The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) says the Federal Government has reduced the signature bonus for the 2025 petroleum licensing round to between $3 million and $7 million.

A signature bonus is a one-off payment made by oil companies upon signing an agreement for the award of an exploration or production licence or lease.

The Commission disclosed this in a statement on Monday, warning that any bidder who fails to propose a signature bonus within the approved range will be disqualified.

According to the NUPRC, all bidders will be required to submit a bid within “a range of $3 million and $7 million as approved by the minister of petroleum for the reduction of entry barriers”.

What the Commission is saying

The commission said bids will be assessed using a score-based system that considers several criteria.

The parameters, NUPRC said, include signature bonus (provided it is within the prescribed limit), proposed work programme, and the unit cost per barrel in relation to the work programme.

The commission said other evaluation factors include professionalism, human and technical capacity, percentage of bank guarantee made available, balance sheet, turnover, green story and decarbonisation programme, and corporate governance structure.

Backstory

On December 1, NUPRC officially launched the 2025 Licensing Round, introducing a digital bid portal as the country moves to deepen investment and strengthen activities in the upstream sector.

With the approval of President Bola Tinubu, NUPRC has placed 50 oil and gas blocks on offer across several terrains, including onshore, shallow water, frontier basins, and deepwater.

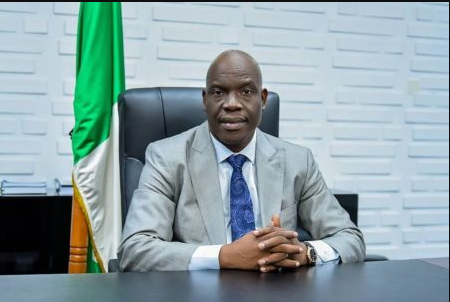

The Commission Chief Executive, Gbenga Komolafe said, “The 2025 Licensing Round is projected to attract about $10 billion in investments, add up to two billion barrels to national oil reserves over the next decade, and deliver an estimated 400,000 barrels per day from fully developed assets.

“At the Commission, we acknowledge that transparency is key to investor confidence. To ensure that the bidding process is credible and seamless, the Commission has rolled out guidelines which are now available on its website,” he said

The NUPRC has adopted a two-stage procedure consisting of a qualification stage and a bidding stage.

What you should know

In December 2024, the Federal Government successfully concluded its first licensing round under the PIA 2021, with several indigenous oil and gas firms awarded Petroleum Prospecting Licences (PPLs), granting them rights to explore and produce hydrocarbons from onshore and offshore blocks.

Licensing rounds have long been a cornerstone of Nigeria’s oil and gas investment strategy. Major rounds were held in 2000, 2005, and 2007, while more targeted exercises for marginal fields and deepwater blocks took place in subsequent years. However, many of the awarded blocks have faced challenges, including technical bottlenecks, funding gaps, and regulatory delays.