The market capitalization of the top five banks, referred to as the Tier-1 banks decreased to N2.43 trillion as of the close of business on the 27th of August 2021 as investors in these banks lost N7.61 billion during the trading week.

According to data from the Nigerian Exchange (NGX), the market capitalization of the top five banks declined to N2.43 trillion, a depreciation of 0.3% during the week.

The loss can be attributed to the sell-off witnessed in the shares of most of the banks, during the five trading days.

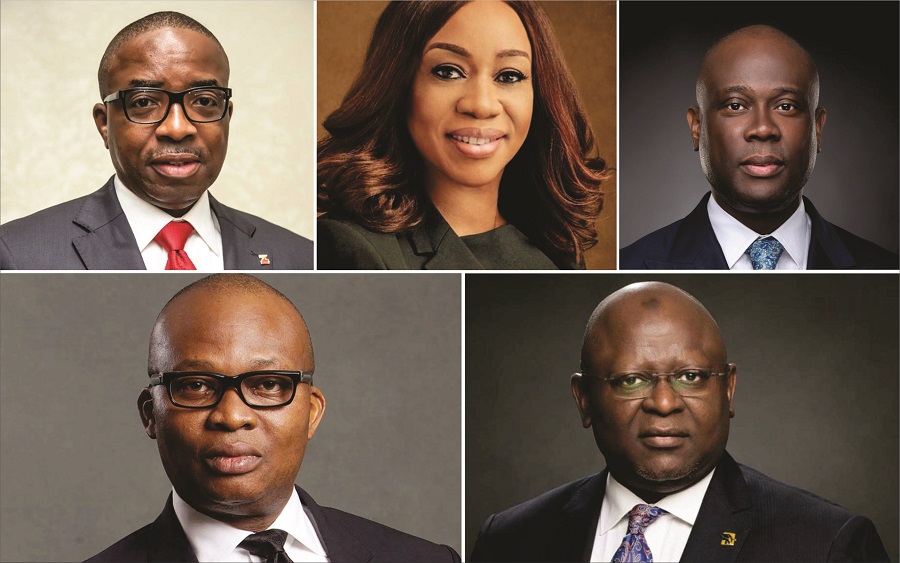

A summary of the performance of each bank’s shares is captured below.

FBNH PLC

First Bank Holdings Nig. Plc gained N3.59 billion as its market capitalization appreciated from N265.63 billion to N269.21 billion, due to the increase in its share price from N7.40 to N7.50, reflecting a growth of 1.4%, at the close of business on Friday, August 27, 2021.

During the week, investors traded about 22,530,215 units of the bank’s shares valued at N167.66 million. The volume of shares traded depreciated by 37.56%, when compared to 36.08 million units traded the previous week.

The bank released their second-quarter result which revealed that Interest Income for the period decreased by 19.36%. However, net profit for the period reported a growth of 79.76% from N12.50 billion in Q2 2020 to N22.47 billion in Q2 2021

UBA PLC

United Bank for Nigeria Plc lost N1.71 billion as its market capitalization depreciated from N258.21 billion to N256.50 billion, due to the decrease in its share price from N7.55 to N7.50, reflecting a decline of 0.7%.

UBA Plc, during the week, traded a total of 39,348,251 units valued at N295.64 million at the end of the trading day on Friday.

In comparison, the bank’s share volume appreciated by 19.57%, from 32.91 million traded last week.

UBA Plc is yet to release its second quarter financial statements for Q2 2021.

GT Holding Company Plc

GTCO Plc lost a total of N16.19 billion after market capitalization depreciated to N810.83 billion from N827.02 at the end of Friday’s trading session.

The decline can be attributed to the decrease in the share price, from N28.10 traded at the end of the previous week, to N27.55 at the close of business on Friday, reflecting a decline of 2.0%.

During the trading week, investors traded a total of 57,722,549 units of the bank’s shares valued at N1.61 billion, making the bank’s stock the most traded in volume and value amongst the FUGAZ during the week. The bank traded its highest number of shares on Friday at 22.09 million units valued at N614.25 million.

In contrast with the volume traded last week, share volume for this week decreased by 2.09% from 58.95 million.

GT Holding Company is yet to release its second-quarter financial statement for Q2 2021.

Access Bank Plc

Access Bank Plc gained a total of N3.55 billion at the end of the trading week as its market capitalization appreciated from N319.91 billion to stand at N323.46 billion to close the week at N9.10 per share from N9.00 the previous week.

At the end of the week, investors had traded a total of 16,752,293 units of the bank’s shares valued at N151.88 million. The total volume traded for the week declined by 29.95% from a total of 23.91 million traded in the previous week.

Access Bank Plc is yet to release its Q2 financial result for the year.

Zenith Bank Plc

Zenith Bank Plc gained N3.14 billion after its market capitalization appreciated to N766.07 billion from N762.93 billion at the end of the week. This growth can be attributed to the 0.4% increase in its share price from N24.30 traded at the end of last week, to N24.40 at the end of this week.

Hence, a total of 38,520,849 units of the bank’s shares were traded during the week, valued at N940.12 million. The total volume, in comparison with the previous week, appreciated by 19.85%, from 32.14 million units.

The bank released their second-quarter result which revealed that Net Interest Income for the period increased by 1.61%. Post-tax profit for the period reported a slight growth of 2.21% from N103.83 billion in Q2 2020 to N106.12 billion in Q2 2021.

What you should know

The Nigerian Exchange Limited (NGX) closed positive week-on-week as ASI appreciated by 0.01% to close at 39,485.65.

The FUGAZ banks make up over 70% of the NSE Banking sector index, hence, they strongly influence the growth or otherwise of the index.

The NGX Banking Index closed positive to increase by 0.30% and closed at 378.99.