Three Payment Service Banks (PSBs) have been given Approval-in-Principle (AIP) by the Central Bank of Nigeria to commence banking operations in Nigeria. The three institutions are Hope PSB, Money Master PSB and 9PSB.

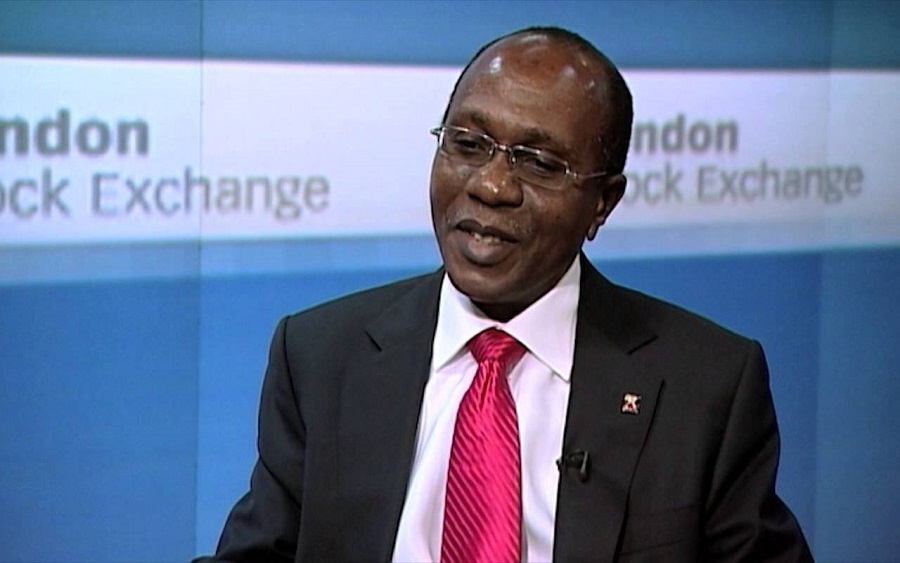

This was revealed in a statement by the Director, Corporate Communications Department of the CBN, Isaac Okorafor, who stated that the provisional approval was part of the Apex bank’s guidelines for establishing PSBs.

[READ MORE: CBN introduces new policies, commences charges on money deposits]

The Details: The approval is in line with the mandate of the CBN to deepen financial inclusion in the country, as well as widen access to deposit products and payments services through a secured technology-driven environment.

Corroborating the CBN’s decision to issue AIP to the applicants, Okorafor said it was only possible because the PSBs adhered to the laid down conditions and provided the right documents.

It doesn’t end here. The three banks will now submit another application, to be granted a final license, not later than six months after this stage. Okorafor hinted that CBN’s code of corporate governance for banks would apply to the PSBs.

What you should know: PSBs were established in line with the mandate of the Apex Bank to promote a sound financial system and enhance access to financial services for low-income earners and unbanked segments of the society. The operational guidelines were set at the end of 2018.

[READ MORE: Fintech: CBN issues new license]

PSBs’ Objectives: They were birthed to provide financial inclusion by increasing access to deposit products and payment/remittance services to small businesses; low-income households and other financially excluded entities through high-volume low-value transactions in a secured technology-driven environment.

- They are permitted to deploy ATMs and Point of Sale devices in some areas.

- They are at liberty to operate through banking agents (in line with the CBN’s Guidelines for the Regulation of Agent Banking and Agent Banking Relationships in Nigeria).

- They can enter a direct partnership with card scheme operators but the cards are not eligible for foreign currency transactions.

What this means: PSBs are expected to facilitate high-volume low-value transactions in remittance services as well as micro-financial serves in rural areas and unbanked locations, targeting financially excluded persons, fulfilling the CBN’s objective in cutting the level of financial exclusion by 20%.

[READ FURTHER: LCCI reacts to CBN’s new cashless policy, says time frame is disruptive]