The total assets of Nigerian Pension funds grew by 3 per cent between March and April 2017 to a record N6.5 trillion, according to information released by the Pension Commission of Nigeria (PenCom) and analyzed by Quantitative Financial Analytics. Pension assets had stood at N6.3 trillion by the end of February, meaning that there has been a surge of N194.5 billion.

Quantitative Financial Analytics further reveals that the asset class that benefited most from the surge is foreign money market securities which grew by 336%, from N5,188 as at February 2017 to N22,645 while investments in Commercial Papers grew by 165% from 16.763 to N44.503 within the period under review. On the flip side, Agency Bonds, comprising NMRC and FMBN bonds suffered the greatest divestment as pension fund asset allocation to that asset type fell by 50.13% to N41,113 from its February ending value of N82,441.

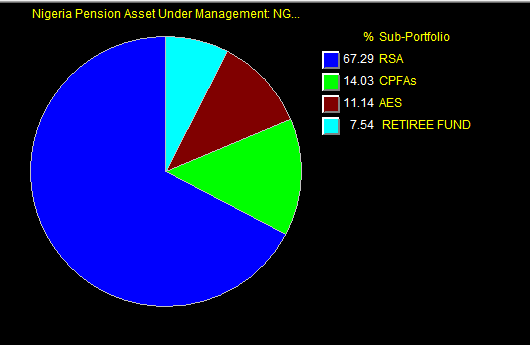

Among pension fund types, the increase is felt almost equally by the RSA and Retiree funds which saw their total assets increase by 3.76% and 3.14% respectively with CPFAs increasing by 2.12% and AES, by just 0.18%. Accordingly, RSA Pension funds account for 67.29 per cent of assets compared to 14.03 per cent for CPFAs, 11.14% for AES and 7.54 per cent for Retiree funds.

The growth in asset value seems to be in tandem with the performance of the various pension fund types. According to our analysis, RSA funds returned 2.48% on the average between March and April while Retiree funds made 2.5%. Our attribution analysis therefore projects that about 1.28% and 0.64% growth in the RSA and Retiree total asset can be attributable to monthly contributions.

There is no significant change in the asset allocation dynamics as FGN Securities (Bonds and Treasuries) still account for 71.36% of total Pension assets, slightly down from the February ending allocation of 72.36%.