Following the trail, blazed by Wema Bank, Standard Chartered Bank has now launched its first Digital Bank in Africa. They confirmed this in a press release sent to Nairametrics on Friday (see below).

The Pan African/International bank chose the Ivory Coast as the country where it will be piloting the digital bank. Standard Chartered has little retail presence in Nigeria where it is more associated with corporate and institutional banking.

In Ivory Coast, it is the 13th largest bank in the country and is also largely regarded as a corporate and institutional banking business, providing financial products and services to multi-national corporations, financial institutions, and development organizations. There are 20 banks in the country.

The launch into digital banking perhaps marks a new turnaround for the bank suggesting that it wants to make inroads into the retail banking space. Digital banking is still considered nascent for Nigerian Banks and could redefine how banking is served in sub-Saharan Africa, where mobile phone penetration growth is expected to continue to grow exponentially.

Interesting to note that Standard Chartered was considered the Best Consumer Digital Bank in 2017 by Global Finance.

Here is a copy of the Press release;

Côte d’Ivoire marks the pilot launch of the digital bank

ABIDJAN, Ivory Coast, March 16, 2018/ — Standard Chartered Bank (www.SC.com) today announced the official launch of its digital bank in Côte d’Ivoire. This marks the Bank’s first digital bank in Africa and the first-of-its-kind to open in Côte d’Ivoire.

Mr. Bruno Nabagné KONE, Minister of Information technologies and communication of the Republic of Côte d’Ivoire, was the guest of honour at the official launch event. The event was attended by dignitaries, business leaders, clients and senior management, as well as sporting legend and Ivorian icon, Didier Drogba. As the Bank’s Digital Ambassador, Drogba shared his experience on the ease of opening an account using his mobile phone. He is the first person in Côte d’Ivoire to open a digital account at the Bank.

Commenting on the launch, Sunil Kaushal, Regional CEO, Africa and Middle East said: “We are pleased to launch our first digital bank in Africa with the support of the Government of Côte d’Ivoire. This is a key milestone on our digital journey as a Bank and underlines our commitment to investing and growing in the market. We have been steadily investing in expanding our footprint in Africa over the years, and this will continue to be a priority moving forward. Digitising Africa remains at the heart of our business strategy for the region, and we look to implement our Côte d’Ivoire model across other markets in the coming months.”

Commenting on the launch, Jaydeep Gupta, Regional Head of Retail Banking, Africa & Middle East, said: “Our new digital bank was developed with our clients in mind. We have taken into consideration the feedback received by our clients at each stage of the design process and have incorporated innovative technology to allow them to execute all banking activities from a mobile device. This includes 70 banking services through the app.”

“In addition, for the first time, the client onboarding journey has been digitised and in under 15 minutes a client can open a new account through the app. What has also been introduced is the ability for clients to track and trace a request submitted, which is a first for Standard Chartered. This is something we are very proud of.”

Isaac Foly, Chief Executive Officer, Côte d’Ivoire, said: “I’m pleased to have launched the Bank’s first digital retail bank in Côte d’Ivoire and proud to see the progress the country has made over the past decade. We have seen how digital transformation has contributed to economic development and will continue to do so, in line with the country’s National Development Plan. Our partnership with Didier Drogba has helped raise awareness, not only for our digital offering, but for enhancing financial literacy and improving accessibility to financial services across Côte d’Ivoire. Promoting the social and economic wellbeing of communities is a key component of our strategy to support sustainable development and our digital bank is certainly another step in the right direction.”

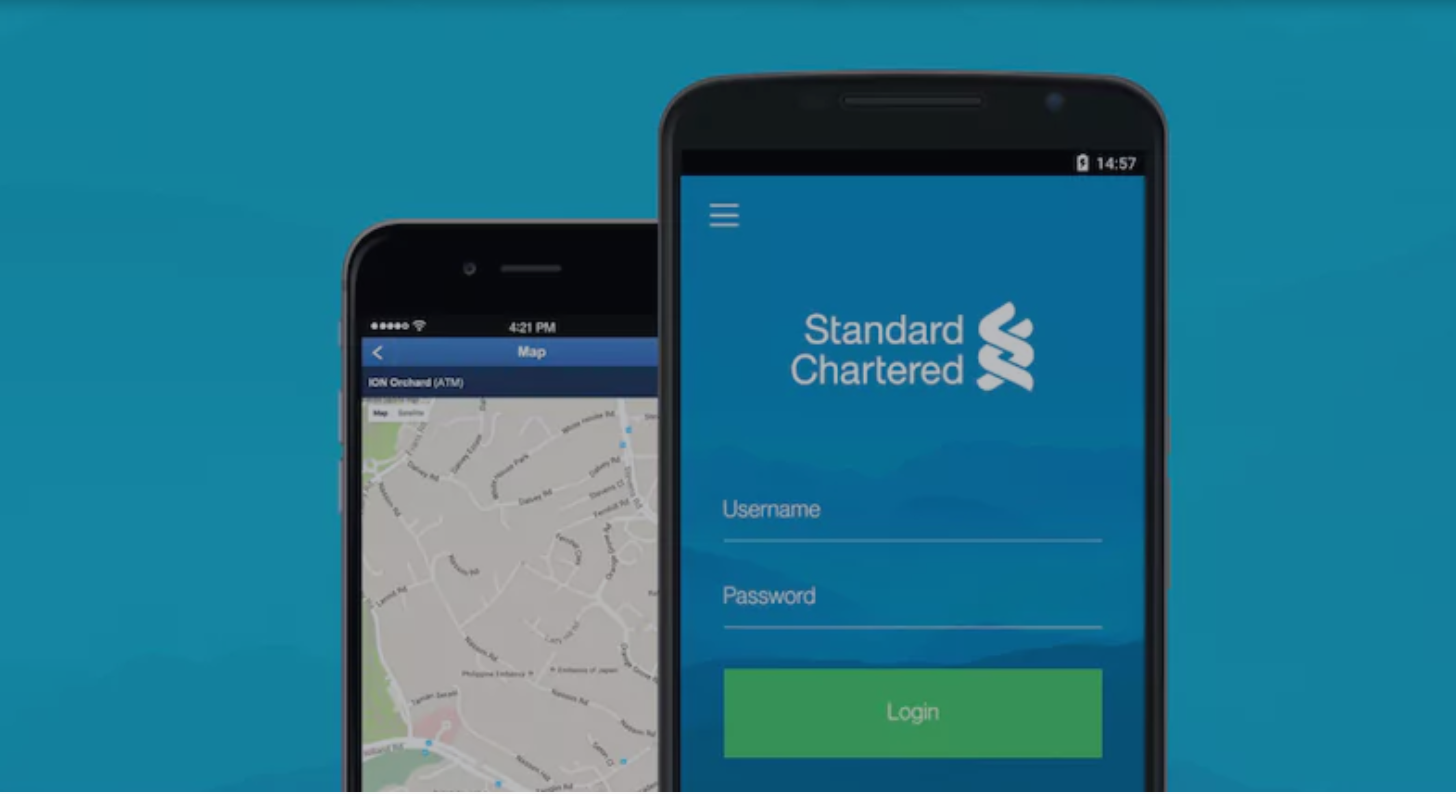

The bank’s digital services are available by downloading the Standard Chartered mobile application. New clients can execute all of their banking activities right from their mobile devices, starting by opening their bank account in less than 15 minutes. They can also provide all verification documents by uploading to the application and fully complete their onboarding process within minutes.