- By Fatai Asimi

Recently, Fitch Ratings downgraded Afreximbank’s Long-Term Issuer Default Rating (IDR) from ‘BBB’ to ‘BBB-’ with a Negative Outlook.

This decision reflects Fitch’s reassessment of Afreximbank’s credit risk profile stemming from concerns over its exposure to African sovereign borrowers and the management of its loan performance.

Notably, Fitch estimated Afreximbank’s non-performing loan (NPL) ratio at 7.1% for 2024, significantly higher than the Bank’s reported 2.3%.

This discrepancy arises from differing loan classification methodologies and highlights loans to countries like Ghana, South Sudan, and Zambia as problematic due to restructuring or default status.

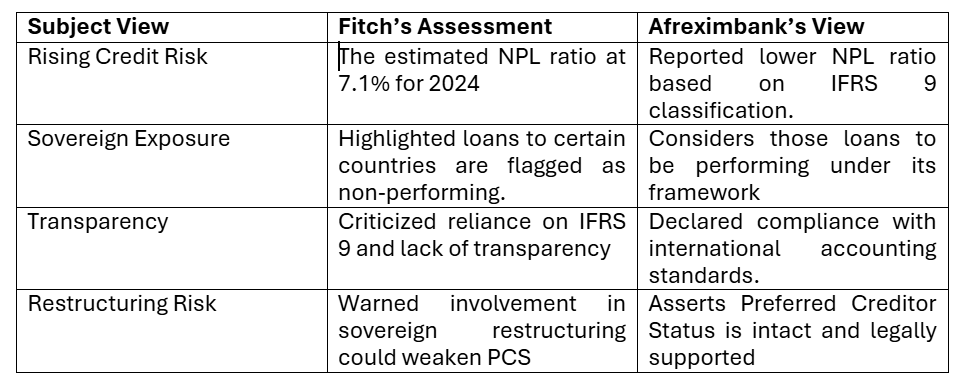

Key Concerns Highlighted by Fitch

- Rising Credit Risk: Fitch flagged concerns about the increased credit risk associated with Afreximbank’s sovereign loan exposure.

- Sovereign Exposure: Specific loans to African countries with restructuring or default were noted, raising alarms about their performance.

- Transparency and Risk Management: Fitch criticized Afreximbank for a perceived lack of transparency and reliance on IFRS 9 standards, suggesting these might understate actual credit risk.

- Restructuring Risks: The agency warned that involvement in future sovereign debt restructurings could weaken Afreximbank’s Preferred Creditor Status, which has been a critical aspect of its creditworthiness.

Afreximbank’s Rebuttal

In response to the downgrade, Afreximbank contended that the evaluation failed to acknowledge the necessary developmental risks it assumes to fulfill its mission as a multilateral development finance institution. The Bank highlighted several points:

- Legal Structure and Preferred Creditor Status: Afreximbank’s legal standing under a multilateral treaty grants it protections typical commercial lenders do not have.

- Alignment with International Standards: The Bank insisted its loan classification and reporting align with IFRS 9, asserting that its reported NPL ratio accurately reflects asset quality.

- Counter-Cyclical Support: Afreximbank emphasized its history of providing support during crises, demonstrating resilience in financial performance, even amid adversity.

The Disconnect Between Global Standards and Development Finance

This situation reveals a significant disconnect between global financial standards and the realities of development finance. The following outlines the perspectives of both Fitch Ratings and Afreximbank:

J.P. Morgan’s Response

In contrast to Fitch’s downgrade, J.P. Morgan upgraded Afreximbank’s bonds for 2029 and 2031 from Underweight to Overweight, primarily due to attractive valuations following the bond spread widening by approximately 65 basis points.

J.P. Morgan acknowledged the increased risk of sovereign debt restructurings but deemed the financial impact on Afreximbank would be limited due to its strong profitability (15% Return on Average Equity), sizable asset base ($37 billion), and ongoing market access.

Afreximbank’s Role in the African Financial Ecosystem

Despite the downgrade, Afreximbank’s role as a development finance institution remains critical. It serves as a linchpin in promoting intra-African trade, supporting industrialization, and enhancing economic resilience.

Recent macroeconomic trends in key African markets—such as Nigeria, Ghana, and Egypt—indicate recovery and reform, further bolstering Afreximbank’s operational outlook.

Recovery and Reform in Key Economies

- Nigeria: GDP growth reached 3.4% in 2024 with expectations for further acceleration due to oil production rebound and strong service sector performance.

- Ghana: After significant macroeconomic strain, Ghana is stabilizing through IMF-backed fiscal consolidation, gradual inflation reduction, and improved debt management.

- Egypt: Structural reforms and strong remittance inflows position Egypt for continued economic resilience.

These developments are crucial not only for Afreximbank’s loan portfolio but also reinforce its mission of promoting sustainable economic growth across the continent.

Supporting Member States: African Solidarity

In light of Fitch’s downgrade, support from African member states and regional institutions has surged, reaffirming Afreximbank’s strategic importance in the African economy.

The African Peer Review Mechanism (APRM) issued critiques about Fitch’s methodology, arguing that the rating agency overlooked Afreximbank’s unique governance structure and developmental mandate.

This collective backing embodies a powerful affirmation of African unity and confidence in homegrown financial institutions, emphasizing the sentiment that Africa will continue to champion its institutions amidst global financial dynamics.

The Need for a Contextualized Credit Rating Agency

The disconnect between global credit rating assessments and Africa’s developmental realities prompts a significant recommendation: the establishment of a contextualized credit rating agency. Such an agency would consider Africa’s unique economic landscape, integrating the following key elements:

- International Standards: Maintain alignment with global frameworks while factoring in local nuances.

- Contextual Risk Factors: Incorporate assessments of informal sectors, political stability, and infrastructure needs.

- Development-Weighted Metrics: Evaluate progress in human capital, climate resilience, and regional integration to reflect sustainability.

- Data Collaboration: Partner with national statistics agencies and multilateral bodies to enhance data quality.

This initiative would focus on enhancing credibility while giving a more holistic view of creditworthiness, ultimately helping to unlock capital for African economies.

Conclusion

Despite its recent downgrade, Afreximbank’s significance as a focal point for development finance in Africa remains unshaken. The institution has continued to demonstrate resilience and a strategic approach to enhancing African trade and industrial capacity.

The divergences in ratings underscore the need for a broader conversation about how Africa’s developmental challenges are assessed and viewed by global financial institutions.

As Afreximbank continues to expand its base and reinforce risk management practices, it is well-positioned to overcome current economic headwinds.

Moving forward, there must be concerted efforts towards greater African solidarity and institutional reform to create a conducive environment for growth and development, strengthening the narrative of self-reliance and sustainable progress in Africa. In this evolving landscape, Afreximbank will play a crucial role in shaping Africa’s economic future.

Asimi is the Head of Research and Chief Economist at PanAfrican Capital Group. For comments, kindly reach out to PAC Research Ltd/Gte via pacresearch@pacresearch.org.