- A lot is at stake after the 1st round of French Parliamentary elections produced unwelcome results and rattled investors.

- The 2nd round of voting is unlikely to produce good outcomes. France faces an uncertain future.

- A financial crisis in France could create a ripple effect, dragging down other heavily indebted Eurozone members, especially Italy. This domino effect would place immense pressure on the euro, potentially jeopardising its stability.

- Should another debt crisis emerge, it would be much harder to tackle than the previous one, as the French economy is among the largest in the Eurozone, while the European Central Bank (ECB) seems to be in no hurry to cut rates.

Less than a month ago, the French president, Emmanuel Macron, called for snap national elections in response to hefty gains made by far-right groups in the European Union elections held on 9 June.

His surprise decision spooked investors and traders alike and added uncertainty to Europe’s future political direction.

Investors’ key fear rests around the notion that if nationalist and populist politicians were to take power, they would initiate big spending campaigns that might hurt France’s fiscal position, undermine its standing within the European Union, and possibly destabilise its relations with the United States.

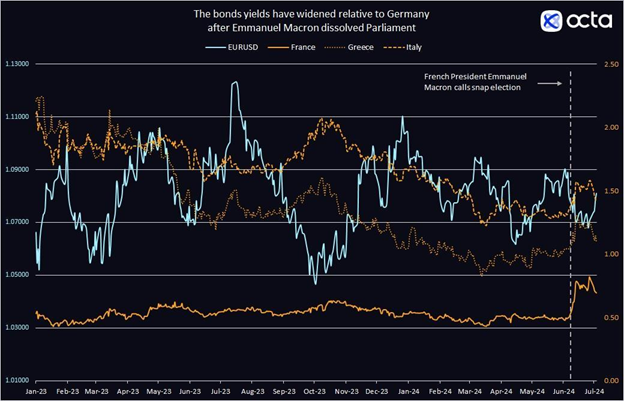

As concerns over the nation’s finances began to mount, the euro weakened, while French bonds sold off, taking the yields higher.

Last Sunday, as expected, the far-right National Rally (RN) party of Marine Le Pen and Jordan Bardella came out well ahead in the first-round vote. The alliance of progressive forces known as the New Popular Front (NPF) polled second, while President Emmanuel Macron’s liberal coalition, Ensemble (Together), trailed in third place. The market’s initial reaction was positive—the euro recovered, while European stocks and bonds rallied. ‘It was more of a relief rally, as RN did not win as many votes as was previously feared’, said Kar Yong Ang, Octa analyst, adding that the overall uncertainty remains in place and major risks have not yet disappeared.

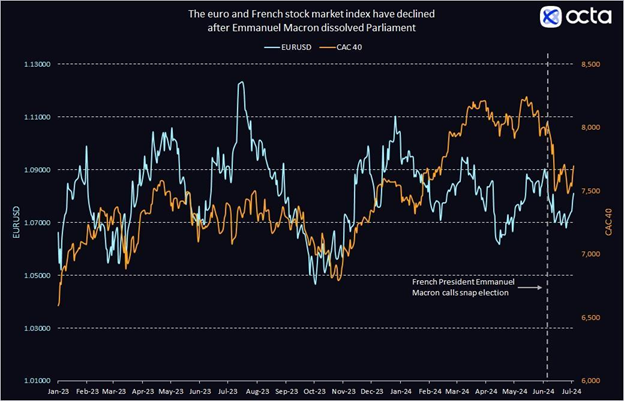

Indeed, the French benchmark stock market index (CAC 40) is still down some 3% while EURUSD has managed to recover. At the same time, the spread between French and German 10-year government bonds remains elevated, meaning that investors continue to demand additional risk premium for holding French bonds over German securities, which are ostensibly safer and are viewed as a key benchmark. Furthermore, the recent EURUSD recovery was more due to the disappointing U.S. macroeconomic statistics rather than the result of the underlying strength in the Eurozone.

EURUSD and CAC 40 Performance (January 2023 – July 2024)

EURUSD and the Spread Between Selected European Countries’ Bonds vs German Bunds (January 2023 – July 2024)

The second round of the French parliamentary elections is scheduled for 7 July. The result is too close to call as RN’s opponents are now doing everything possible to keep the far-right from obtaining an absolute majority in the National Assembly. Either way, France may be facing a period of intense political instability and unsustainable government spending. In case of an indecisive victory of either of the parties, France will be vulnerable to political gridlock, while a decisive victory by either a far-right or a far-left group would increase the likelihood of irresponsible government spending. ‘It seems that there are no good scenarios at this point’, says Kar Yong Ang, Octa analyst. ‘Both scenarios will likely lead to a sharp rise in yields on French government bonds’.

If borrowing costs were to start rising and France’s problems spread across the continent, other debt-laden Eurozone economies—particularly, Italy—could be severely impacted. This would potentially threaten the stability of the single currency, the euro. However, it would not be the first time that the Eurozone would be facing a challenge of such kind. The previous debt crisis of 2009–2010 was avoided thanks to resolute actions by the European Central Bank (ECB), which stepped in and lowered interest rates, while also providing cheap loans of more than one trillion euro in order to maintain money flows between European banks. However, unlike the countries at the heart of the previous crisis, France and Italy boast significantly larger economies. Therefore, avoiding a crisis this time (should it emerge) will be much harder.

Although the ECB is widely expected to cut interest rates this year, the scale of its actions is not significant. Currently, interest rate swaps market data imply roughly 40 basis points (bps) worth of rate cuts by the ECB by the end of the year. However, even these minor steps are not guaranteed. In fact, ECB officials have recently started to advocate a more cautious approach to policy easing. On Tuesday, Gabriel Makhlouf, an ECB official and the Governor of the Central Bank of Ireland, expressed his preference for only a single additional interest rate cut this year. He emphasised the need for further evidence that inflation is on track to reach the ECB’s target of 2%. Pierre Wunsch, another ECB policymaker, acknowledged that the next interest rate cut is a relatively straightforward decision. However, he cautioned that subsequent actions should be data-driven, waiting for concrete evidence that inflation is definitively on a path towards the ECB’s 2% target. Finally, Christine Lagarde, the ECB President, herself indicated not so long ago that there was no urgency to cut interest rates as economic developments were not favourable yet. Indeed, while Eurozone inflation dipped slightly in June, a key measure of price pressures that excludes volatile items like food and energy stayed put at 2.9%, above the ECB target.

The first exit poll results of the 2nd round of voting will hit the wires during the early hours of the Asian trading session on 8 July. Traders should stay on high alert. A victory by the far-right RN party will likely trigger a massive risk-off move in the forex market. Investors will flee to safety, selling French bonds and the euro. Depending on the magnitude of RN’s victory, EURUSD may potentially drop anywhere between 1.07900 and 1.06500. Conversely, should the RN opponents manage to drive support for each other’s candidates, French elections may produce a more benign result, avoiding the worst-case scenario. Therefore, should it become clear that a governing coalition could be formed without the RN, the euro will likely rally—possibly, above 1.0900—provided that U.S. Nonfarm Payrolls report comes out in line with the market expectations.

Emerging markets may also be affected by the development in Europe. ‘A risk-off move in financial markets implies a flight to safety, which means that investors and traders would be buying the U.S. dollar, making it more valuable for holders of other countries’, said Kar Yong Ang, Octa analyst. As a result, the Malaysian ringgit and Indian rupee may suffer. Gold, on the other hand, will shine even against the backdrop of appreciating greenback. However, in case RN does not win the majority of the votes, the market volatility may subside but long-term uncertainty will persist.

Octa is an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services already utilised by clients from 180 countries who have opened more than 42 million trading accounts. Free educational webinars, articles, and analytical tools they provide help clients reach their investment goals.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In the APAC region, Octa received the ‘Most Secure Broker Indonesia 2022’ and the ‘Most Reliable Broker Asia 2023’ awards from International Business Magazine and Global Forex Awards, respectively.