The Nigerian All Share Index ended 2015 in negative territory as the All Share Index closed 28,642.25 posting -17.36% return year to date (YTD) 2015. Market capitalization also ended the year at N9,850,605,500.53 compared to its December 2014 close of N11,477,661,174.49. Nigerian stocks effectively lost N1.62 trillion at the end of 2015.

Indices

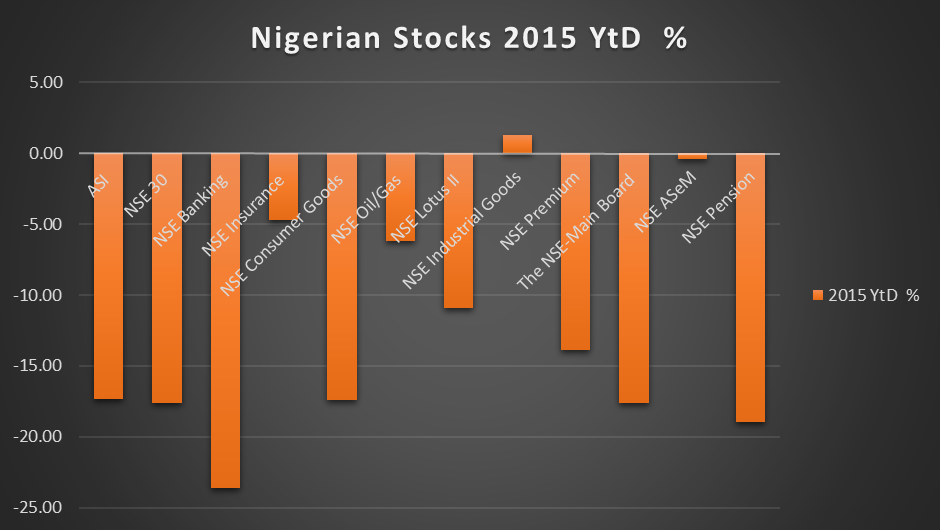

All the major sub-indices posted significant losses at the end of the year except for the Industrial Goods sector.

| Indexes | 2015 YtD % | 2014 YtD % |

| The NSE All-Share Index (ASI) | -17.36 | -16.4 |

| NSE 30 Index | -17.63 | -18.03 |

| NSE Banking Index | -23.59 | -21.53 |

| NSE Insurance Index | -4.70 | -2.11 |

| NSE Consumer Goods Index | -17.41 | -17.88 |

| NSE Oil/Gas Index | -6.20 | 11.84 |

| NSE Lotus II | -10.92 | -21.63 |

| NSE Industrial Goods Index | 1.27 | -15.98 |

| NSE Premium Index | -13.89 | N/A |

| The NSE-Main Board Index | -17.60 | N/A |

| NSE ASeM Index | -0.39 | N/A |

| NSE Pension Index | -18.96 | N/A |

Top Losers and Gainers

The Banking Index took the most hit posting a negative return of about 24% by the end of the year. The NSE 30 Index of the most capitalized stocks also mirrored the wider index posting -17.63% (2014: -16.4%) returns at the end of the year.

Despite the poor performance of stocks this year, some stock still posted significant gains by the end of the year. Beta Glass and Forte Oil (for the third year straight) led the pack posting strong double digit gains by the end of the year.

| Ticker | %age Gain |

| BETAGLAS | 92% |

| LAWUNION | 46% |

| FO | 45% |

| UPL | 42% |

| NPFMCRFBK | 38% |

| PRESCO | 35% |

| VITAFOAM | 34% |

| AIRSERVICE | 30% |

| CUTIX | 28% |

| UNILEVER | 21% |

However the likes of Diamond Bank, Oando, Cadbury all topped the losers list. Oando’s loss was mostly attributed to the record losses it incurred when it released its 2014 FY results and its 2015 9 months results. Cadbury had also posted over 90% drop in profits amidst tough competition and economic conditions. Diamond Bank had provided for over N39billion in impairments in 2015 taking its tally since 2013 to N117 billion.

| Ticker | %age Loss |

| EVANSMED | -78% |

| OANDO | -63% |

| DIAMONDBNK | -59% |

| CADBURY | -57% |

| ACADEMY | -53% |

| TRANSCORP | -53% |

| AGLEVENT | -53% |

| NNFM | -53% |

| CHAMPION | -52% |

| LEARNAFRCA | -47% |

This is the second straight year of losses for Nigerian stocks after a similar bad performance last year. Things may have been worse where it not for the last two days of trading in December where stocks gained over 6% both days combined. The fall in oil prices and the currency restrictions in Nigeria is thought to have contributed largely to the bad performance of Nigerian stocks. The CBN has held on to its policy of capital controls since it scrapped the rDas and wDas windows in place of a managed float system. It then placed further restrictions on dollar transactions affecting deposits, purchases and withdrawals.

Analysts believe foreign portfolio investors are withholding investments in the capital markets due to these policies thus affecting liquidity in the capital market. The long-awaited increase in US Fed rates also kept foreign investors guessing and ultimately out of emerging markets like Nigeria ensuring most EM countries also posted losses in 2015. The MSCI EME Index reveals stocks returned -16.9%YTD. Nigeria’s Global X MSCI ETF returned -27.3%.

Will 2016 be any different?

For Nigeria, our faith is intertwined with events around the world which are largely out of our control. It all depends on the trajectory of the world economy and any positives will be dependent on how commodity prices perform and if the oil prices will settle quickly at a support price. The world economy continues to react irrationality with every volatility with price.

Events in the middle east and the relationship between Russia and the West will also play a significant role in shaping the world economy in 2016. Will the Iran Nuclear deal finally be effective or will tensions escalate again? Will the Syrian war end this year or will the west send foots on grounds? Will Isis be defeated or will lone wolf terrorist attacks ratchet up? Back home will Boko Haram remain technically defeated or will they be finally defeated? Will the protests in the South East instigate other regions? On the economic turf will the budget be passed quickly and will all the so-called reforms backed by a N6trillion budget affect the economy positively? How these questions turn out at the end of the year will determine whether stocks perform or not.