GT Bank Plc released its 2016 half year results revealing it a blistering pre-tax profits of N91.3 billion a 45% increase from the same period a year earlier.

The results as was analysed here suggest the impressive result was mostly due to FX gains which is likely not to repeat again at least at this current level. An FX gain of about 972% doesn’t happen too often except maybe the naira depreciates to N600 within the next 6 months. Besides, the bank is also losing a ton of cash from bad loans. It provided for about N37 billion in bad loans (up 531% year on year).

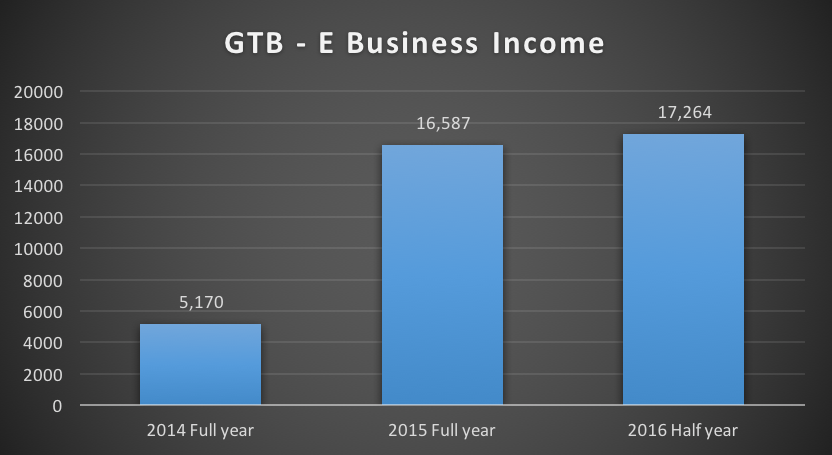

Nevertheless, we did notice other areas of strong showing by the bank. GTB posted a whopping N17.2 billion in E business (about N2.8 billion monthly) Income about 3x the same amount it posted a year earlier. The amount is already more than the N16 billion the bank reported in the whole of 2015 and more than 3x the amount it reported in 2014 as a whole.

Source: Nairametrics Research

Whilst the bank did not break down the constituents of this income stream, the bank’s E-business income is thought to draw mostly from the commission and fees it earns from charging customers from the use of the banks cards and usage of its online mobile banking apps for transactions. GTB is currently one of Nigeria’s most popular banks in the retail segment of the banking industry and has a huge presence online.

According to Alexa’s ranking, GTB is the 14th most visited website in Nigeria. Zenith bank, Diamond Bank and First Bank all rank behind at 104, 166 and 169 respectively. According to the same data from Alexa, GTB gets about 91% of its visit from its online platform https://ibank.gtbank.com. This shows customers who visit the bank’s website, login to its online banking platform to do one transaction or the other.

These are all pointers to GTB’s remarkable revenue from e-business. The bank is able to rapidly convert a lot of its visitors into revenue making streams by giving them a platform where they can pay for some of the services offered by the bank. From the bank’s internet banking, customers can make online transfers to beneficiaries within the bank or outside the bank, purchase items online, pay for utilities etc.

These confirms the potential that a sound retail business model can provide when banks focus their strategy effectively on retail banking. The bank recorded about 88.7 million card transactions in the first half of 2016 valued at about N866 billion. One percent of that alone is about N8.6 billion.

Some of the lower middle class customers of GTB we spoke to reveal that they decided to open an account in GTB because it was fairly easier. Whilst its competitors demanded that you have a balance to open an account, GTB mostly offered a zero balance in exchange for opening an account. It was also fairly easy to open an account from the bank as it was one of the first to make a major foray into online internet banking.

Customers could open accounts via Facebook or other online tunnels. This strategy drew younger people, students, lower middle class employees and those who earned very little closer the bank but served as a form of investment for the future. A lot of these guys go on to utilize these accounts for transactions when they eventually start earn some money. Most commercial banks though late to the game, are now adopting this strategy.

With its E-business segment growing at a pace of over 100% annually its tough to bet against being a major part of the bank’s income stream. The segment can only grow higher in the coming years as commercial banks move aggressively to capture millions of unbanked Nigerians.