News of the Nigeria government swapping a fraction of its foreign reserve for the Chinese Yuan was received by Nigerians with mixed feelings. Most are of the opinion that it would trim down the demand for the dollar hence, ease the pressure on the country’s foreign reserve.

The question is will a currency swap resolve the issues surrounding our foreign exchange? Will it reduce our demand for imported products? Will it aid the inflow of foreign exchange into the country?

Let’s take a little trip to see what the real issues are. Mid 2014, our one sector economy got its bubble busted when oil prices took a plunge. Hopes of a rebound faded as the supply glut continued. With an election year in view and a lack of political will to save for the rainy day, caution was thrown to the air and no expense was spared to ensure the incumbent party retained its ruling position. Unfortunately for the ruling party, things went the opposite direction. A new government assumed office on a mantra of change, hoping to make a difference, but soon came face to face with reality of empty coffers and depressed revenue.

The question of how to fund our humongous need for foreign exchange, (being an import dependent country) without devaluing the currency came to fore. The CBN under the control of the government placed restrictions on transactions that could assess foreign exchange. This had a ripple effect on the economy with the manufacturing sector going into a recession and inflation spiking to new levels.

Devaluing the currency makes no sense when the fundamental problems have not been tackled, so what can be done to address this elephant in the room everybody is worried about?

Rumour has it the Central Bank is proposing a two tier foreign exchange system where a segment will cater to top priority transactions like education, healthcare etc, while the other segment will cater to manufacturers and other users of foreign exchange at a rate different from the official rate. This would definitely ease the pressure for a while and reduce the speculation on the Naira at the parallel market.

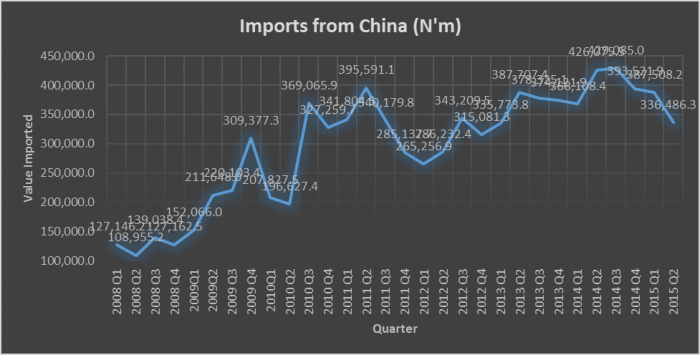

The currency swap is in line with the Chinese government’s agenda of increasing the use of its currency around the world. China has signed currency swap agreements with about 30 countries including Kazakhstan & Argentina. The exchange of a portion of our foreign reserve for Yuan will reduce the demand for the Dollar and give very short-term relief to our foreign exchange problems. We however have to thread with care. China is at the bargaining end of this deal and hence, could easily tilt things to its advantage. Our government needs to pay attention to the loose ends of this deal and ensure they are tied up before the MoUs are signed. We don’t want to become a dumping ground for Chinese products neither do we want to become subject to the demands of the Chinese government in the future.

The government in the meantime needs to device means of shoring up revenue. There are quick wins this administration can make in terms of driving up revenues. The government needs to first of all cut the cost of running it operations, duplicity of functions, unnecessary allowances on feeding, housing and security for government officials needs to be slashed, our state governors need to get creative as to the things that can be done to grow internally generated revenue so, the issues of recurrent bail outs of state governments can become a thing of the past. The high duties placed on exports should be reduced to encourage exportation and the flow of foreign exchange into the country, restricting the activities of Fulani Herdsmen in the middle belt and other parts of the country will allow farmers who haven’t harvested their crops since 2013 go back to their farms and grow enough crops to consume locally and export (believe or not Nigeria imports Garri from other west African countries). Developing tourist attraction sites in Nigeria and attending to the problems of insecurity will definitely increase the inflow of tourist to Nigeria and also reduce the number of Nigerians going abroad for tourism purposes.

Diversifying our foreign reserve doesn’t reduce the pressure on our reserve, the fact that the Yuan is quite volatile and much weaker than the Dollar makes matters worse. Yes most of our imports come from China and it will be easier to offset payment but this still doesn’t address the issue of increasing our revenue to meet our immediate needs for foreign exchange, it doesn’t make the pressure on the Naira fade away. We advocate Nigerians purchasing made in Nigeria goods but most made in Nigeria goods have foreign inputs that require foreign exchange to get. Like it or not Nigerians still like Italian shoes, they still shop in Dubai, we still buy Louis Vuiton bags, Brazilian hair, Swiss lace etc, so the demand for FX isn’t going reduce anytime soon hence, the need to drive up revenue in order to have enough to meet demand for FX, implement economic policies and save.

The lasting solution to our foreign exchange problems is for the government to create an enabling environment for businesses to thrive in Nigeria. With basic infrastructures (power, transportation, proper healthcare and a restructured education sector) in place, locally produced products become much cheaper to purchase. High import duties, high standards placed on the quality of local produce and a proper re-orientation of the Nigerian people will bring a drastic reduction to the demand for the Dollar and an appreciation of the value of the Naira.

Though Chinese export accounts for about 80% of our total bilateral trade volumes and the currency swap seems more or less like our “knight in shining armour”, we are just buying time. We need to face the reality, we need to shore up revenue.