Dangote Cement reported a 3.8% y/y growth in Revenue to N249.2bn in Q1 2020. The growth in group revenue was solely driven by an improvement in revenue from its Nigerian operations (up 5.6% y/y to N179.3bn) amidst a flattish performance from Pan African operations (down 0.6% y/y to N69.8bn). We expect the impact of COVID-19 to have a more profound impact on Nigeria Sales in Q2-2020, given that Lagos, Ogun, and the FCT went on full lockdown from 30 March. Although the lockdown measures were relaxed on 4 May, economic activities are yet to return to pre-COVID-19 levels.

Similarly, we expect weaker Revenue from Pan African Operations driven by weakness in South Africa (poor macro conditions, lockdown in the last week of March amidst weak infrastructure spending by the government), Tanzania (production challenges and unfavorable weather conditions) and Zambia (the economy slipped into recession in Q1, leading to a decline in the cement market) to have a material impact on overall Pan African sales volumes. As such, we have made marginal adjustments to our forecasts.

We retain our target price of N182.4/s and maintain our Buy recommendation largely due to attractive valuations. Trading at FY 2020 EV/EBITDA of 7.0x compared to its EM peer average of 9.2x and its 5-year average of 7.7x, we believe the company’s valuation remains attractive. We arrived at our target price using a blend of DCF valuation and relative valuation in the ratio 60:40. We also note that the company’s planned share buyback has been approved by SEC and management will review the opportunity to deploy the programme in due time. We believe this remains a catalyst for an upward re-pricing of its shares.

READ ALSO: Dangote Cement’s Q1 Result: Weak topline and higher OPEX drive weak earnings

Review of Q1 2020 performance

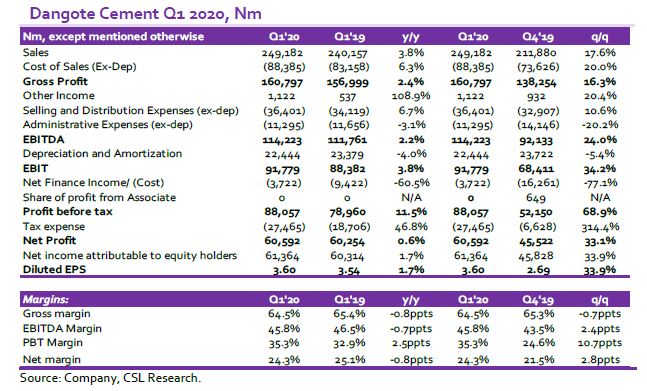

Q1 2020 Revenue grew 3.8% y/y to N249.2bn. The growth in group revenue was solely driven by an improvement in revenue from its Nigerian operations (up 5.6% y/y to N179.3bn) amidst a flattish performance from Pan African operations (down 0.6% y/y to N69.8bn). On a q/q basis, we note that group revenue grew stronger, up 17.6% q/q, again on the back of a sturdy growth from Nigerian operations (up 26% q/q). We believe the growth in revenue from Nigerian operations reflects stronger demand for cement particularly in the months of January and February which more than compensated for the slowdown in March due to headwinds triggered by the outbreak of the global pandemic. Notably, cement sales volumes grew by 0.7% y/y to 4.0MT, the highest Q1 volume in the last four years. However, we note that the momentum in sales volumes has slowed down, following the lockdown implemented in states such as Lagos, Ogun, and the Federal Capital Territory (FCT).

EBITDA grew 2.2% y/y to N114.2bn. The low single-digit growth in EBITDA was due to a higher increase in cost of sales adjusted for depreciation (up 6.3% y/y) compared to the growth in revenue (up 3.8% /y). The increase in cost of sales adjusted for depreciation was largely driven by growth in salaries and related staff costs (up 13% y/y) and other production expenses (N4.0bn in Q1 2020 vs N1.5bn in Q1 2019). However, the company reported a sub-inflationary growth in OPEX (up 4% y/y to N47.7bn). We highlight that expenditure on advertisement and promotion was up 96% y/y to N3.7bn- we believe this was due to the continued implementation of sales promotional activities to drive sales volume. Overall, EBITDA margin weakened marginally by 0.7ppts to 45.8% in Q1 2020.

READ MORE: Continental Reinsurance reports Q1 2020 results, affirms support towards COVID-19 pandemic

Net Finance Cost dipped significantly, down 60.5% y/y t0 N3.7bn in Q1 2020, due to a decline in Finance Cost (down 23% y/y to N9.0bn) alongside foreign exchange gains of N3.7bn recorded in Q1 2020. However, Finance Income was down 32.6% y/y to N1.5bn, reflective of the decline in Cash and Bank Balances (down 41% y/y to N101.8bn) and a lower yield environment. We note that the decline in Finance Cost was due to the absence of Foreign exchange loss in Q1 2020 compared to N3.1bn recorded in Q1 2019.

Pre-tax Profit grew 11.5% y/y to N88.1bn in Q1 2020. A higher effective tax rate of 31% in Q1 2020 compared to 24% in Q1 2019 led to a flattish growth in Profit after tax, up 0.6% y/y to N60.6bn in Q1 2020. Earnings per share rose to N3.60/s in Q1 2020 from N3.54/s in Q1 2019.

Looking ahead, we expect the deterioration in the macroeconomic narrative of Nigeria, caused by the outbreak of COVID-19 and significantly lower oil prices to constrain activities in the construction industry as fiscal spending on capital projects weakens, on the back of lower oil revenue. In a similar fashion, we expect private sector investment in gross fixed capital formation to slow down as businesses cut down on their CAPEX plans given fragile macro conditions, which will weaken aggregate demand.

READ ALSO: FAAC disburses N1.945 trillion in Q1 2020, highest Q1 allocation since 2014

Similarly, we expect weaker Revenue from Pan African Operations driven by weakness in South Africa (poor macro conditions, lockdown in the last week of March amidst weak infrastructure spending by the government), Tanzania (production challenges and unfavorable weather conditions) and Zambia (the economy slipped into recession in Q1, leading to a decline in the cement market) to have a material impact on overall Pan African sales volumes. Considering the 1.4% decline in Pan African Sales Volumes in Q1 2020, we have revised downwards our forecast on Pan-African volumes to 9.25MT (previously; 9.82MT) in 2020.

Valuation; BUY rating maintained

We retain our target price of N182.4/s and maintain our Buy recommendation largely due to attractive valuations. Trading at FY 2020e EV/EBITDA of 7.0x compared to its EM peer average of 9.2x and its 5-year average of 7.7x, we believe the company’s valuation remains attractive. Furthermore, we highlight that the proposed share buyback is a positive catalyst for upward re-pricing of the shares. We arrived at our target price using a blend of DCF valuation and Relative valuation in the ratio 60:40.

CSL Stockbrokers Limited, Lagos (CSLS) is a wholly-owned subsidiary of FCMB Group Plc and is regulated by the Securities and Exchange Commission, Nigeria. CSLS is a member of the Nigerian Stock Exchange.