When Nigeria’s power sector was privatized in November 2013, the reality was different for the investors who paid $2.5 billion for the control of 11 power distribution companies and 6 power generating plants. The exchange rate at the time was $1 to N158.29, with the highest rate for that month at N158.99.

Nine years after and depending on where they buy, the exchange rate between the naira and the United States dollar is N440/$1 on the official market and N735/$1 on the black market. No one expected things to have deteriorated this much barely a decade after the investors tapped local banks for the loans used to pay for the assets.

Whilst the sector grumbles over issues such as a cost-reflective tariff, estimated billing and remittances, depreciation of the naira and access to forex appears to be the most existential threat facing the industry on all fronts.

- Players in the sector are grappling with repaying foreign currency loans borrowed when the exchange rate was more than three times its current value.

- According to sources with knowledge of the issues, some investors are tethering on the edges of default as they struggle to find forex to repay loans from an investment that has been a colossal loss.

- They also face the daunting task of funding CAPEX hugely required to improve the state of power supply in the country mostly in dollars.

- Power transformers, distribution transformers, electrical conductors, meters, and most of the technological solutions required to deliver stable power are mostly imported, according to Power sector analyst, Bayode Akomolafe.

Electricity Investments at risk: Akomolafe told Nairametrics that the electricity industry is highly dependent on the direct importation of goods and services as the local supply chain is not robust enough to support the high technology (hi-tech) products needed to ensure the reliability and availability of power in the value chain.

According to him, importing raw materials is also necessary for the limited local supply chain that supports the sector.

- “With the low liquidity of FX in Nigeria’s open market and the high exchange rate in the parallel market, the cost of electricity production increases. The additional expense adds to the strain already caused by the lack of cost-reflective tariffs. The Naira’s volatility puts investors’ returns at risk rather than encouraging them to invest in Nigeria’s energy industry or the country as a whole,” he said.

The Central Bank of Nigeria (CBN) under Godwin Emefiele appears to have recognized these challenges, having agreed two years ago to provide intervention funds running into trillions of naira for the power sector.

To address the levels of importation of equipment required to support the sector, the CBN also mandated players in the sector to explore backward integration. Yet, the assembly plants and manufacturing companies still complain about the cost of raw materials most of which are imported and indexed to the black market exchange rate.

To make matters worse, the central bank has now turned its attention to battling rising inflation, citing the increase in money supply as one of the major drivers of higher prices of goods and services.

The collateral damage is on the power sector players, who no longer have the lifeline provided by the central bank via intervention funds, leaving them in a more precarious situation to fend for themselves.

More insights into the matter: According to Akomolafe, parts for equipment reliability are typically sourced from original equipment manufacturers (OEMs) who sell in foreign currency or at the most index to the black market exchange rate. In addition, while services can be local, many labour-cost transactions still occur in foreign currencies, especially with OEMs who provide specialized services.

The currency rate similarly influences the cost of gas, which is the primary fuel for Nigeria’s power plants. This scenario is the same for all sectoral players, from gas suppliers through the transmission to distribution companies.

In addition to operational costs, fixed costs are also a function of forex. Construction, engineering, and equipment purchases all rely significantly on foreign exchange. The instability of the Naira makes financial decision-making extremely difficult for private investors.

The cost of borrowing money from foreign sources rises due to currency depreciation, like that of the Naira, which can significantly raise the cost of financing capital projects in the electricity industry. Despite these obvious challenges, charging a cost-reflective tariff is viewed as politically sensitive as we approach the 2023 elections.

- For investors, investments in the electricity value chain are risky under these conditions due to the sub-optimal utilization of the assets and uncertainty in cash flow for the service provided.

- Experts recommend that the government must provide a forex window for power sector players if stable and affordable electricity is critical to boosting local production.

- But to achieve this, the country must resolve the forex challenges either by boosting oil exports in the short term or securing a lifeline from external sovereign funding.

Renewable Energy Players also struggle with forex: Forex volatility also impacts the heavily funded renewable sector, seen as the future of power generation for sub-Saharan Africa.

This is because Nigeria still lacks self-sufficiency when it comes to providing energy due to a lack of infrastructure as well as a lack of investments, says Ezeocha Amudo, the Chief Executive Officer of REEnergy Africa.

According to him, Nigeria does not have enough power sector investments, which is why the country’s electricity sector is yet to grow beyond its current capacity.

For players in Nigeria’s renewable energy sub-sector, most of the off-grid components are imported and as forex rates increase, operators will need to adjust to the increased costs. However, when operators deploy renewable energy technologies, customers are made to bear the brunt of those costs.

Amudo said the forex crisis could pose a challenge to the increased adoption of renewable energy technologies as the burden encountered by rising costs of imported technologies reduce the purchasing power of Nigerians at the end of the day. He said:

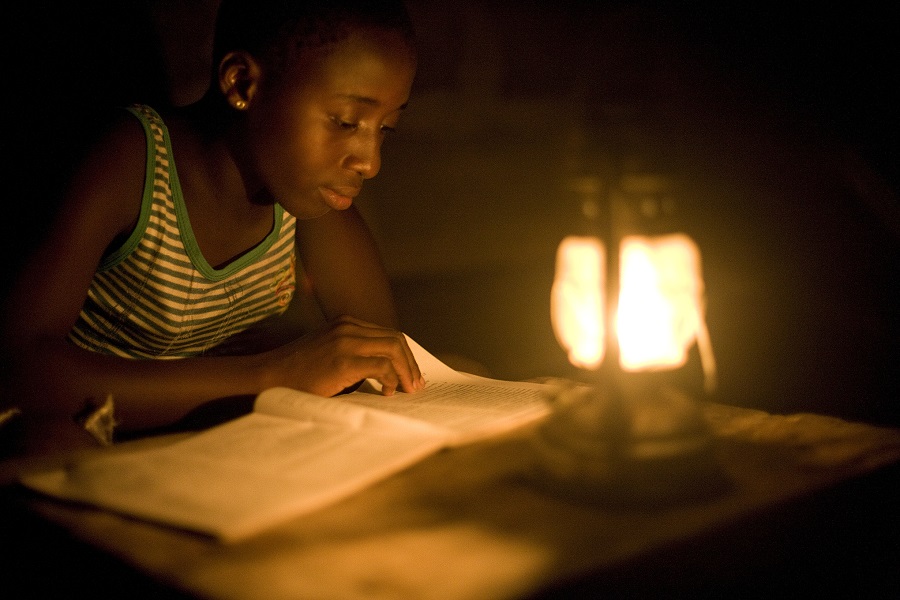

- “Nigeria is scaling its renewable energy adoption, especially for unserved/underserved communities. People in these communities are informal workers and there is a limit to the costs they can bear. On the other hand, operators have to at least make some profit from the installations. When they pay so much to import the components for these off-grid power installations, the costs could go beyond what people can afford.”

From Amudo’s statements, it is clear that the impact of the forex and Naira volatility on an economy like Nigeria, which depends heavily on imports is evident in the high inflation rate, as higher importation costs are passed along to consumers, raising the price of goods and services.

Forex also dissuades new investors: The forex situation has limited the entry of new private participants in the industry. For most generating companies (GenCos), whose operation and maintenance (O&M) is dependent on imports, the forex crisis adds to the strain on their already precarious cash flow and poor bottom line.

- “They are paying more in Naira due to the high exchange rate to secure support services and products, while income in Naira remains unchanged. The operation and maintenance cost of an energy facility, generating companies (GenCos) for example, consists of; services (labour), gas (fuel) prices, and overheads,” Akomolafe adds.

As Christmas approaches: Electrical systems engineer, Chukwuemeka Eze, believes the status quo could remain as the end of year approaches.

However, he told Nairametrics that it is important for all Nigerians to be aware of the situation so they can push for policy implementation action steps that will trickle down the electricity sector value chain for the benefit of on-grid and off-grid power consumers. He said:

- “Due to a lack of modern infrastructure, Nigeria still depends a lot on imports of processed natural gas, and equipment needed in the electricity sector. If the forex rate is unstable, it affects even the end consumers. That should be a source of concern for everyone that has the power and authority to do something. Nigerians are already dealing with a lot.”

Akomolafe shares the belief that the country’s forex issues will not change significantly through Christmas. He projects a rather gloomy outlook for the Christmas season as well as Q1/2023:

- “Nigerians should not anticipate systemic changes to the grid’s electrical supply through the holiday season. According to expert analysis, a further depreciation of the Naira is anticipated going into Q1 2023, which would put more pressure on the operational cost of the value chain. As a result, the value chain’s participants may be forced to delay scheduled outages or descope or cancel some maintenance programs due to this cost pressure, which might eventually impact system reliability.”

- “The focus of policymakers is currently not on governance but on winning the upcoming general elections in February 2023. Experience from previous election cycles indicates that it is not aberrant to witness landmark announcements, major commissioning projects, and equipment startups, primarily in the electricity and energy sector, to score political points in anticipation of the upcoming election. The jostling for political victory means that the government may likely effect no new significant monetary changes which can alter the current monetary policy trajectory.”

Akomolafe anticipates a worse situation than Nigeria’s current forex challenges after the presidential election.