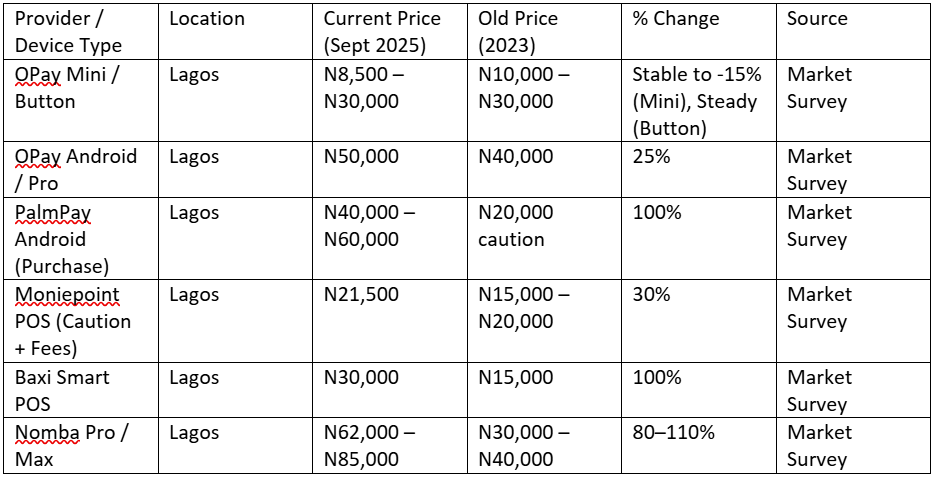

The cost of Point-of-Sale (PoS) terminals in Nigeria has surged between 2023 and 2025, with increases ranging from 30% on the low end to as much as 100% for high-end devices.

The jump, driven by inflation, foreign exchange pressures, and higher logistics costs, is reshaping the business model of Nigeria’s fast-growing agency banking sector.

While entry-level PoS machines that once cost about N15,000–N20,000 now go for around N21,500, more advanced Android and smart terminals have doubled in price, rising from N30,000–N40,000 to between N62,000 and N85,000.

The price increases come even as demand for PoS services continues to grow, particularly in underserved areas where the machines serve as the primary gateway to financial services.

The growth in demand has seen the number of registered PoS terminals in Nigeria jump to 8.3 million as of March 2025, according to data from the Nigeria Inter-Bank Settlement Systems (NIBSS).

PoS terminal price changes (2023-2025)

What fintechs are saying

While some commercial banks also offer PoS to their customers on demand, the PoS market in Nigeria is dominated by fintech companies, which are aggressively pushing out the devices as they onboard more agents.

An official from one of the country’s leading fintechs, who spoke on condition of anonymity, said the increase in costs is unavoidable due to currency volatility and rising logistics expenses.

“The dollar rate is a major factor in all these. Currently, there is no locally produced PoS; all are imported, and the price has to reflect the exchange rates.

“Even the prices you see today are not the true reflection of the associated costs because some of us are more concerned about financial inclusion, and we have to do everything possible, including bearing some costs to ensure that PoS terminals remain affordable,” he said.

Mr. Michael Adewale, whose company acts as a dealer for some of the fintechs to distribute the terminals, noted that fintech companies have adjusted their pricing models to balance affordability with sustainability.

“Before now, some used to give out Android PoS at N20,000 caution, but that is no longer realistic. Now most merchants either pay outright or deposit a higher caution fee,” he said.

- For many young Nigerians, the rising cost of PoS machines is creating barriers to entry into one of the fastest-growing small business sectors.

- The increased costs are also affecting operators with multiple outlets, who now struggle to expand aggressively.

- Some companies are turning to leasing models, where fintechs retain ownership of devices but require higher transaction volumes from agents.

Macroeconomic factors

The price surge is closely tied to Nigeria’s macroeconomic environment. Inflation rose from 21.34% in December 2022 to a record high of 34.60% in November 2024, before moderating to 20.12% in August 2025.

Meanwhile, the naira has depreciated sharply, hovering around N1,500/$ in 2025, compared to N500/$ in early 2023.

With most PoS devices imported and subject to global supply chain costs, local fintechs have limited ability to keep prices down. The lack of local hardware manufacturing also means Nigeria is heavily exposed to FX movements.

What this means

For aspiring PoS agents, the cost of entry into the business has become significantly higher, limiting opportunities for small entrepreneurs.

While fintech companies such as OPay, PalmPay, Moniepoint, and Nomba continue to offer flexible models, ranging from refundable caution deposits to outright purchases, the reality is that PoS businesses are no longer as cheap to start as they were two years ago.

Still, analysts say demand will remain resilient, given the role of PoS in Nigeria’s cash-light economy. For millions of Nigerians in underserved areas, these machines remain their closest access point to formal financial services, regardless of cost.