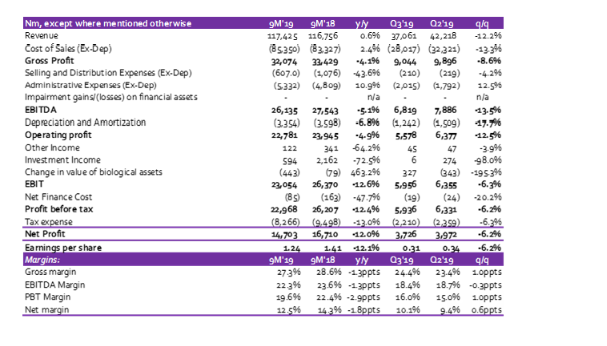

Dangote Sugar, in its recently released 9M 2019 financials, reported 0.6% y/y rise in revenue to N117.4 billion in 9M 2019 from N116.8 billion in 9M 2018. However, on a q/q basis, Revenue dipped 12.2% q/q to N37.1 billion in Q3 2019 from N42.2 billion in Q2 2019. However, we note Revenue in Q3 2019 came in higher than Q3 2018 Revenue by 13.4% y/y which suggests the possibility that the company may be feeling the positive impact of the border closure which has limited entry of smuggled sugar.

Across business segments, sales of the 50kg bag category grew 0.9% y/y to N111.2 billion while Revenue from retail sugar was up 2.7% y/y to N3.3 billion. On the other hand, Revenues from retail molasses and freight services were down 26.8% y/y and 7.3% y/y.

[READ MORE: Quick Take: Lower revenue & higher leverage underpins weak operating performance]

Cost of Sales (adjusted for depreciation) edged higher, climbing 2.4% y/y to N85.4 billion for 9M 2019 from N83.3 billion in 9M 2018. On a q/q basis, Cost of Sales fell by 13.3%, higher than the 12.2% q/q decline in revenue. However, the growth in Cost of Sales on a y/y basis was faster than the growth in Revenue driven by 4.6% y/y growth in raw materials cost.

Notably, other line items of Cost of Sales were lower on a y/y basis save for raw materials cost and freight expenses which suggests DangSugar must have been impacted by the mild pressure on raw sugar price. Against this backdrop, Gross Profit fell 4.1% y/y to N32.1 billion in 9M 2019 from N33.4 billion in 9M 2018. On a q/q basis, Gross Profit was down 8.6% to N9.0 billion in Q3 2019 from N9.9 billion in Q1 2019. Gross margin printed at 27.3% in 9M 2019, 1.3ppts lower than 9M 2018 28.6%.

Operating Expenses (adjusted for depreciation) grew marginally, up 0.9% y/y to N5.9 billion for 9M 2019 driven by a 10.9% y/y growth in Administrative Expenses (excluding depreciation) to N5.3 billion. On the other hand, Selling & Distribution expenses was down 43.6% y/y to N607.0 million. On the back of lower Gross Profit, EBITDA declined 5.1% y/y to N26.1 billion in 9M 2019 from N27.5 billion in 9M 2018. EBITDA margin for 9M 2019 was lower by 1.3ppts y/y to 22.3%.

EBIT fell 12.6% y/y to N23.1 billion in 9M 2019 from N26.4bn in 9M 2018 on the back of lower Other Income (down 64.2% y/y to N122.1m) and lower Investment Income (down 72.5% y/y to N593.7 million) booked by the company for the period. Lower Tax Expense (down 13.0% y/y to N6.1bn) and Net Finance Cost (down 47.7% y/y to N85.2 million) cushioned the decline in Net Income. Nonetheless, Net Income fell 12.0% y/y to N14.7 billion in 9M 2019 from N16.7bn in 9M 2018. Earnings per Share (EPS) stood at N1.24/s for 9M 2019 compared to N1.41/s in 9M 2018.

[READ ALSO: Quick take: 9M earnings impressive despite weak Q3 performance]

We have a target price of N14.50 for Dangote sugar with a HOLD recommendation. Current price; N10.35.

______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.