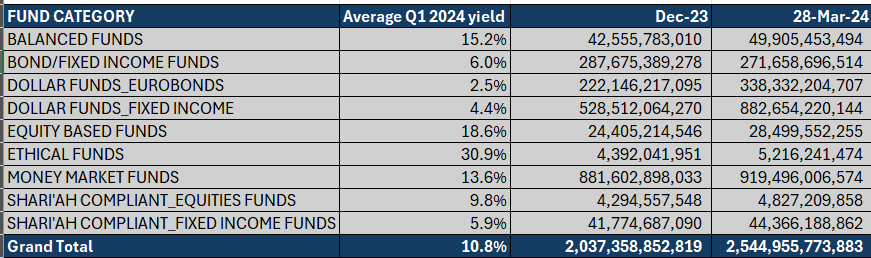

Nigerian mutual funds recorded an average return of 10.76% in the first quarter of 2024, largely driven by the 30.89% yield printed by ethical funds during the period.

This is according to data released by the Securities and Exchange Commission (SEC).

The total Net Asset Value (NAV) also increased by 24.9% in the review period, representing a whopping N507.6 billion addition from the initial N2.04 trillion recorded as of the end of December 2023. The NAV as of the end of March 2024 stood at N2.54 trillion.

The 10.76% return recorded in the first three months of the year, is already more than half of the 18.46% return printed in the whole of 2023. The positive movement in the mutual funds was majorly due to bumper yields on ethical (30.89%), equity based (18.6%), and balanced funds (15.23%).

For context, ethical mutual funds are investment entities that seek to generate profits by investing in companies that adhere to specific ethical and social criteria. Typically, these funds allocate their investments to companies that exhibit dedication to environmental sustainability, social equity, and ethical governance practices.

In the same vein, the rally in the Nigerian equities market also supported the returns in mutual funds. Notably, the All-Share Index (ASI), which measures the performance of the equities market gained 39.84% to close the review quarter at 104,562.06 points.

Recommended reading: Best performing Nigeria mutual funds in 2023

Also, high yields in the fixed income market, following a 600 basis points (bps) hike in the Monetary Policy Rate (MPR) by the CBN, contributed to the yields printed in Nigerian mutual funds during the quarter under review.

Meanwhile, below are the best performing mutual funds in the country based on their different fund classifications in Q1 2024.

Best performing Balanced Mutual Funds

A balanced fund is a type of mutual fund that commonly includes both stocks and bonds within its portfolio. These funds generally adhere to a predetermined asset allocation, often maintaining a fixed ratio of stocks to bonds, such as 70% stocks and 30% bonds. The fund category recorded an average yield of 15.23% during the review period with an NAV of N49.91 billion.

- Capital Express Balanced Fund – 68.77%

- ARM Discovery Balanced Fund – 65.5%

- Cowry Balanced Fund – 30.5%

- Coral Balanced Fund – 29.14%

- ValuAlliance Value Fund – 23.76%

Best performing Bond/Fixed Income Funds

Bond or Fixed Income funds are mutual funds that allocate their investments to a selection of debt instruments issued by various entities, including governments and corporations. Examples of these instruments include FGN Bonds, state government bonds, Eurobonds, corporate bonds, and potentially other assets such as commercial papers and treasury bills. The fund recorded an average year-to-date return of 6.01% with an NAV of N271.66 billion.

- PACAM Fixed Income Fund – 97.39%

- Radix Horizon Fund – 21.46%

- Meristem Fixed Income Fund – 16.61%

- DLM Fixed Income Fund – 15.41%

- Cowry Fixed Income Fund – 14.36%

Best performing Dollar Funds

Dollar funds are mutual funds overseen and regulated by the SEC, which invest in instruments denominated in US dollars. These instruments may include Eurobonds, US dollar bank deposits, and other similar assets. The average returns for the review period stood at 2.55% (Eurobonds), 4.43% (Fixed income), with NAV of N338.3 billion and N882.7 billion respectively.

- PACAM Eurobond Fund – 12.09%

- Cowry Eurobond Fund – 11.38%

- Meristem Dollar Fund – 9.63%

- Nigeria Dollar Income Fund – 8.88%

- United Capital Global Fixed Income Fund – 7.84%

Best performing Equity Based Funds

An equity fund is an investment vehicle that combines capital from multiple investors to primarily trade a collection of stocks, commonly referred to as equity securities. Equity based mutual funds recorded average yield of 18.6% with an NAV of N28.49 trillion.

- ARM Aggressive Growth Fund – 96.08%

- Cowry Equity Fund – 34.02%

- PACAM Equity Fund – 25.52%

- Legacy Equity Fund – 21.97%

- Anchoria Equity Fund – 19.15%

Best performing Ethical Funds

Ethical funds are mutual funds in which investment decisions are based on predetermined ethical criteria. These criteria may stem from religious, environmental, social, governance, or other moral perspectives. Average returns for the review period was 30.89% with a Net Asset Value of N5.22 billion. Also, note that there are only three ethical funds registered with the SEC.

- ARM Ethical Fund – 71.84%

- Stanbic IBTC Ethical Fund – 16.83%

- ESG Impact Fund – 4%

Best performing Money Market Funds

A money market fund is a type of mutual fund that allocates its investments to highly liquid, short-term instruments. These instruments typically comprise cash, cash equivalents, and debt-based securities with high credit ratings and short maturities. Average yield on money market funds was 13.62% with an NAV of N919.5 billion.

- Meristem Money Market Fund – 17.87%

- Page Money Market Fund – 17.89%

- Emerging Africa Money Market Fund – 17.38%

- FBN Money Market Fund – 16.91%

- Norrenberger Money Market Fund – 16.9%

Bottom line

Mutual fund investments are a great option for people for a number of reasons. First of all, investors can diversify their risk by spreading it across a range of assets by using mutual funds. Also, mutual funds are professionally managed, giving investors access to knowledgeable supervision and advise on their investments.

Furthermore, mutual funds provide flexibility and convenience, with options to meet different risk tolerances and investing objectives.