The Federal Government of Nigeria (FGN) has reintroduced a request to the National Assembly to borrow up to $22.74 billion from the international markets.

The government’s case has many merits which we can summarize as follows:

The Federal Government’s organic cash flow is exceptionally weak

Bloomberg reported that since 2015, the fiscal revenues flowing to the FGN has underperformed by 45%. The FGN crude oil and gas revenues, make up about 45% of the total revenues but 70% of foreign exchange earnings; however, the obligations of the FGN, including mandatory obligations e.g. Salaries and Debt Service, have eaten up 100% of the crude oil revenues. The FGN thus must run a deficit budget to fund capital projects and other obligations; the 2020 annual budget, for instance, is budgeted at N2.18 trillion deficit financing.

The FGN tax collection is also very weak

The GDP to tax revenues ratio of the FGN, according to the Organization for Economic Co-operation and Development (OECD), a grouping of the world’s leading market economies, was put at 6% as at 2016 (The World Bank measures at 3.4%). Compared to Kenya and Ghana at 18% each, and South Africa at 29%. This leaves the government with borrowing as the only real solution to raise revenues.

Why borrow externally in foreign currency?

The FGN has been financing her fiscal deficits by issuing Treasury Bills for shorter durations and Bonds for longer durations. These instruments have interest costs from 9% for Treasury Bills to almost 15% for long-dated bonds. The FGN, however, has issued Eurobonds at much lower interest cost, e.g. the 2025 Euro bond was issued at a coupon of 7.62% but payable in USD not Naira, thus incurring foreign exchange risk. However, the FGN is also looking at concessionary and bilateral loans which are not issued at commercial rates.

To summarize, the FGN needs to borrow for capital projects, because her tax revenues are low and oil revenues are already spoken for. The FGN also seeks to borrow in foreign currency because cost of foreign currency obligations is lower than locally issued debt instruments. Good so far.

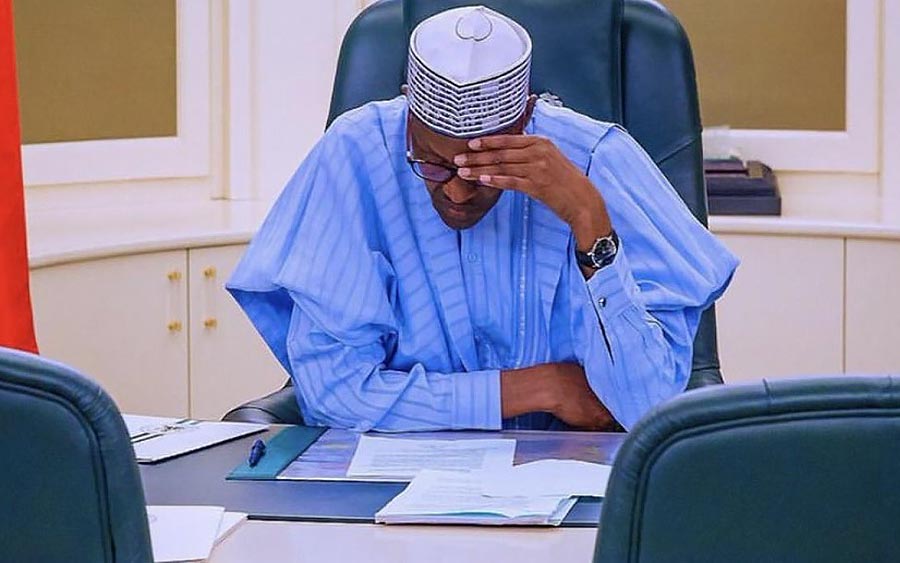

[READ MORE: Buhari seeks speedy approval of the 2016/2018 external borrowing plan)

So, the FGN borrowing of $22b is justified? Not quite.

Questioning the amount and cost of the loan is the wrong debate. The real debate is why the FGN should be borrowing on her balance-sheet to build a railway. The debate is should the FGN own and maintain railways, or should the private sector? If you agree that the FGN should build, own and operate railways then sure, the $22 billion borrowing is apt. However, if you take the view that railways can be built, owned and operated by the private sector, with strong government support, then there is no need to add $22 billion to the FGN balance sheet.

Nigeria has a corruption problem, but I posit that a bigger problem Nigeria has is the entry of the FGN into commercial business. You will struggle to find an asset owned by the FGN or State Government that is being successfully run.

Examples abound. Let’s look at Nigeria’s number one forex earner, crude oil and gas. Consider the Nigerian National Petroleum Corporation (NNPC) and Nigerian Liquified Natural Gas Company (NLNG). The latter is 49% owned by the FGN, thus FG is a minority shareholder. The FG does not manage NLNG, which, in a strong show of financial strength, offered the FGN N60 billion as “contribution” to build a road in Bonny.

However, NNPC is owned and managed 100% by the Nigerian Federation. In June 2019, NNPC reported Group operating revenue of N518.18b with a trading surplus of just ₦3.92 billion, that’s a net position of just 0.75%, (less than 1%).

Let’s talk about steel, which is essential for industrial development. Quantity of steel produced is an indication of national strength. Nigeria has about two million metric tons of iron ore reserves, the second-largest iron ore deposits in Africa and 12th largest in the world (iron Ore is used to make steel). So how have we fared with making steel? The Federation built the Ajaokuta Steel, the Delta Steel and three steel rolling mills in Jos, Katsina and Oshogbo… they were all dead when owned by the Federation.

Yet, a Nigerian owned company, Kamwire Industries Ltd, has built a cold steel mill in Kwara. African Foundries Ltd, a flagship of the African Steel Mill group, commissioned in 2011 and located in Ogijo, Ogun state is a steel complex. That complex began export of about 5,000 metric tons of TMT rebar to Ghana in 2013. Dana Steel bought the moribund Katsina Steel rolling mill and turned it around.

I can go on and speak about the Eleme petrochemical plant, or the ports in Lagos recently concessioned to private operators both now with improved efficiency and productivity, paying taxes to the FGN. The point is simple, the federation has not managed the oil industry, steel or ports, this is the economy of Nigeria. But there’s more… the Federation has not been able to stop cholera or conduct a census without controversy. It cannot even maintain its own national stadium. The Federation has shown repeatedly that it is incapable of delivering results.

Now, does it mean all privatized assets managed by the private sector have been successful? No! Air Nigeria comes to mind. But you can’t point at any federally owned asset, company or enterprise, that is delivering as planned. That is telling.

What to do? It’s simple

The Federation should lay off business …the business of government is not business. How can we do this? Models already exist. I like the model we currently have in the pension industry, with the private sector as the OWNER and OPERATOR, and the government as REGULATOR.

[READ ALSO: Nigeria borrows fresh €500m from Credit Suisse, others, to finance industrialization)

Such a model applied to the loan will see the FGN simply put out proposals to the private sector to enter partnerships to develop these projects on Public-Private Partnerships. This means only projects that have a revenue basis will be approved. Loans may come, but not on the FGN balance sheet.