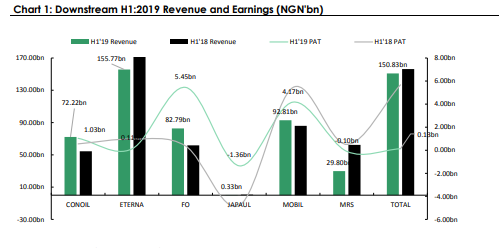

With earnings season now over, we have yet another opportunity to take more than a cursory glance at the H1:2019 financial scorecards for Nigeria’s downstream segment. The narrative is largely unchanged from Q1, although with a further shift in fortunes to the downside. In H1, overall topline for listed players (ex-OANDO) took a 1.67% hit, pitching in at NGN584.54bn (vs. NGN594.45bn in H1:2018), as product stockpiles built up. For TOTAL (-3.48%; NGN150.83bn), MRS (-52.18%; NGN29.80bn) and their ilk, large retail networks were not enough to drive substantial topline growth.

While TOTAL shut down some of its retail outlets during the period for renovation/upgrades, MRS shifted emphasis from serving its Bulk/Industrial customers (which historically are receivables-laden) to a retail-driven strategy, a shift which has impacted its revenues in the short-term but is certain to deliver better efficiency in asset-use in the long-term. After a 4-month hiatus resulting in suspension by the NSE, CONOIL finally turned in its 2018FY, Q1:2019 and H1:2019 results.

While its governance issues remain a critical red flag, the company is staking a claim to the crown of “downstream darling” after posting a NGN72.22bn topline (+32.56%) in the half year and significant bottomline growth, in spite of the prevailing environment. Bottomline growth across the segment was a sizeable 8.33% (NGN8.72bn to NGN9.44bn), albeit propped by FO’s NGN5.45bn (+1,386.97%) and CONOIL’s NGN1.03bn (+87.54%), as all other players recorded earnings declines.

Then again, FO’s result was purely a one-off income booked on the back of outstanding subsidy payments, which suggestively waters down the quality of the earnings growth posted. Share prices have reflected sentiment on the segment; the NSEOILG5 has lost 27.30% YtD, with the likes of TOTAL and FO testing new year-lows. The consensus is clear – the risks in Nigeria’s downstream are as diverse as they are knotty. As we work towards domestic sufficiency in refined products in the near term, PMS prices need a much-needed lift as quickly as is realistically possible.

At the July meetings between OPEC and its Non-OPEC allies, Iraq (one of the founding members and 2nd-largest producer in the OPEC bloc) suggested a 1.8mbpd production cut, seeing this as the key lever to balance an oil market that was increasingly tending towards

a bearish outlook.

The rest of the coalition took exception, instead maintaining status quo at 1.2mbpd, albeit for longer into Q1:2020. Iraq now appears to be vindicated, as fears about weakening global demand have been exacerbated by the escalation of the trade war barely a month after that meeting. In the first week of August, oil prices dipped below the psychological mark of USD60pb, testing new 7-month lows at USD57pb.

The announcement by US that a 10% tariff would come into effect on the last tranche (USD300bn worth) of Chinese goods, effective September 1 was the trigger traders needed to sell off on oil. As China retaliated via a number of announcements, global equity and fixed income markets felt the heat, and oil futures were not spared. The US President has since backtracked, with tariffs on a number of key goods now set to kick in from December 15. While prices have seen a slight recovery since then, they remain firmly below USD60, a valid pointer to the fact that the risks did not go away, they were only delayed.

Critical questions are now being asked of the near-term sustainability of the current OPEC strategy, particularly with the US rapidly gaining a march on the coalition’s market share. In July, the group pumped 246tbpd (-0.8%) lower than it did in June, with gross crude production now at 29.61MMbpd, 3.77% lower than the 30.77MMbpd recorded at the start of the adjustment period in January – the 9th successive month of declines. Saudi Arabia keeps leading from the front (-134tbpd in July) and has promised an additional 2MMbpd in cuts in the next few months.

In addition to the tensions in the persian gulf, artificial declines in Iran and Libya are also helping this cause. However, the demand picture remains the overarching issue and the speedy compromise or otherwise of the trade war will determine the direction in which oil speculators pitch their tents for the rest of 2019. In the meanwhile, OPEC might need to make a forceful statement of intent – perhaps by announcing a much larger cut, to calm the morbid frenzy. In July 2019, tensions in the Persian Gulf got to a head, as Iran sustained protection of its oil market share, in defiance of sanctions imposed on it by the US and its allies.

Two tankers, one owned by the US and the other by the UK, were seized along the Strait of Hormuz, the key artery for global oil trade. The United Kingdom similarly seized an Iranian tanker on the British overseas island of Gibraltar, arguing that Iran was evidently circumventing the sanctions by selling oil in the international markets. There have been indications that the Middle-East country has sustained sales via illegal mechanisms including ship-to-ship transfers and turning off tracking devices to stay off the radar of maritime watchdogs.

Watchers have similarly suggested that Iran has found a willing accomplice in the Orient, as it continues to ship to China, which is also at the receiving end of US tariffs. If Iran is somehow still finding space for sales, it goes without saying that the oil market will sooner than later be in a state of oversupply, a situation which will counteract OPEC’s output cuts and place further downward pressure on already-battered prices. Top of the mind (in the near term though) is the OPEC output cap, which would limit the extent of any production ramp up.

As it were, the US is now the world’s largest source of light-sweet crude and remains strategically positioned to take advantage of the new regulations. However, as shale growth peaks in the early 2020’s (and subsequently declines), vessels will need new fuel sources. The investments required to take full advantage need to be in place from now. January 1, 2020 will herald new regulations in the maritime industry that have far-reaching implications for the global oil and gas business.

In fulfillment of its climate change obligations, the International Maritime Organization

(IMO) has stipulated that all marine bunkers and vessels are powered by only Low Sulphur Fuel Oil (LSFO), which hold sulphur content of 0.5% or below. As a way to circumvent this new rule, vessels can rather install an expensive “scrubber” system which acts to remove sulphur content from exhaust before discharge into the atmosphere.

This new rule directly impacts “sour” oil (sulphur content >0.5%) producing nations, as we expect to see a rapid shift towards sweet crude types which hold relatively lower impurities. As most Nigerian crude varieties are on the light sweet end of the spectrum, this is immediately positive news for investors in Nigeria’s exploration space.

Specifically, Bonny Light, Brass River and very recently, Egina varieties have proven popular with buyers; an indication that the goldmine is undoubtedly offshore. However, fiscal terms for the industry (as codified in the various subdivisions of the Petroleum Industry Bill) remain uncertain and are constraining capital investments.

Is Nigeria in pole position to leverage IMO 2020 shift?

In the early 2010’s US crude imports began a pronounced slump. The US did not discover any new significant conventional oil formations, but a new way to drill oil from difficult areas. Thus began the shale boom, a precursor to the global oil price crash of 2015/2016. Since then, the US has seen sustained success with its shale efforts, nicking the title of the world’s largest producer from Saudi Arabia in 2018.

Current production levels are c.12MMbpd, with c.70% of this made up by Shale. With c.2MMbpd in production, the Permian Basin in Texas is the most evident driver of US shale exploits. On the other side of America, the Vaca Muerta is warming up to lead crisis-ridden Argentina out of an economic watershed. Spanish for “Dead Cow”, the Vaca Muerta shale basin was also discovered in 2010, with the EIA putting proven reserves at c. 16.0bn barrels of oil & condensate and 308Tcf of gas.

Natural gas production in Argentina touched 1.0BCfd in December 2018, largely due to the shale play which currently accounts for c.23% of Argentina’s gross natural gas production. Oil produced from this basin is of the light-sweet variant, and would readily compete with US shale and other favorites such as Nigeria’s Bonny Light in the international market, more so with IMO 2020 regulations coming on board in January next year.

While some early production forecasts have put the formation’s potential at 1.25MMbpd, OPEC has put out more cautious numbers – an average supply of 0.46MMbpd up until 2023. While the numbers do not point to a very strong threat, we acknowledge that the competition in the light-sweet market has intensified, prominently in the gas market where Nigeria is currently the 4th largest LNG exporter and has reserves of only c.202Tcf.

Will Argentina’s Vaca Muerta replicate US Shale Success?

By October 2019, Nigeria will have added 6,000bpsd in refining capacity to the existing volumes, with the commencement of the Edo modular refinery. Much smaller than the conventional refinery, a modular refinery is designed such that its components are assembled on site, rather than constructed from scratch. Fabrication and construction of parts for the Edo Refinery has already been completed in China, and is currently awaiting inspection cum approval by the Department of Petroleum Resources (DPR) before being shipped to Nigeria.

Due to their configuration, modular refineries produce greater yield efficiency for products when they are fed with the light-grade crude oil which Nigerian oilfields produce. They process between 500bpsd and 30,00bpsd, with far less operating cost. Very recently, the Nigerian government has inclined towards modular refining to improve capacity, availability of locally sourced products and general investment into the refining segment of the oil and gas industry.

This shift appears poised to yield impressive dividends, as 31 of the 37 (84%) licensed private refineries as at December 2018 were modular refineries, with 3 of them having been granted Approval-to-Construct (ATC) licenses, while 12 own active Licence-To-Establish (LTE). The USD12bn Azikel Refinery in Gbarain, Bayelsa state also has a 2021 completion date, while the largest refinery on this side of the world – Dangote’s 650,000bpsd single-train facility is also set for completion c.2021. In July, the refinery’s atmospheric chamber (touted the largest in the world), set sail from China. Current national refining capacity (PH 1 & 2, Warri, Kaduna and NPDC) is 446,000bpsd.

With the planned additons of Dangote (+650,000bpsd), Modular Refineries (+689,000bpsd) and Other Complex Refineries (+700,000bpsd), overall capacity is set to surge to c. 2.49MMbpsd from c.2023, cutting back importation, building a viable export market and increasing contribution of the oil and allied industries to national GDP.