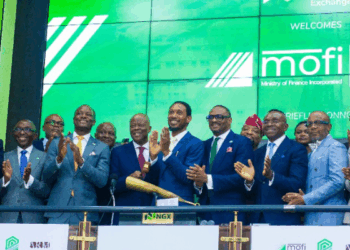

UAC of Nigeria Plc (UACN) has opened a N45 billion Commercial Paper (CP) issuance under its N65 billion CP Issuance Programme, offering investors an opportunity to subscribe to its 182-day and 268-day series at effective yields of 18.5% and 19.5%, respectively.

The offer, which opened on October 16, 2025, closes on October 20, 2025, with settlement on October 21, 2025.

The offer is open to Qualified Institutional Investors and High Net-worth Individuals, in line with the Securities and Exchange Commission’s Rule 321 governing commercial paper issuance in Nigeria.

Issue details

- The Series 1 CP (182 days) is issued at a 16.94% discount rate (18.50% effective yield) and matures on April 21, 2026.

- Series 2 CP (268 days) carries a 17.06% discount rate (19.50% effective yield).

- The minimum subscription is N10 million, and thereafter in multiples of N1,000.

Repayment of the CP will be funded from the cash flows of the UAC of Nigeria Group.

- The company generated net operating cash flow of N10.84 billion in H1 2025, compared to N6.91 billion in FY 2024.

- The Group’s retained earnings stood at N53.17 billion as of June 2025, supported by a five-year profit CAGR of 43% and cumulative operating cash flow exceeding N6 billion.

According to the press release, the notes may be quoted on the FMDQ Exchange platform or any other recognized exchange, offering investors secondary market liquidity.

Understanding the yield

The discount rate represents the percentage deducted from the face value of the note at purchase, while the effective yield reflects the actual annualized return an investor earns at maturity, taking into account the time value of money.

Since CPs are issued at a discount and redeemed at par, the effective yield is higher reflecting the true percentage gain over the investment period.

Inflation context

With Nigeria’s headline inflation rate at 18.02% as of September 2025 and the last Treasury Bill stop rates between 15% and 15.77%, the yield premium on UACN’s Commercial Paper is moderate roughly 2 to 3% above government securities and only marginally above inflation.

Financial and credit profile

The issue is rated A- (Agusto & Co) and A (DataPro), reflecting the company’s strong brand equity, diversified portfolio, and adequate liquidity position.

Investor takeaways

- Moderate yield advantage: The UACN Commercial Paper offers a modest premium over comparable Treasury Bills, though the real return above inflation remains limited.

- Credit exposure consideration: Unlike government securities, the CP carries corporate credit risk, with repayment tied to UACN’s cash flows and overall financial performance.

- Credit ratings: Rated A- (Agusto) and A (DataPro), the notes reflect good credit quality and moderate risk of default.

- Minimum entry point: The offer is targeted at Qualified Institutional Investors and High Net Worth Individuals, with a minimum subscription of N10 million.

- Liquidity advantage: Being tradable on recognized exchanges like FMDQ, the CP provides investors with short-term yield and potential secondary market liquidity.