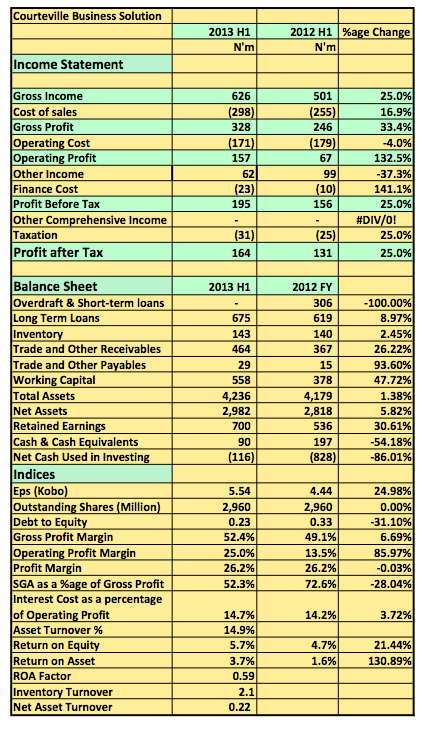

[upme_private]Courteville Plc (Courtvil:NL) released its 2013 results showing a 25% improvement in revenues. Revenue increased to N626million (2012: N501million). The company was able to hold down cost of sales as Gross Margins improved by 6.7% over the prior year. Operating expenses dropped 4% to N171million helping push operating profit to N157million 132% over 2012 H1. The company will eventually post Pre-tax profits of N195 millon 25% higher than 2012 as income from other sources as well as finance cost faired worse than the prior year.

The company has also reduced its overdraft position to zero evidenced by the drop in debt to equity from 0.33 to 0.23. Highlight of the result to me is the drop in operating expenses as a percentage of Gross Profit. If this persist in the remaining half of the year earnings per share should rise above 40%.

Courteville Plc released its 2013 H1 results in the website of the NSE[/upme_private]