This is a narration on a stock market phenomenon called 14.29. It explains how the stock prices of some listed companies act suddenly to achieve determined outcomes, often in a way that surprises small investors and stock traders. The term 14.29 was coined by a very good friend of the house named Dexter. Dex, as he is fondly called is also a phenomenon.

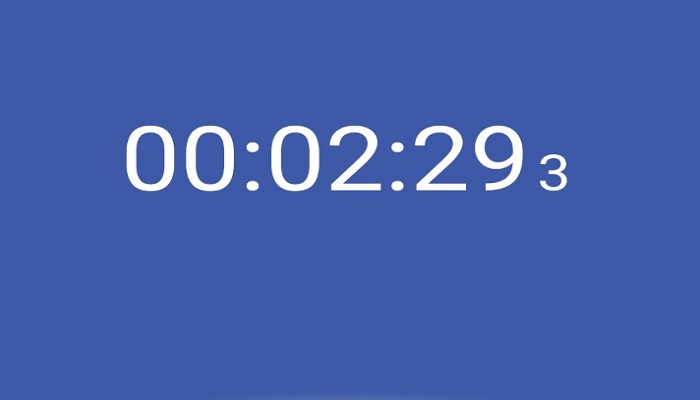

For ardent and eagle-eyed retail investors in the Nigerian stock market, the term 14.29, which actually means 2:29 pm, is a specific point in time during the trading day that has to be taken note of, if you trade stocks in real time. Those of us who understand this term, like to call it the 14.29 protocol, because it sounds quite snazzy.

But to explain what it means, let’s define a few terms and activities of the stock market, which you may find useful as we go on.

Bid/offer: A bid is when you place an order to buy stocks, while an offer is an order to sell shares. When total bid (buy orders) outweigh total offers for a stock, it is likely that the share price will rise because the demand for it is high.

If offers (sell order) outweigh the bids, it is likely that the share price will drop because people do not want it.

Now, to online stock trading.