OurFavOnlineDoc 🩺 🇬🇧 (@OurFavOnlineDoc) February 5, 2021

On the investor side of things, CEO of TalentQL, Adewale Yusuf warned that Nigeria’s government policies that restrict ease of business for tech startups are a worry for foreign investors. Others warned of general risks as the policy fails to fix monetary bottlenecks and tackle why Nigerians are adopting crypto.

I just spoke with a foreign investor that invested in Gokada and a crypto startup in Nigeria. He's really worried.

— Adewale Yusuf (@AdewaleYusuf_) February 5, 2021

Investing in Nigeria will take the biggest hit. Why will anyone invest in a Nigerian fintech startup when their future could be terminated with a typo ridden memo? This is the same for all other regulated spaces. Other African countries will win. There is AfCTA now.

— Osaretin Victor Asemota (@asemota) February 6, 2021

The CBN directive to ban Crypto transactions is outrageous. There are so many young people innovating, creating so much despite the hostility of the Nigerian government. This is an assault on all those staking so much in investing themselves in Nigeria.

— . (@FakhuusHashim) February 5, 2021

Meanwhile, former Vice President, Atiku Abubakar also warned that prohibiting crypto trade is harmful to the job prospects of young Nigerians as it also reduces inflow of capital to Nigeria.

The former Vice Presidential candaidate of the Peoples Democratic Party stated, “What Nigeria needs now, perhaps more than ever, are jobs and an opening up of our economy, especially after yesterday’s report by the National Bureau of Statistics indicated that foreign capital inflow into Nigeria is at a four year low,having plummeted from $23.9 billion in 2019 to just $9.68 billion in 2020.

“Already, the nation suffered severe economic losses from the border closure and the effects of the #COVID19 pandemic.

“This is definitely the wrong time to introduce policies that will restrict the inflow of capital into Nigeria, and I urge that the policy to prohibit the dealing and transaction of cryptocurrencies be revisited.”

This is definitely the wrong time to introduce policies that will restrict the inflow of capital into Nigeria, and I urge that the policy to prohibit the dealing and transaction of cryptocurrencies be revisited.

— Atiku Abubakar (@atiku) February 6, 2021

However, true to the saying, necessity, they say is the mother of all inventions, the recent crypto prohibition has forced some Nigerians to suggest different ways to bypass the CBN regulation.

Chin, a tech and finance writer said, “Watch crypto exchanges use Ghanian banks as their contact points and watch the Ghanian economy benefit from the inflow of so much money.”

A Twitter user with the handle @sirpeeworld advise other bitcoin traders not to panic, but explore the option of transferring their bitcoins abroad.

“No one should panic yet. Many ways will be discovered soon. If you have anyone outside Nigeria, it will be easy for you to do your bitcoin things. You can transfer to anyone outside Nigeria. They will buy from you and send you naira,” he tweetd.

watch crypto exchanges use Ghanian banks as their contact points and watch the Ghanian economy benefit from the inflow of so much money.

— c (@LXRE__) February 5, 2021

Crypto trading about to switch into full P2P mode in Nigeria and take flight. Time to buy more bitcoins

— Retired Nigerian (@Dolarpo) February 5, 2021

Remarkably, Nigeria attracts more interest in Bitcoin than any country in Africa. According to a recent report released by blockchain.com, Nigeria emerged as one of the fastest-growing crypto markets globally.

This increasingly growing interest is partly due to poorer monetary policies that cause devaluation and makes crypto a good alternative source to hedge against inflation. Judging by the reaction and responses on the internet, that interest will not end soon.

The Nigerians use crypto to decentralize against “government control,” and as a result, peer-2-peer crypto transactions are expected to rise over the next weeks, according to analysts.