If like me you follow Nigerian Banks across social media networks, then like me you must have rebroadcasted some of their colorful advertising telling the world of their low-interest loans to fight COVID- 19, and hopefully restart the economy. One thing you must have noticed, however, during those rebroadcasts is how highlights of the advertisements- rates, tenor, and target industries- are the same no matter the brand.

Well, that is because the Banks are all advertising the same product; CBN’s intervention funds.

READ MOREL: El Rufai declares zero RoW charges for broadband infrastructure in Kaduna

What does that mean?

CBN in a bid to reclaim the economic frontiers already lost to the COVID- 19 pandemics is releasing cheap funds to strategic sectors of the economy to hopefully restart the economy and possibly save the Nation from looming recession.

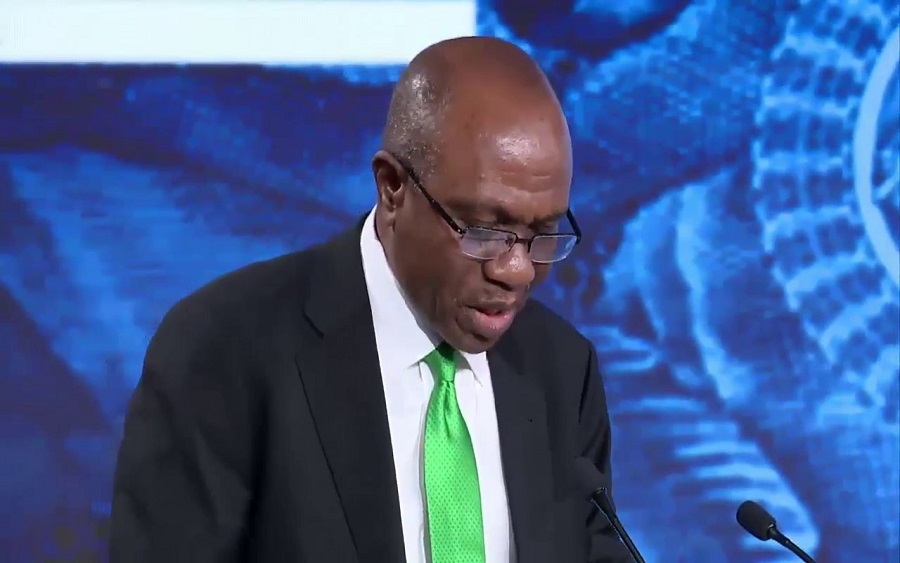

In April 14, 2020, a press release by the CBN Governor titled “Turning the COVID- 19 tragedy into an opportunity for a new Nigeria”, he highlighted a three-phase approach to tackling the pandemic to include an immediate, short term and medium term timelines of 0-3months, 0-12months and 0-3 years respectively. Critical to these phases are different aspects of the economy that need to be tackled in each phase. These key sectors include the health sector, manufacturing, and infrastructure, while others include agriculture and power.

(READ MORE: Covid-19: Timeline of every pronouncement made by Nigeria to support the economy)

To this end, the CBN has provided easily accessible loans to businesses in these sectors at below the market rate. These loans could either be overdrafts or long term loans that come with a moratorium, are accessible through the DMBs who assess the prospective borrower’s creditworthiness, and pass the same to the CBN for ratification and approval.

The intervention funds are placed in the following categories: Micro, Small, Medium Enterprises Development Fund (MSMEDF), Commercial Agric Credit Scheme (CACS), and the Real Sector Support Facility (RSSF) which funds the N100billion credit support intervention for the health sector.

All the loans are reasonably priced at 9% except for the health sector loans which are presently 5% and will revert to 9% in March of 2021.

Why the intervention?

Because the CBN believes that by accompanying these funds with the necessary policies and regulatory backings that they can revamp the Nigerian economy by fast-tracking the development of the Nigerian economy through these sectors. A move that will generate employment, diversify revenue base, provide input for the industrial sector and ultimately increase foreign exchange earnings.

This is what the CBN is all about.

What’s in it for the Banks?

Apart from the obvious- a spread on the loan amount, commissions on transactions, and other ancillary charges, the Banks are also playing their roles in working towards a better economy where we can all thrive.

So, when next you come across such advertisements… tell the next person. Let’s build a better economy together.

Article written by Zolonye Ushedo is passionate about Banking, and simplifying complex issues around personal finance and start-ups. He has over 8years experience in various job functions in the Banking industry across top Banks.

@Zolonye on Twitter