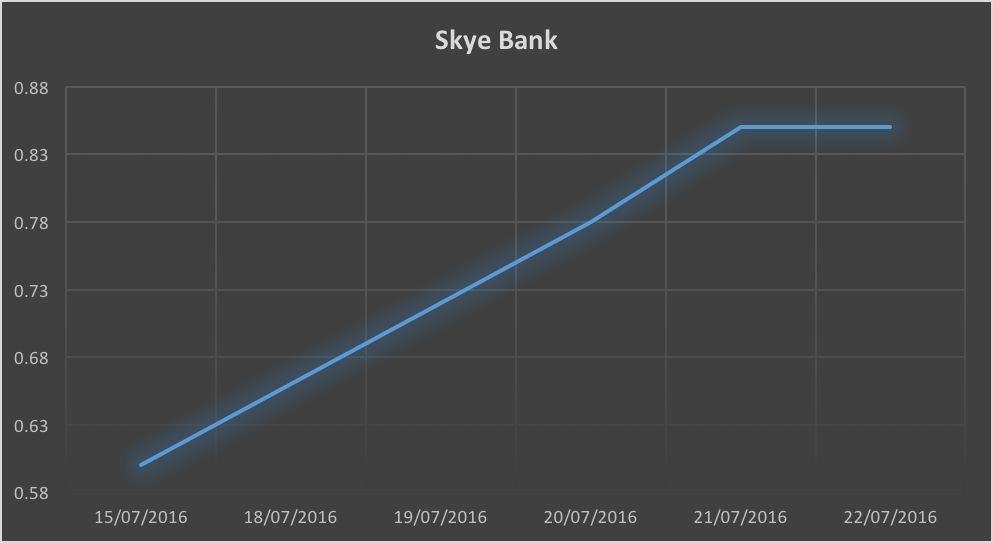

Shares of Skye Bank Plc was up a whopping 41% at the end of trading Friday July 22, 2016 in a remarkable turn around for a bank that has been under fire since the CBN announced that it had failed prudential ratios.

Skye Bank shares dropped to as low as 60 kobo per share after the Central Bank of Nigeria announced that it had reached a deal for its Chairman, CEO and some other directors of the bank to resign following the revelation that the bank had fallen short of capital adequacy ratios as well as liquidity ratios. Investors panicked dumping the shares in droves amidst fear that the bank could be Nationalized.

The new Management of the Bank as well as the CBN then commenced a major damage control initiative that was meant to restore confidence in the banks financials presenting a view that the current problems befalling the bank was mostly regulatory and not structural. They opined that with time, the bank will turnaround its fortunes.

However, the shares of the bank started a major rally after the news broke that the bank had reached a deal with Integrated Energy to refund $87.8 million. The bank was also reported to have received a bailout fund from the CBN in the form of a loan to enable it meet demand pressure from depositors who were scrambling to pull out their funds.

Trading Stats

| Date | Close | % Chg | Vol |

| 4/7/16 | 0.95 | -9.52 | 10,832,684.00 |

| 8/7/16 | 0.87 | -8.42 | 21,592,573.00 |

| 11/7/16 | 0.79 | -9.2 | 9,714,686.00 |

| 12/7/16 | 0.73 | -7.59 | 1,659,108.00 |

| 13/07/2016 | 0.67 | -8.22 | 4,226,681.00 |

| 14/07/2016 | 0.61 | -8.96 | 4,499,788.00 |

| 15/07/2016 | 0.6 | -1.64 | 61,304,814.00 |

| 18/07/2016 | 0.66 | 10 | 138,258,326.00 |

| 19/07/2016 | 0.72 | 9.09 | 57,710,403.00 |

| 20/07/2016 | 0.78 | 8.33 | 35,948,471.00 |

| 21/07/2016 | 0.85 | 8.97 | 54,000,541.00 |

| 22/07/2016 | 0.85 | 0 | 41,002,935.00 |

A look at the trading data in the last 12 days reveals there was a major spike in volumes traded between the 18th and 22nd of July indicating that there were market makers scooping up significant volumes of the stock at whatever price was available. Over 360 million shares has been traded in the last 6 days ending in a positive gain for the stock. The rally fizzled out on Friday after the stock closed neutral. Whilst some analysts suggest the stock is now in a bearish phase, it is hard to bet against the bulls especially at these sort of volumes. We will continue to watch this stock closely.