Nigerian banks are scrambling for funds.

The foreign exchange (forex) reserves are dwindling, and the Naira is fluctuating. What an eventful year so far, and the second quarter has only just begun.

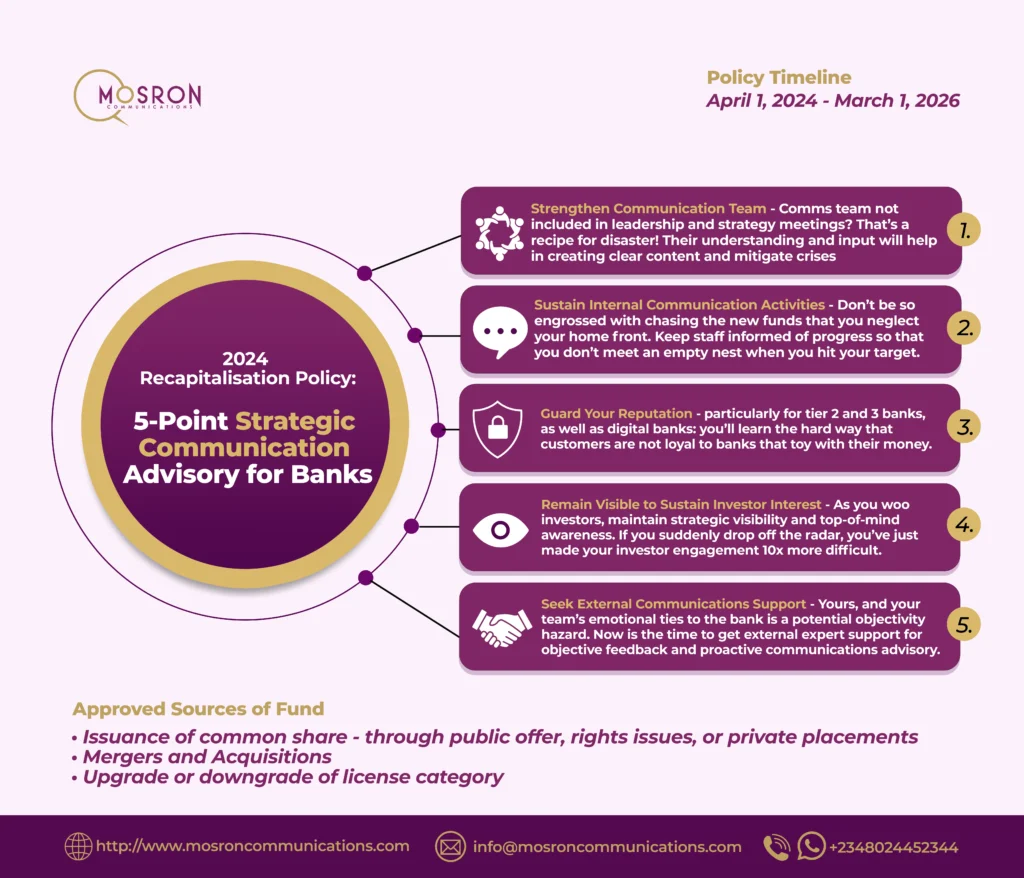

On March 28, 2024, the Central Bank of Nigeria (CBN) issued a circular announcing a new recapitalisation policy for commercial, merchant, and non-interest banks in Nigeria, effective from April 1, 2026.

This means that banks in Nigeria have now been given 24 months (April 1, 2024, to March 31, 2026) to raise the required funds. The same timeline applies to prospective banks seeking licences.

The CBN stipulated that the minimum capital requirement for banks will consist solely of paid-up capital and share premium. This means that banks must have the actual funds contributed by shareholders (paid-up capital) and any additional amounts paid by investors for shares above their face value (share premium) to comply with regulatory standards.

To meet these requirements, the CBN has specified three options for banks to raise the minimum capital, and strict adherence to these options is mandatory. Any alternative methods will not be accepted:

- Injection of funds through private placements, rights issues and/or offers for subscription

- Mergers and acquisitions

- Upgrade or downgrade of licence authorisation

According to the circular, all banks must have submitted their implementation plan to the CBN by the end of April 2024. By implementation plan, the CBN is asking that they clearly indicate their chosen option for meeting the new capital requirements and various activities involved in their timelines. All these will happen in a month!

You can see why banks are scrambling to secure funds. The next few months will be challenging for bank MDs, their management staff, and employees. Strategic decisions need to be made, and potential investors wooed, all while maintaining transparent communication with relevant stakeholders.

Why recapitalisation policy? Why now?

During the 58th Annual Bankers’ Dinner in November 2023, the CBN governor, Dr. Olayemi Cardoso, announced plans to increase the capital base requirements for banks. This decision raises questions about its underlying reasons. Could it be a response to the Naira devaluation, the banking industry’s struggles to support other economic sectors or the decline in forex reserves previously mentioned? These issues are major concerns as they impact the Nigerian economy.

What is this recapitalisation policy all about?

It is a regulatory initiative of the CBN that requires banks to increase their minimum paid-in common equity capital to a specified amount according to their licence category within a specified period. Simply put, the CBN wants banks to increase their financial strength by raising additional capital.

The purpose of this is to strengthen the banks and position them to play pivotal roles in driving development across all sectors of the economy. The CBN is also seeking to ensure the emergence of stronger, healthier and more resilient banks to support the achievement of a $1 trillion economy by 2030 and promote financial stability.

In 2004, when the last recapitalisation process took place, the CBN increased the minimum capital requirements for commercial banks from N2 billion to N25 billion within an 18-month period. Mergers and acquisitions dominated this period as some banks were not able to meet the capital requirements and had to shut down. This reduced the number of banks in Nigeria from 89 to 25 in 2005, and later to 24. Over 12,000 staff of affected banks such as Oceanic Bank, FinBank PLC, Spring Bank, Union Bank, Intercontinental Bank, and others lost their jobs.

However, Nigeria’s soaring inflation has weakened the value of money over time, which makes the 2024 recapitalisation necessary and inevitable.

Implications of recapitalisation policy

- The attraction of foreign investors through foreign direct investments will help the country drive the much-needed long-term foreign currency investment into the banking sector to stabilise the value of the Naira

- Reposition the commercial banks to finance large-scale infrastructure projects in the country

- Safety of depositor’s funds, and strengthening of the financial system’s resilience

- Stronger ability to absorb loan losses and withstand economic shocks

- The Tier-1 banks control over 70 per cent of total assets and revenue in the sector. Hence, they have a major role to play. The recapitalisation will reposition them to be more efficient, resulting in increased capacity

- Increase in business activities especially lending in the medium to long-term

As a leading public relations consulting and advisory firm with clients across Africa, we understand that amid these challenges, banks may overlook a key contributor to their success: stakeholder management and effective strategic communication. Therefore, this five-point communication advisory for banks is a call to action as they commence implementation of their plans to raise the required capital over the next 23 months.

- Strengthen Communication Team: This is the time to be strategically inclusive – you must ensure top-level access for your communications team (the director or lead, in this case) to all strategy and management meetings. Seeking new investors or contemplating a merger/acquisition? The process of developing compelling communications materials starts with a clear understanding of the thought processes behind decisions made. To enjoy the full benefit of communications advisory from your team, bring them in from the start.

- Sustain Internal Communication Activities: To maintain staff morale and retention, it is essential to keep employees informed as progress (or otherwise) is made while protecting important trade secrets. Employee loyalty must not be taken for granted at this time; don’t be so engrossed with wooing investors that you neglect the home base, lest you meet your target but return home to an empty nest.

- Guard Your Reputation: The market is exceptionally competitive during the recapitalisation process. This is not the time for banks, especially tier two and three banks, to risk their reputation. As customers are always scouting for a bank that offers more, the regulator is keeping a stringent eye on bank operations. The CBN sacked five bank CEOs in 2009 due to significant non-performing loans: four of those five banks are no longer operational today. Everything is at stake now; your bank may not survive a scandal if it occurs during this period.

- Remain Visible to Sustain Investor Interest: This advice is particularly relevant for non-tier 1 banks. It is crucial to maintain strategic visibility while engaging investors; this is not the time to be invisible in the market. While you should not be omnipresent when seeking funds, you also do not want to be forgotten by the public. Top-of-mind awareness and strategic visibility are important when wooing investors. If you suddenly drop off the radar, the implication is that you have given up mid-battle. Sharing periodic thought leadership articles, speaking at selected high-profile events, and being seen amongst global and local business leaders indicates that you are not cowering in fear from the public. Remain bold, and maintain strategic visibility!

- Seek External Communications Support: Your team’s emotional ties and proximity to the bank may compromise their objective, and yours too. Objective communications assessment and advisory have saved many organisations from avoidable crises, guiding them on proactive issues management and strategic visibility programs for senior executives. Now is the time to get external expert support for objective feedback and proactive communications advisory.

Lastly, we encourage banks to conduct periodic customer surveys to understand their opinions and address their concerns. This will help meet their expectations and maintain their loyalty.

About Mosron Communications

Mosron Communications is a public relations consultancy and advisory firm serving B2B organisations and social impact brands operating in, and expanding to, sub-Saharan Africa.