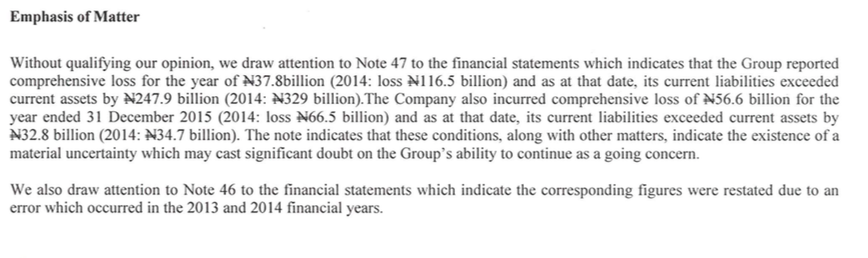

The recurring losses of Oando Plc, huge debts and severe negative working capital position may cast significant doubt as to the company’s ability to continue. That in a nutshell is how their auditors, EY expressed their opinion in its latest 2015 FY result. Here is a screenshot of it;

Therefore, if urgent and responsible steps are not taken by the management and boards of directors of the oil giant, its ship may hit an iceberg and sink like Titanic.

The 2015 audited financial statement of Oando showed the company recorded a loss after tax of N49.68 billion from a loss of N145.12 billion as at December 2014. It has been recording losses since the third quarter of 2014, when oil price began its fall and the central bank embarked on its first series of devaluation. It’s 2014 FY loss of about N145 billion is still on record as one of the largest by a Nigerian company.

The recent loss was mostly due to a 115.17 percent rise in cost of sales. Rising cost of sale ate up the modest revenue growth of about 10 percent recorded for the year. Here are highlights of this result

- Turnover decreased by 10%, N381.7 billion compared to N425.7 billion (2014)

- Gross Profit increased by 7%, N77.7 billion compared to N72.3 billion (2014)

- Loss-Before-Tax decreased to (N51) billion compared to (N138) billion (2014)

- Loss-After-Tax decreased to (N49.7) billion compared to (N145.7) billion (2014)

Oando also released its 2015 Q1 results reporting another loss of N13.8 billion (2014: N15.5 billion). The company also reported a drop in revenues from N30.6 billion reported in 2014 to N27.7 billion in 2015.

Oando faces a two-pronged problem which traditionally sinks companies. It faces a liquidity squeeze due to its highly leveraged balance sheet and it also faces a steep revenue decline that is way below its own projections. With cost rising due to the floating of the Naira, the company will need to look for ingenious ways to get out of this dual axis of evil threatening to send it into oblivion.

Oando’s Plc is obviously in a financial mess and has made recognizable efforts to try to address this issues. Here are examples of some the efforts it has put in place to restructure its finances;

- The company last month announced a restructuring of its debt with the execution of its N94.6Billlion Medium Term Note facility with 10 leading financial institutions.

- Oando PLC also struck a deal that will help inject about USD210million from Helios/Vitol JV.

- It has also sold some of its assets in the Power sector to help raise adequate capital.

Here are its plans to improve revenues;

- In its upstream it claims to have recorded an 118% increase in total production to 19.9 million boe in the 2015 as compared to 9.1 million boe 2014. Growth in average production from 24,945 boe/day in 2014 to 54,520 boe/day in 2015.

- In its more profitable midstream segment it says it is commencing an 8.5km pipeline expansion for the Central Horizon Gas Company (CHGC)

Despite these efforts it still has a over N300 billion in negative working capital as at March 2016. A negative working capital for any business is a signal that its ability to continue as a business is seriously in doubt. It’s creditors can essentially pull the plug on Oando. We doubt that will ever happen due to the “too big to fail” status Oando seems to have acquired for itself.

The banks that have now refinanced about N95 billion of Oando’s loans seem to also understand how dire Oando’s liquidity crisis really is. By giving them a loan with a moratorium on principal repayments of three years, it could be seen in hindsight as a smart move as they obviously knew Oando will not be able to repay the principal from operations. This incidentally also helps the banks avoid provisioning. Nevertheless, there is a huge cause for concern as the company’s ability to service interest is not guaranteed.

There still has a retained loss of about N195.5 billion indicative of its inability to pay dividends in the short-term medium term. It has an option to set-off its Share Premium against its retained losses but that will confirm that all the value it has created over the years are not gone. Oando’s total equity is about N55.2 billion but still has market capitalization of about N80 billion. It will be interesting to see how long the market continues to place a multiple to its net assets.

Oando’s share price closed at N6.6 gaining about 2.2 percent. It is either investors have not yet fully digested the results or simply believe the worst is over for Oando. We advice caution at this stage as we continue to review the progress made by this company to dig itself out of this seemingly insurmountable hole.

Based on your analysis, would you say OANDO’s result was better this year than the year before?

If the answer is yes, while does it share price trade above 10 Naira in 2014?

This results was better than last year if you are looking at losses only.