Nairametrics| Old habits do die-hard. Last year, the former CBN Governor and Emir of Kano, Sanusi, Lamido, Sanusi, ruffled feathers after he revealed that Federal Government borrowing from the Central Bank was now in excess of N4.7 trillion and in violation of (Section 38.2) which caps advances to the FGN at 5% of last year’s revenues. The revelation shocked a lot of Nigerians instigating a hasty response from the government.

[visualizer id=”99923″]

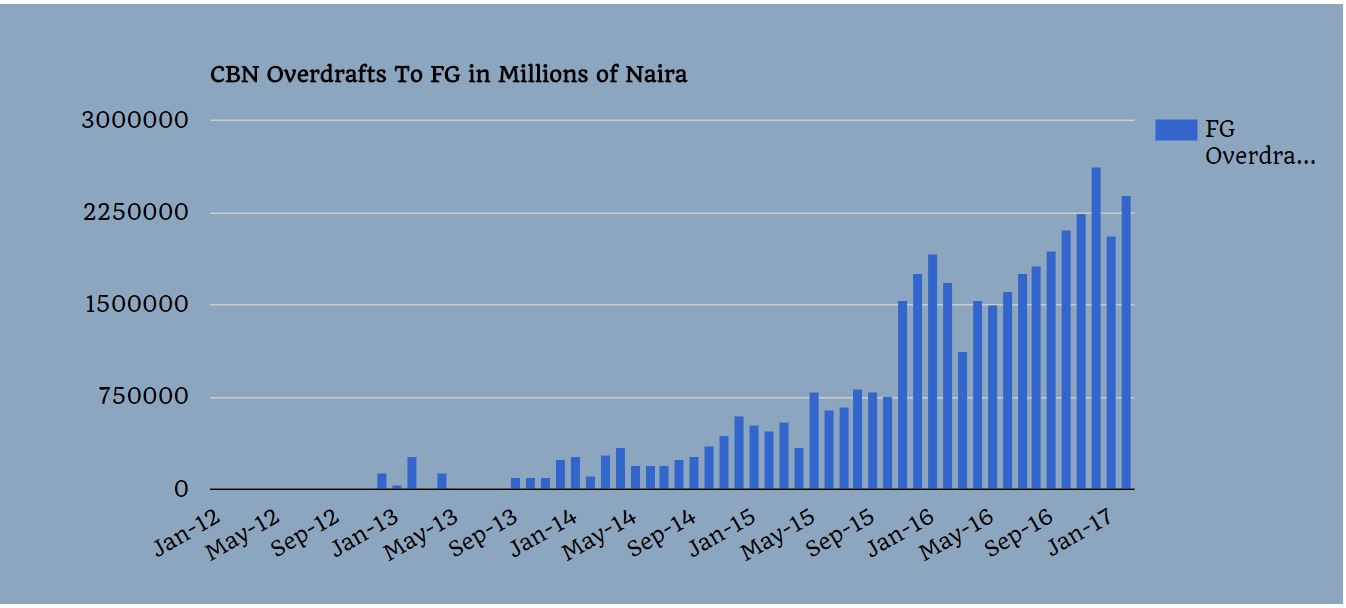

Latest data from the CBN however, shows that the government is still borrowing heavily from the CBN. CBN claims against the Federal Government hit an all time high of N5 trillion in December 2016, about 50% of the government’s total domestic borrowing and N300 billion more than the N4.7 trillion that was also controversial when Emir Sanusi made the revelation.

Total claims to the FG of N5 trillion as at December 2016 nearly doubles FG revenue of N2.7 trillion recorded in 2015. In fact, total overdraft of N2.6 trillion is about 96% FG revenue for 2015.

Highlights of the data

- Total claims to FG as at December 2016 was N5 trillion but dropped to N4.78 trillion as at February 2017.

- Overdrafts to the FG was about N2.6 trillion in December 2016. This has now dropped to N2.3 trillion as at February 2017.

- FG’s Ways and Means borrowing from the CBN was about N360 billion as at December 2016. It was about N359 billion in February 2017.

The Federal Government currently has a total domestic debt portfolio of about N10 trillion and plans to borrow about over about N2.4 trillion to finance 2017 budget. Government debt service to revenue ratio is currently estimated at about 66%.

Critics of CBN lending to the FG also opine that it is basically printing new money to help finance government deficits. Even though, the idea is for the CBN to repay the loans, at least within the year, evidence point to the fact that the loans are not being cleared. By 2017, the government is expected to have repaid the N5 trillion but is still carrying a net balance of N4.7 trillion suggesting, if any, only N300 billion has been paid.

The independence of the CBN has been questioned severally by analysts suggesting that its ability to exercise its power of not placing a freeze on borrowing may not be entirely possible. However, with the net balance reducing compared to 2016 year end, the FG may be at least repaying the loans, albeit by borrowing from the retail market.