A major driver of the Nigerian stock market’s impressive 18.95% return in the third quarter of 2025 was the strong performance of a select group of heavyweight stocks known as SWOOTs.

In Q3, 9 out of 22 SWOOTs gained more than 20%, while 16 advanced between 15% and 20%.

Altogether, 17 of them closed the quarter in the green, highlighting the breadth of positive sentiment among Nigeria’s largest corporates.

By definition, SWOOTs (an acronym for Stocks Worth Over One Trillion Naira) are companies whose market capitalization exceeds N1 trillion.

Given their enormous influence, any sustained movement in SWOOTs tends to shape the overall market direction.

Hence, their impressive showing in Q3 was powerful enough to lift the Nigerian All-Share Index to its third-best quarterly performance since 2020.

This work ranks the top 10 best-performing SWOOTs in Q3 2025, focusing on share price appreciation rather than size, with each company maintaining a market capitalization above N1 trillion.

Here are the top 10 best-performing SWOOTs:

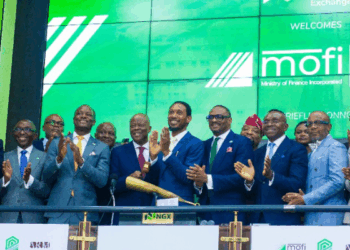

Stanbic IBTC Holdings Plc ranks 5th with a 28.24% Q3 return.

As of September 30, it had a market capitalization of N1.73 trillion and 15,901,769,246 outstanding shares.

The stock opened the quarter at N85.00, traded 174 million shares, and closed at N109, joining GTCO as one of the few banking stocks to cross N100 this year.

An 18.8% rise in July drove much of the gain, followed by a brief August dip before rebounding 9% in September.

- Stanbic’s H1 2025 pretax profit jumped 65.81% to N243.7 billion, driven by a 56.34% growth in interest income to N384.7 billion, indicating strong lending and investment returns.

Year-to-date, the stock is up 89.24%, among the year’s best banking performers.