I remember hearing of some rant about how there is little or no differentiation among Nigerian fintech startups. People have complained that they all appear to be doing the same thing or solving the same question. Some other people have risen to their defence, saying that if 50 people are still trying to solve the same problem, it means that the problem remains unsolved. Once the problem is solved, then there would be no need to solve it anymore.

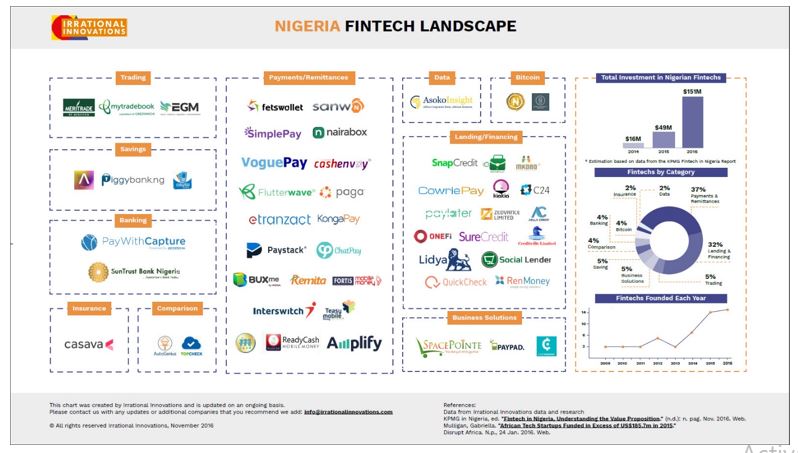

Looking at Nigeria’s fintech space, payment, lending and savings appear to be leading the pack. I will agree that the bandwagon effect drives a lot of Nigerian entrepreneurs. 2 years ago, when PayStack got into YCombinator, it was as though payment was the only problem within the Nigerian financial system. Almost everyone was building a payment company.

Now that it appears that there is a clear leader in that space, entrepreneurs are jumping into the next wagon – lending. The issue with lending becomes clear once you enter. Liquidity is one. How do you get money to lend? How do you profile a potential borrower? How do you deal with non-performing loans (NPLs) and how do you organise collection? These are big problems.

Then the wave of savings came in. This is a simpler problem perhaps… until you find out that you need to convince the users to trust you. You might need to attract them by offering significantly higher interest rates on their savings. You need a bit of treasury management to ensure that once a saver requests his money, it is always available.

All these activities are lines along the operations of banks.

Are banks waking up?

Since the beginning of this tech revolution, the banks appeared to be taking the back seat and people suggested that traditional banking will be disrupted by these fintechs. In case you have not yet noticed, I have come to announce to you that the banks are responding!

It started with allegations that a certain bank is notorious for copying and implementing ideas run by it. I am sure you know the bank in the box.

Entrepreneurs became wary of the bank and banks by extension. This bank in a box then showed everyone how to build a proper digital infrastructure. It led the way in innovation amongst its peers. The bank built a solid mobile app and led the USSD banking revolution.

I believe that as other banks do not want to be pushed aside, a lot of them have also improved their internet banking channels. Then, we started noticing banks launching products other than savings and current accounts.

PayWithCapture was launched by Access Bank to facilitate merchant payment using QR Codes. I am not sure this experiment was successful. However, it appears that a lot has changed since then. The bank was not deterred by the poor adoption of the product. It then fostered strong partnerships to provide payment infrastructure for web payment.

Perhaps the most courageous and leading attempt to challenge the fintechs is Wema Bank’s launch of ALAT, which claims to be Nigeria’s first fully digital bank.

ALAT launched with a savings product, offering 10% interest rate on savings subject to certain minimum balance. Just last week, ALAT announced that it has made another addition to its product including Quick Loan and Virtual Dollar Card.

Banks such as Keystone and Union bank are reawakening the millennial (Whatever that means) in them with interesting features such as ATM or branch locator. These banks were unlikely sources of innovation; however, in 2018, things are done differently.

What actually inspired me to write this post is the announcement of “Specta” by Sterling Bank. Specta is Sterling Bank’s digital lending platform, promising loans in 5 minutes. This is a clear indication that the banks are no longer resting on their oars.

Banks have done it before, they will do it again

Fintechs should be concerned about the renewed interest of legacy commercial banks in their businesses. These banks don’t take prisoners. Over the last decade, the CBN governors have always been ex-bankers. This implies that a former bank MD will not go against his colleagues. So, I don’t expect that fintechs will get any regulatory leverage.

These banks have done it before. Back in the days, Interswitch was the de facto switching engine within the banking system, however, once the banks noticed that it was becoming too powerful, NIBSS was created to check the powers of Interswitch. In fact, NIBSS was then given the regulatory backing as the “National Switch” (Whatever that means).

The actual operation and relationship among NIBSS, Interswitch, the banks and CBN is unclear, but one thing is certain— the Banks know how to get what they want.

So, what’s the MOAT? Become a Bank!

MOAT talks about defensibility. How will fintechs defend themselves against the potential onslaught of the banks? Let’s not forget, what most fintechs ride on is the fact that their operations are more efficient compared to the banks since they are not required to build branches across the country and pay huge salaries to a bloated workforce.

That said, banks have the capital to build and execute these different fintech lines if they really want to. ALAT and Specta are cases in point. GTPay is a payment gateway powered by Guaranty Trust Bank. So, how will a fintech ensure that it survives this potential onslaught?

Become a Bank! That simple. I don’t think any fintech should restrict itself to just payment, lending, savings or transfers. They should aim to become banks themselves (maybe digital banks). If not, the banks have regulators on their side, they have the customers already and they have the cash to experiment and scale fast. They can essentially build fintech products and run them.

Conclusion

My parting words: You don’t disrupt an incumbent by announcing to him that you are coming. The banks have gotten the announcement, now they are responding. We have shouted the disruption story so loud that the “disruptee” appears to be waking up from her slumber in an attempt to drive innovation in financial technology.

Happy entrepreneuring!

Gbam.

fintech needs to obtain licence to accept deposit before they can compete with banks in the first place….fintech still leverage on banks customer account database….

Well said Fisayo. No regulatory body controlling their activities. My fear is I hope they won’t eventually cash out with people’s money when the CBN/NDIC hammer decides to come on them. Recall what happened back in the days when MFBs was all over the place and there was no clear cut regulation from the CBN and Deposit Insurance company. Eventually, when they did a lot of the MFB closed down and lots of the BOP people lost money.

the Banks are really not playing with introductions of chatbots and ATMless withdrawals.. They have really woken from their slumbers.