The Central Bank of Nigeria on Thursday released results of its latest treasury bills auction. As has been the case for weeks, it was fully subscribed and yields were, well, as expected.

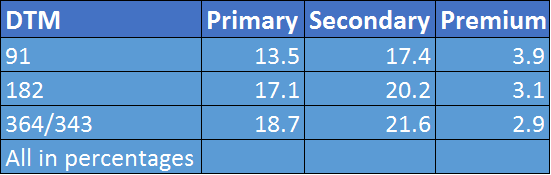

A 91-day treasury bills yield sold for 13.5%, while a 182 day bills sold for 17.1% A 364 day bill on the other hand sold for 18.7%.

Everything seems normal looking at this result. But fish smells when you juxtapose this with the how much yield the secondary market is attracting.

According to data from the FMDQ OTC, a 91 day treasury bill is going for 17.43%, 182 day 20.21% And 343 day 21.66% respectively.

Let’s put it in a table for you to appreciate the variance.

Analysts who have looked at this repeatedly inform Nairametrics that it seems at odd with market behaviour. Typically, primary market yields track secondary market yields as the latter is an indication of how much investors want. So, who is buying treasury bills at a lower yield in the primary market when they can get a better yield in the secondary market?

Since the start of May, there has been a growing divergence between NTB auction yields and yields in the secondary market. In particular, the 91-day and 182-day yields are much lower at the auction vs in secondary market trading, as depicted in the table above.

According to an analyst who will not want to be named officially, “the move reflects CBN actions to curb system liqudity which has resulted in the apex bank issuing OMO bills almost on a daily basis. This has pushed secondary market yields higher.” OMO, which refers to the Open Market Operations, an instrument used by the CBN to control money supply, currently trades at a premium of about 5% to the MPR, another occurrence we find intriguing.

Ordinarily NTB yields should not be so far away between both primary and secondary markets, the continued existence of this anomaly reflects a glut of not too savy investors at the primary auctions had allowed the FGN take advantage by issuing bills at a significant discount to the secondary market levels.

What is likely going to happen? according to our analysts, “the longer this continues the more likely more investors will stop going to auctions though unfortunately a lot of passive investors still going to auctions continue to make it possible for the FG to get away with the anomaly.”

As another analysts inform Nairametrics, who are the greater fools buying these bills?

so how do you buy from the secondary market.???

Just have chat your banker, you will be provided with the boutique of instruments in the secondary market. Then you can purchase anyone you want

A nigerian woman asked nairametric “What is secondary treasury bill. As nairametric have paid me some dollar I may tell you what it can be,let start asking what is treasury bill and the causes and it’s effect.it’s simple means as treasury as in govt treasury,it’s govt debt or secured debt,another derivation of govt bond,but it’s issued for short-term in days.the cbn uses to advertises in newspaper and it’s tenure.it is bought almost by Nigerian banks.

Now with the growth of Nigerian money market.WE DO HAVE DEALERS REGISTERED BY THE NSE TO DEALS IN SECURITIES.

The primary function of treasury bill is for govt to get funds, without raising taxes or having a deficit budget,but previous govt have taken the role of the cbn lending directly to the federal govt,by setting up the Nigerian debt office called debt management office the DMO.it is possible for any govt incurs more debt as Nigeria debt is not up to 20 % of Nigerian gnp.which most govt a hesitating to do.

Secondary treasury bill simply means a” second” is it a second treasury bill within the same period, a dual treasury bill or the cbn is targeting the secondary money market.i.e are they are bye-passing the primary securities dealer.i.e bankers or stockbroker.They are selling directly to the Nigerian public.which I think is what they wants to do as the DMO raised another govt bond with about 5 % this year now it looks the function or the aim of the cbn is the mopping of liquidity,as the previous attempt by the cbn to mop-up liquidity is not working then

As a small scale investor, say i have #50,000 to invest; which will be smarter/better: investing in an MMF (not the MMM ponzi!) or T-Bills via the Secondary markets. Especially since their yield is almost equal around 18% — at least Stanbic & FBN MMF’s are both yielding around 18%.

Plus will banks typically sell T-Bills worth as low as #50,000?

Thanks.

When you say there’s something ‘fishy’ does it mean that this is not a good time to invest in Tbills?

Treasury bills is good just that it appears it might be better to buy from the secondary market for longer tenors

Is secondary market for TB better for 91days?

If there is really something fishy going on in Nigeria T-bills it means the increase in interest rate isn’t simple realistic, that’s you can’t borrow from Peter to pay Paul considering how the oil prize has gone done drastically. If we were meant to think with our brains, it obvious – we are on a very dark side of things and the government isn’t telling us all of the truth.

Buying in primary Or secondary market for treasury bill,which is better? Which one earn higher interest?