Key highlights

- Nigerian fintech, Moniepoint leads other investors to inject $3 million into Payday.

- Payday said it would deploy the fund to power its “future of work” initiative through borderless payment alternatives in major currencies.

- The latest investment brings Payday’s total raise since 2021 when it was established to $5 million.

A group of investors led by Moniepoint have invested $3 million in Payday, a Nigerian fintech company that facilitates international payments.

Other investors that participated in the oversubscribed seed raise include Techstars, HoaQ, DFS Lab’s Stellar Africa Fund, Ingressive Capital Fund II and angel investors such as MFS Africa chief Dare Okoudjou and Norebase CEO Tola Onayemi.

Payday, which had earlier in 2021 closed a $2 million pre-seed deal, said it would deploy the new raise to power its “future of work” initiative through borderless payment alternatives in major currencies. With its total raise since inception now totaling $5 million, Payday said it would also look to secure operational licensing in the U.K. and Canada while building out operations in the former, where the startup has recently been incorporated.

According to a statement from the company, Payday processes an average of 40,000 transactions per day worth millions of dollars and adds 100,000 users monthly. As of today, the company said it has over 330,000 users.

Why Moniepoint invested in Payday

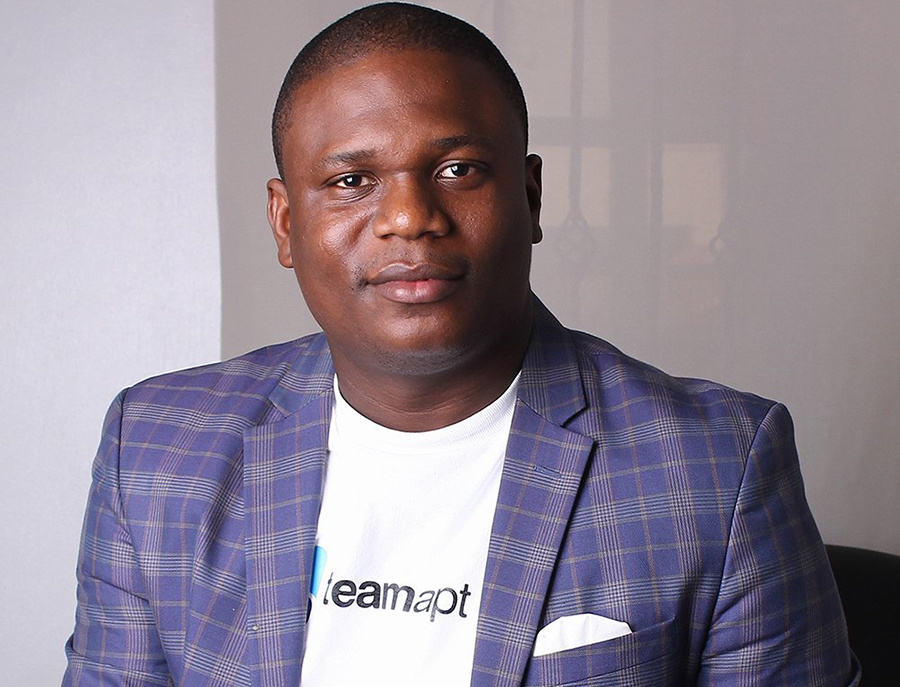

Commenting on the investment, the CEO of Moniepoint (formerly TeamApt) Tosin Eniolorunda, said:

- “At Moniepoint, we’re excited about the unique things Favour and the team are doing with Payday. Personally, I connect deeply with his drive, technical depth, and desire to execute. The urge to encourage that fire inspired us to want to be a part of this.

- “More important is the alignment in our goal to provide financial happiness by addressing key payment pain points—Moniepoint with merchants and Payday with individuals. We see a potential to leverage their infrastructure further to deepen our suite of financial services for merchants, and we’re looking forward to all that’s to come”.

Speaking on the company’s new fundraise, CEO and Founder of Payday, Favour Ori, said:

- “This investment represents a significant milestone for our company, and we are grateful for the trust and commitment shown by our existing and new investors. We’re thrilled that this round of funding will lay the foundation for the continued growth of our platform as we expand our services to a wider audience.

- Our passion for empowering individuals and businesses with convenient and secure payment solutions is tangible. This funding will allow us to do so even more.”

What you should know

In June 2021, Favour Ori launched Payday from Rwanda to facilitate global payments from and to Africa, with a widespread use case for remote African workers to receive payments from their employers and spend anywhere in the world. Its incorporation in Rwanda and admission into Techstars Toronto accelerator made it the first time the latter admitted a Rwandan startup into its three-month accelerator programme.

Today, the fintech startup allows those on the continent and in the diaspora to send and receive money in 23 currencies, including USD, GBP, and EUR, from over 130 countries. Thus, Africans who work remotely can receive their money in foreign currency and withdraw in the currency of their choice using virtual Mastercard and Visa cards.