Last week, Bloomberg and the Nigerian Stock Exchange organised the third edition of the annual Nigerian Stock Exchange (NSE) & Bloomberg CEO Roundtable themed “Innovating out of Nigeria’s Recession: Exploring New Paradigms for Nigeria’s Economic Growth”.

This edition brought together reputable economists, top government officials and CEOs spanning the Manufacturing, Financial Services, Telecommunications, Agricultural, Investment and Educational sectors to address the issue of resource dependency and the alignment of the economic recovery plan and road-map to insulate the Nigerian economy from the shocks that come with resource dependency.

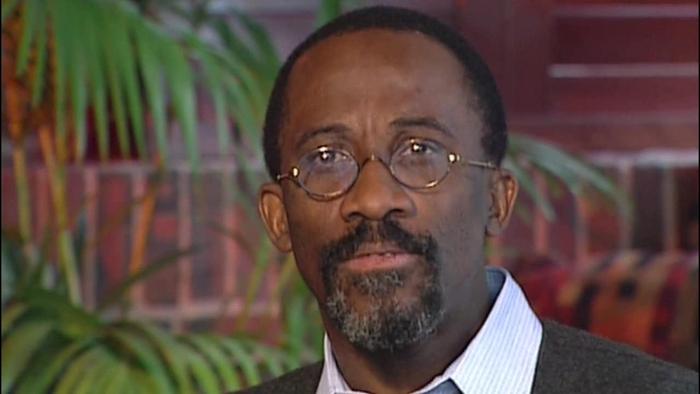

Nairametrics had an opportunity to interview one of the panelist, Mark Bohlund, Senior Economist, Africa and the Middle East, Bloomberg Intelligence. We asked him a wide range of questions to get his view on the Nigerian stock market and the wider economy. See below;

How would you rate the government’s handling of the economy in the last two years?

The government’s response to an admittedly very difficult situation has without doubt been poor. Especially the decision to stick with the naira peg has aggravated the economic downturn with no clear advantages for the situation of the poor as claimed by the president.

Do you see the country getting out of recession any time soon? If yes, when?

The economy hit its trough in the third quarter of last year and has been on an uptrend since, albeit a weak one. We expect real GDP growth to return to positive numbers in Q217, largely due to an improved contribution from the oil and gas sector.

The stock market has gained about 25% YTD, on account of the success of the investor window. Do you think the market is now in a bubble or are there still rooms for upsides?

The current regime with a lot of different exchange-rates has created an environment with a lot of activity centred on arbitraging between the exchange rates and the black market rate and anticipating what policy changes there may be in the future. This is drawing capital from more productive activities that could grow the economy and benefit a wider share of the population.

The Nigerian capital market relies majorly on FPIs to drive volumes and increase market cap. Are there clear indications now that FPIs have returned or is the latest bullish run mostly locally driven?

The new NAFEX window has improved liquidity in FX trading. I can’t say if it is foreign or local funds running the latest rally but larger inflows are unlikely given doubts about for how long the window will remain open, especially if there are further pressures on the balance of payments from lower oil prices.

Kindly share your thoughts on Nigeria’s 2017 budget, which has just been signed into law.

The increase in the benchmark oil price gives less of a buffer, especially as global oil prices have dipped below $50 per barrel again. Nonetheless, the squeeze on fiscal finances is still less severe than in the first half of 2016. I fully agree with Finance Minister Kemi Adeosun’s comments at the NSE/Bloomberg CEO roundtable that Nigeria needs to raise its revenue in tandem with borrowing. We are already in a situation where the federal government is likely to have to retain a larger share of oil and corporate income tax revenue in the future in order to have sufficient funds to service debt. Considering the rising powers of the two legislative chambers reducing the share of federal government revenue distributed to the state level is likely to be politically challenging, especially going into the 2019 elections,

Even though, there are some signs of improvement in some of Nigeria’s macroeconomic indices, what would you consider fault lines in the nation’s quest to get out of recession?

I still think there is a lack of political will to work together to reshape the economy and reduce the dependence on oil revenue and rent-seeking behaviour. There are too many powerful vested interests benefiting from the current situation.

Back to the government, how would you rate CBN Governor, Godwin Emefiele’s handling of the exchange rate?

Well, arguably the foundation of the FX policy, i.e. maintaining the naira peg, has been decided at the presidency, not the CBN, so difficult to judge Emefiele on that. The NAFEX window has drawn in some funds but does not materially later the situation.

Bloomberg is global leader in the world of business. Are there any plans to provide wider coverage of the Nigerian economy, particularly the informal sector which makes up nearly 50% of the economy?

My role includes efforts to source data series that could be useful to track economic activity. While Nigeria has among the best statistical coverage in Sub-Saharan Africa, there is still a lot of economic activity that goes unregistered, in the informal sector in particular. Bloomberg is working on narrowing this information gap, among other things by drawing on night-time light emissions measured by satellite.