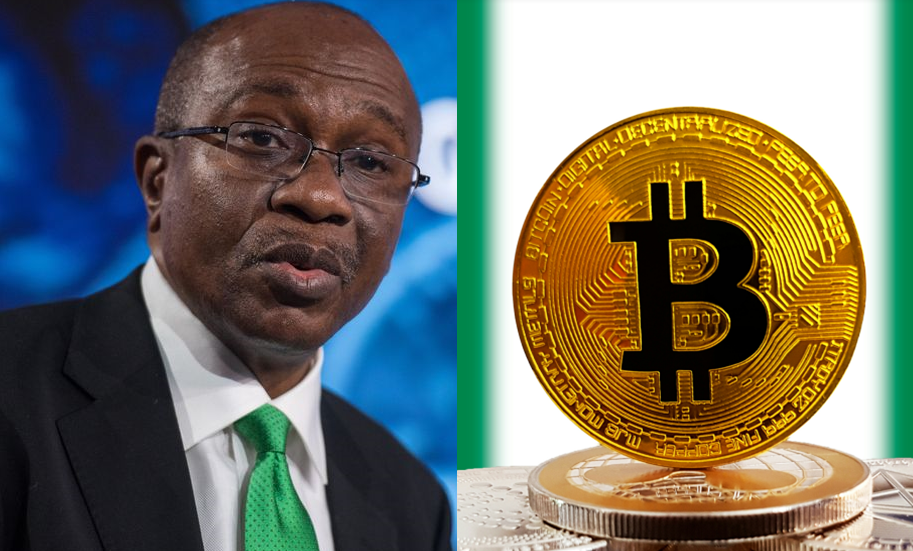

Despite the Central Bank of Nigeria expressing its concern about Cryptocurrency in Nigeria, the cryptocurrency space has continued to roll out ingenious solutions to real-world problems. One of the most recent solutions is the advent of Non-Fungible Tokens (NFTs), a unit of data stored on a blockchain to certify that a digital asset is unique and non-interchangeable. It is an innovation that allows that an artist gets digitized title/ownership for their work.

Based on a report from Coinbase yesterday, NFTs’ adoption is fast growing among Nigerian creatives, given that it provides a marketplace for creatives and art collectors across the globe. Although currently, the platform has recorded complaints from some artists whose artworks were minted without their consent, the platform’s potential market for African creatives is undeniably massive.

Over time, the Nigerian creative industry has been quiet due to perennial problems such as inadequacy of patronage and piracy, which disincentivizes players in the space. This problem, coupled with the apparent low interest in other economic segments, led to Nigeria’s current overdependence on oil receipt. Most creative deals in the Nigerian NFT space are currently being consummated anonymously.

Furthermore, Nigeria being the second largest market for cryptocurrencies globally over the last five years, with a market worth of trade totalling 60,215BTC, portends an interesting figure when the segments’ potential proceeds are considered.

According to the National Bureau of Statistics, Nigeria has an unemployment rate of 33.3% as of Q4 2020. There is also the recent prohibition of local banks from facilitating cryptocurrency transactions. As an offshoot, the NFT’s ability to provide support to the economy in the area of rightly engaging creatives and other providers of ancillary services in the segment could be frustrated.

There are also indications that Nigeria might be setting itself up to miss out on an otherwise potent foreign exchange source. In an era where oil receipt is becoming increasingly unreliable, avenues like this could provide a decent level of support given Nigerians’ tenacity and creativity, hence drawing more accretion to its external reserves.

It is undeniable that Cryptocurrency poses some downside concerns in how it could easily aid some undesirable ventures, such as money laundering and terrorism financing. Nonetheless, we noted that Authority’s efforts should be geared more towards finding common ground where those concerns could be mitigated instead of shutting down the entire space.

Noteworthy is that the buying and selling of cryptocurrencies have continued unabated since the last CBN’s directives were issued. Is it time to retract those directives and find a more effective way of combatting cryptocurrency concerns? Yes! However, we opine that as we advance, every move should be tailored to ensure Nigeria is not blindsided in this gold rush.

CSL Stockbrokers Limited, Lagos (CSLS) is a wholly-owned subsidiary of FCMB Group Plc and is regulated by the Securities and Exchange Commission, Nigeria. CSLS is a member of the Nigerian Stock Exchange.