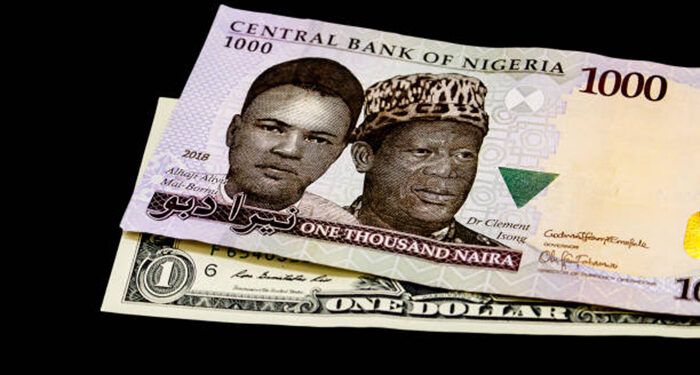

A series of policy moves to unify Nigeria’s exchange rate have been welcomed by the markets, but without the CBN injections, the naira has been on the downtrend even as the dollar falls against major currencies.

The naira has been fluctuating over the past two weeks, trading between 750 and 790 nairas on Wednesday, when it reached a high of 782.36/$ at its highest levels on the official market

However, there were already bids for the dollar as low as 800 Naira on Tuesday before the central bank decided to sell the dollar.

The currency, which lost about 40% last month, has been trading near $750 since June 26. Market experts say the naira won’t deviate much from current levels until there is more clarity on CBN’s monetary policy.

Investors and economists recognize that de-pegging the currency would end years of foreign currency rationing and boost portfolio and direct investment inflows to Nigeria, but the latest data show.

Central Bank foreign currency holdings continue to decline, reaching a low of $34 billion, its lowest level since the unification of the naira

Dollar’s Decline and Impact on Inflation

Recent data from the world’s largest economy highlighted that consumer price inflation slowed in June thus pushing the dollar to a one-year low.

The dollar index fell to 100.54, the lowest since April 2022, and was expected to drop 1% to 100.55, the biggest one-day drop since early February.

In addition, price action shows the dollar is being dumped by traders as the market doubles bets on one more rate hike by the Federal Reserve.

The US Dollar Index (DXY) is well below 101.50 and is expected to trade below 101.00 for the fifth straight day of decline.

Data showed U.S. core consumer prices rose just 0.2% in June, versus expectations of a 0.3% rise. Monthly core inflation is the lowest since August 2021.

Every year, US core CPI rose 4.8%, below market expectations of a 5% rise.

Inflation reports continued to depreciate the dollar even after payroll payments, with losses continuing to be most pronounced against severely undervalued and US yield-sensitive currencies such as the Norwegian krone, the Swedish krona, and the Japanese yen.

Looking ahead, all eyes will be on Fed press announcements lining up to see if they will stick to the same message that Fed Chairman Jerome Powell has delivered over the past few weeks.

The Fed’s official stance remains that it wants at least two more rate hikes before deeming the tightening cycle complete.

These inflation indicators create resistance in the Fed’s committees, which could lead to even wider margins at the next few meetings or even more suspensions.