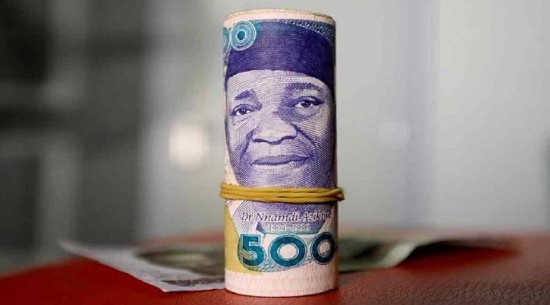

The Naira strengthened against the US dollar during Friday’s trading session.

The haven currency experienced significant declines against the British pound sterling, which reached its highest level in over two years following Federal Reserve Chair Jerome Powell’s indication that the anticipated interest rate cut in September will proceed.

FMDQ data revealed that the local currency appreciated against the dollar to N1570.14/$, improving from N1586.1/$ on Thursday.

This represents a N16 gain against the US dollar compared to Thursday’s rate at Nigeria’s FX Market.

Similarly, on the black market, the naira’s value increased from N1620/$ to N1615/$ on Friday. The Central Bank of Nigeria (CBN) has intensified its efforts this month to reduce the volatility of the naira’s exchange rate.

This has partially contributed to the naira’s gradual strengthening against the dollar, along with the dollar index hitting new lows this year due to a more dovish Fed statement.

The Nigerian currency began to rise after reaching its N1,912/$ low in late February, fell below N1,000/$ in April, and is now around N1,585/$.

Nigerian businesses expect the naira to weaken further before strengthening in late 2024 or early 2025, according to a recent survey conducted by the CBN. Despite the CBN injecting millions into the forex market, this pessimism persists.

However, most Nigerian businesses remain optimistic despite concerns about the immediate future of the naira. More than 1,600 Nigerian businesses participated in the CBN’s Business Expectations Survey, which indicated that respondents anticipated the naira would weaken in July and August, as well as over the next three months.

The U.S. Dollar Falls Against Major Currencies

The euro reached a 13-month high due to the weakening dollar, and the US currency fell to a 17-day low against the yen. “The time has come for policy to adjust,” Powell declared in his keynote address at the Kansas City Fed’s annual economic conference in Jackson Hole, Wyoming. Powell noted that while upside risks to inflation have decreased, downside risks to employment have increased.

Powell stated, “We do not seek or welcome further cooling in labour market conditions. As we move closer to price stability, we will exert every effort to maintain a robust labour market. There’s reason to believe that the economy will return to 2 per cent inflation and a robust labour market with a suitable loosening of policy constraints.”

Traders speculated that the Fed would cut interest rates by a quarter of a percentage point in September. Powell’s comments raised the odds of such a cut to 65 per cent for the September 17–18 meeting. However, they also increased the probability of a larger 50-basis point cut from slightly more than one in four to roughly one in three.

As a result, the dollar index which measures the US dollar’s strength against a basket of six different currencies moderated considerably. The index was marginally stronger before Powell’s remarks, but it dropped by 0.81 per cent by late Thursday to 100.64 index points.

Austan Goolsbee, the President of the Federal Reserve Bank of Chicago, stated later on Friday that although he isn’t prepared to call for a central bank rate cut, monetary policy remains very tight and out of sync with the current state of the economy.

Powell’s remarks about the dollar’s negative correlation with signs of strength in the UK economy helped sterling reach a two-year high against the US dollar.

The pound had gained 0.94 per cent to $1.3211 by late evening. It surpassed the 2023 high of $1.3144 to reach $1.32295, its highest level since late March 2022.

Positive signals in the broader UK economy were reinforced by an August survey showing British consumer confidence holding at an almost three-year high.

The euro ended the day up 0.75 percent at $1.1195, after hitting a high of $1.12015 on Friday afternoon, the highest since July 20, 2023.

This August’s low for the dollar/yen was reached. By the end of the day, the yen had dropped by 1.36 per cent to 144 points. BOJ Governor Kazuo Ueda’s earlier Friday statement that he would raise rates if inflation continued on its current trajectory and reached the bank’s 2 per cent target steadily supported the yen.