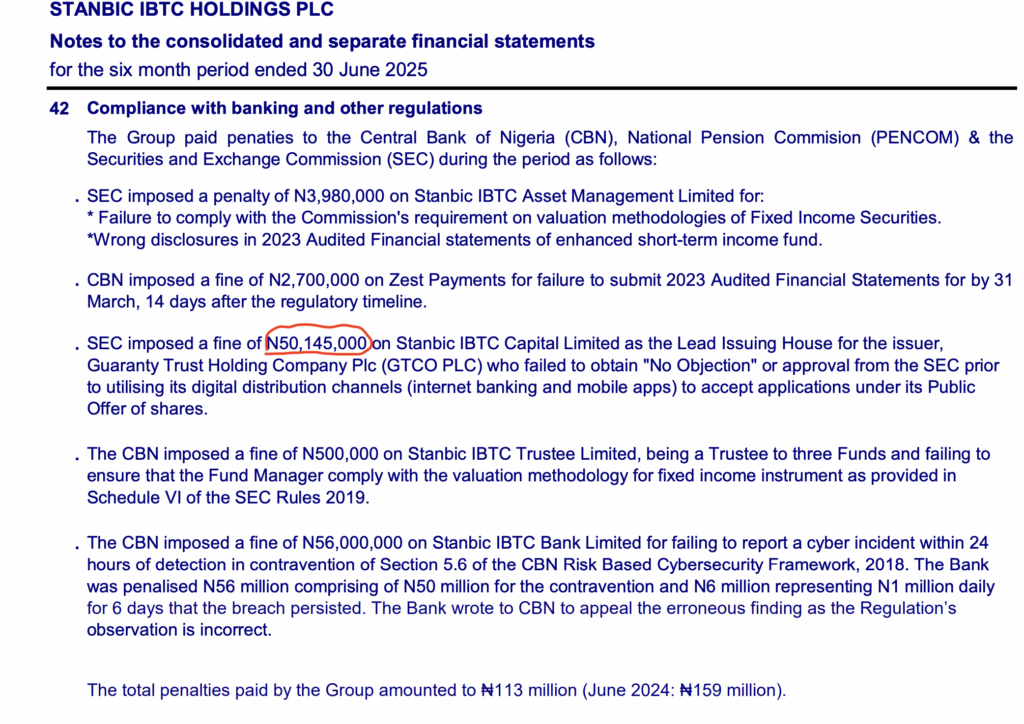

The Securities and Exchange Commission (SEC) has imposed a fine of N50.145 million on Stanbic IBTC Capital Limited for regulatory breaches tied to Guaranty Trust Holding Company Plc’s (GTCO Plc) public offer of shares.

According to Stanbic IBTC’s half-year 2025 financial results, the fine was issued in its capacity as Lead Issuing House for the GTCO offer.

An earlier report from another online media (not Nairametrics) had captured N50.1 billion as the fine, however, notes from the company’s published financial statement indicate a fine of N50.1 million.

The SEC said Stanbic IBTC Capital failed to obtain its mandatory “No Objection” or approval before deploying digital distribution channels such as internet banking and mobile apps to receive applications during the public offer.

Regulatory framework and what went wrong

In Nigeria, SEC requires that issuing houses and other market operators obtain explicit approval from the Commission before deploying digital or electronic channels for public offers.

- This includes when offers are distributed or applications received through internet banking, mobile applications, or USSD platforms.

- Such “No Objection” letters or approvals are intended to ensure investor protections: that documentation, subscription processes, disclosures, and data handling meet regulatory standards, and that the digital process does not circumvent protections found in traditional paper-based offers.

- By using digital distribution without this requisite SEC nod, Stanbic IBTC Capital breached these rules, triggering the fine.

Digital platforms in public and rights offers

The use of electronic / digital offering platforms (“e-offerings”) in Nigeria has been growing rapidly. SEC has, in recent years, been promoting and regulating such platforms.

Under draft guidelines published by SEC, an electronic offering (e-O) allows internet, mobile apps, USSD, and other electronic means to carry out key parts of public offers, such as display of prospectuses or offering memoranda, subscription, payment, and allotment.

- The Nigerian Exchange Group (NGX) has also launched NGX Invest, a digital investment platform that has secured SEC approval to manage public and rights issues via digital/online processes.

- This platform is intended to streamline primary market transactions and increase accessibility for ordinary retail investors, removing some friction associated with physical forms, trips to issuing houses or brokers, and delays.

- SEC also reduced the approval timeline for public offers to 14 days once full documentation is submitted, a move aimed at making the regulatory process more efficient.

However, regulators have stressed that though the process is becoming more digital, this must not come at the expense of compliance.

The need for formal approval before deploying digital channels is part of this: to protect investors, to ensure transparency and fair processes, and to guard against misuse or incorrect disclosures.