In a bid to reduce the nation’s capital housing deficit and boost revenue for the FCTA, the Federal Government should introduce property taxes for unoccupied buildings in the Federal Capital Territory (FCT).

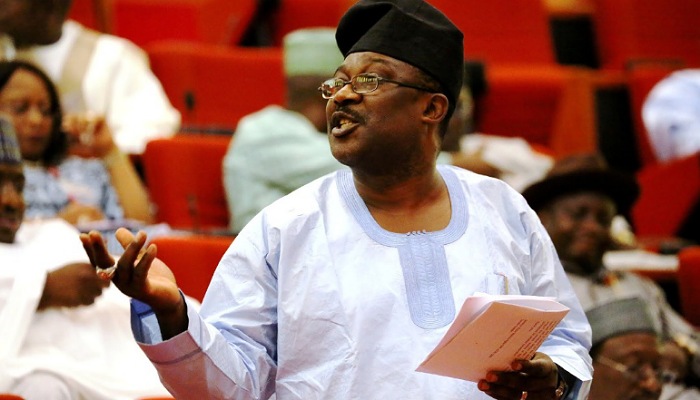

This was disclosed by Senator Smart Adeyemi (APC-Kogi), on Thursday at the opening of the Senate’s Committee on FCT’s meeting in Abuja, according to NAN.

The Senator also warned that the sum of N12.9 billion allocated to the FCT in the budget was inadequate.

What the senator is saying

Senator Adeyemi urged the Federal Government to introduce property tax on buildings in the Federal Capital Territory (FCT), especially unoccupied buildings to enhance revenue generation.

Adeyemi noted that the action became necessary given the growing number of uninhabited residential buildings in FCT, as the property tax generated could be used to further develop the city.

He added that it was out to complement the effort of the executive in further development of FCT. He said given the growing population in the FCT, there was a need for the government to improve the budget of the territory to enable it provide infrastructure for the residents and open up more districts in the city as the N12.9 billion allocated to the FCT in the budget was inadequate.

“For the road to be good, for good security, what is allocated to Abuja today is far below what is required of this developing city.

“So we call on President Muhammadu Buhari before the presentation of 2023 budget, we want an improvement in the capital vote for the FCT,” he said.

What you should know

- Recall that Nairametrics reported earlier this year that the Federal Capital Territory Administration (FCTA), kicked off steps to recover outstanding ground rents of N29 billion owed to the administration by property owners in Abuja.

- FCT inaugurated a 9-member Committee to coordinate the recovery of the funds.

- They noted that in a bid to boost revenue generation in compliance with the Federal Government’s directive, the FCTA had to migrate all revenue collections to Treasury Single Account (TSA), via REMITA Platform.