Several Nigerian startups are exposed to the failed US bank, Silicon Valley Bank, which was closed down by US regulators on Friday due to a rush of deposit outflows.

The UK banking regulator, the Bank of England, also placed the UK arm of the company under banking resolution after the company asked for £1.8bn in cash support over the collapse of the parent company.

The collapse of both the US and UK arms of the bank has put the tech industry on alert, as many startups reportedly operate accounts with the bank.

Some Nigerian Startups affected

Some Nigerian startups are also caught up in the crisis affecting the embattled bank, as Nairametrics can authoritatively confirm. These startups also operate bank accounts with the US and UK arms of the bank, especially those affiliated with the likes of YCombinator and Tech Starts.

Garry Tan, president of Y-Combinator tweeted on Friday.

“30% of YC companies exposed through SVB can’t make payroll in the next 30 days.”

The bank made it easy for foreign-funded local startups originating from Nigeria to open bank accounts.

Nigerians who hold interests in some of these startups inform Nairametrics that they have already started receiving updates from the startups about the status of their exposure to SVB.

While some of the companies inform their investors that the exposure could affect the funding of regular operations, it was not significant enough to represent any existential threat to their operations. However, these are early stages, and the collapse of the bank is still unraveling.

Nairametrics cannot mention the names of the Startups for confidential reasons. We also note that none of the startups we know have indicated any immediate cash flow challenge to their operations as they also operate accounts with other banks that are safe.

We have also started seeing more cryptocurrency-based companies coming out to reveal levels of exposure that are likely to spill into more companies in the tech space.

For example, Circle, the crypto-based firm that operates stablecoin USDC, revealed concerns over the effects of Silicon Valley Bank’s bankruptcy, which caused USDC to decline from $1 on Friday, even though it is intended to retain a 1-to-1 peg with the US dollar.

Payment will be made: A recent FDIC statement confirmed insured depositors will start receiving payments starting Monday, March 13th, 2023.

- “All insured depositors will have full access to their insured deposits no later than Monday morning, March 13, 2023. The FDIC will pay uninsured depositors an advance dividend within the next week. Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors.”

Why the bank collapsed

The bank’s troubles stem from a decision made during the peak of the tech boom to park $91billion of its deposits in long-dated securities such as mortgage bonds and US Treasuries, which were deemed safe but are now worth $ 15 billion less than when SVB purchased them after the Federal Reserve aggressively raised interest rates.

The bank’s woes were also worsened by failed efforts to raise new capital to plug the hole, marking a significant fall for the company that was valued at more than $44 billion a few months ago.

The closure has made SVB the second-largest bank failure in US history after Washington Mutual’s collapse in 2008. The regulator, Federal Deposit Insurance Corporation (FDIC), guarantees bank deposits of up to $250,000 and has guaranteed deposits in SVB, making payouts to depositors with balances exceeding this amount in due course.

What a collapse could mean for Nigerian Startups

If the collapse of Silicon Valley Bank (SVB) worsens, it could have an impact on Nigerian startups that operate accounts with the bank. Specifically, if SVB is unable to return the funds held in these accounts, it could affect the funding of regular operations for these startups.

Additionally, if SVB’s bankruptcy leads to a broader economic downturn or a contraction in the tech industry, it could become more difficult for Nigerian startups to raise capital or attract investment. This could slow down the growth of the tech industry in Nigeria and lead to a reduction in the number of new startups.

That said, it’s worth noting that at this point, it’s still too early to say how severe the impact of SVB’s collapse will be on Nigerian startups. While some startups have reported exposure to the bank to their investors, it’s unclear how many are affected or how much money is at stake.

Moreover, it’s possible that other banks or investors could step in to provide funding if needed. Several online reports indicate this is already happening. Big name Startup investors are also piling pressure on the US government to get another bank to acquire SVB. The pressure appears to have gotten to President Biden who called the governor of California Gavin Newsom on Saturday about the Silicon Valley Bank’s failure and efforts to address the situation.

Some Silver Lining

About SVB

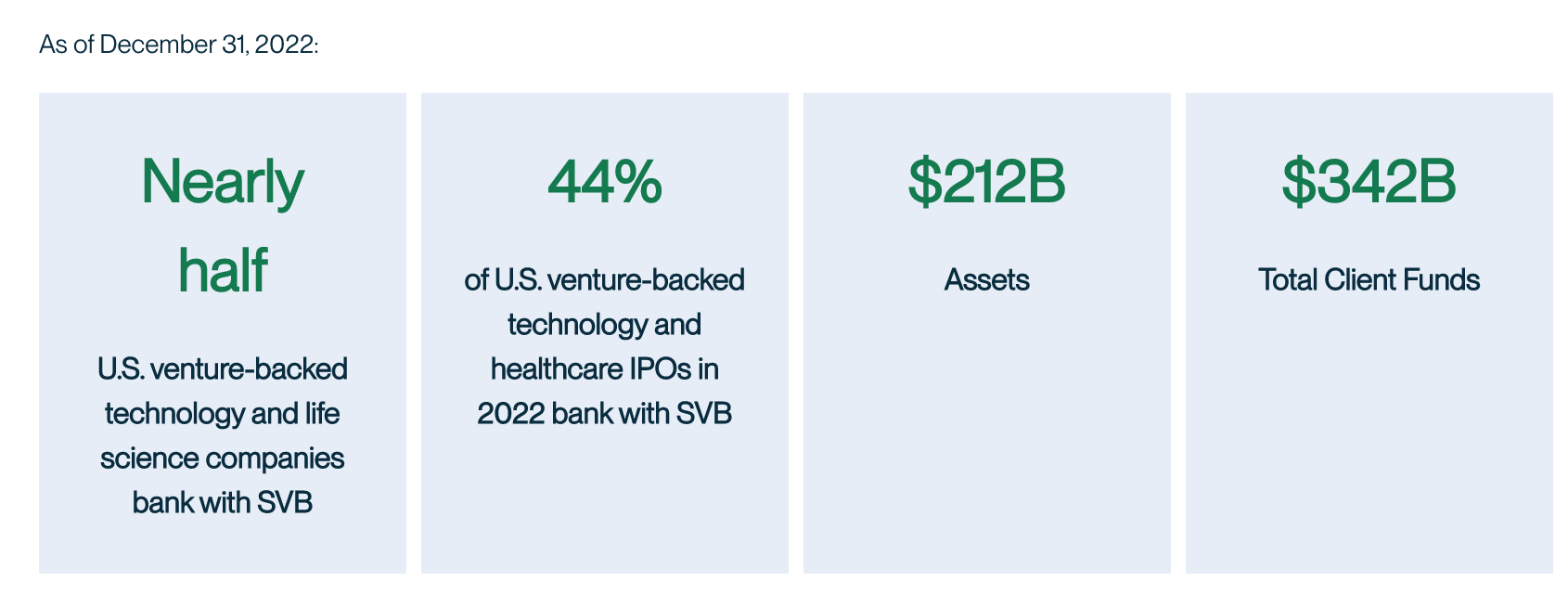

Silicon Valley Bank (SVB) was founded in 1983. It is a financial institution headquartered in Santa Clara, California, USA, that primarily serves the innovation and technology sectors. SVB is known for its focus on providing banking services to startup companies, venture capitalists, and private equity firms.

- SVB is a subsidiary of SVB Financial Group, a publicly traded company that is listed on the NASDAQ stock exchange under the ticker symbol SIVB.

- The bank’s headquarters is located in Santa Clara, California. It also has offices in major innovation hubs around the world, including New York, Boston, London, Hong Kong, Shanghai, and Bangalore.

- The bank has a reputation for being highly selective in its client base, preferring to work with startups and emerging companies with a strong potential for growth.

Note: This article was updated to provide more information. This is a developing story, check back for more updates.

This article is providing incomplete information that may have the effect of unintentionally misleading the public.

SVB’s failure did not come from its ill-fated sale of $20bn in 10-year US treasury bonds at a $1.8bn loss, it came from the over $42bn in deposit withdrawals that venture capitalists and their portfolio companies made over a 24 hour period at the bank. It was a classic bank run sparked by poor communication on the part of SVB’s executive leadership to effectively manage what was otherwise a salvageable situation that placed pressure on the bank’s short term income statement and earnings, but not its balance sheet and long term solvency.

No bank in the world can withstand that level of panic and simultaneous withdrawals.

What triggered the bank run? Pls, the article is very accurate!

You are very right.

Even federal reserve bank and bank of England cannot withstand a situation where 40% of their depositors demand cash. Because minimum allowed liquidity is 20% of deposit liability, where more depositors come for their deposit within few days, the bank may not be able to sell or convert some of their asset to cash.

What led to the bank run? The article is no way misleading. There’s no smoke without fire.

Then why did you use such a title when you can’t exposure the names of the startups? 🙄

It wouldn’t have been appropriate to mention the names of Nigerian startups exposed to SVB!

Yes no bank in world can withstand bank rush. I think the situation was not properly handle by the managers

Naming the startups is also akin to adding fuel to fire. You increase and create more contagion!