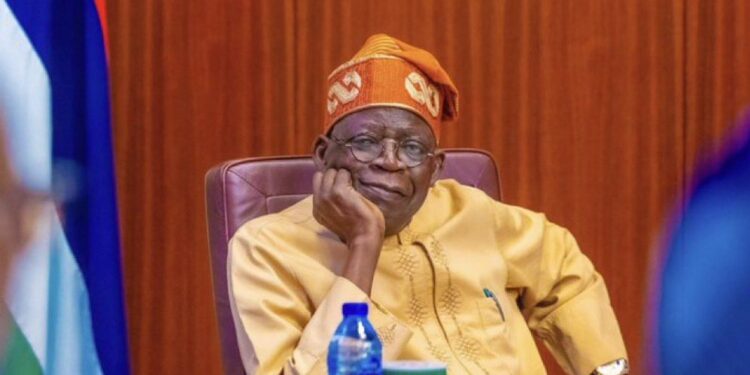

Five months after Asiwaju Bola Ahmed Tinubu was sworn in as president in May 2023, Nigeria’s crude oil production rate has increased by a mere 131,926 barrels per day.

This figure is based on a Nairametrics review of available data from the Nigerian Upstream Petroleum Regulatory Commission (NUPRC).

When Tinubu assumed office in May 2023, Nigeria’s daily crude oil production, including condensates, reached 1,430,146 barrels.

The following month, in June 2023, this output rose to 1,499,416 barrels per day. However, July 2023 witnessed a slight decrease, with production recorded at 1,303,428 barrels daily. August 2023 saw an increase, reaching 1,414,664 barrels per day.

September 2023 marked a significant milestone for the year, as Nigeria achieved its highest production thus far, hitting 1,572,315 barrels per day.

However, in October 2023, there was a minor dip, and production levels slightly decreased to 1,562,072 barrels per day.

Across these months, Nigeria experienced fluctuations in its daily crude oil output, with certain months recording increases and others witnessing marginal declines.

Separate ministers; separate goals

When Bola Ahmed Tinubu was sworn in as Nigeria’s president in May 2023, he separated gas from petroleum, effectively naming Ekperikpe Ekpo as the country’s minister for petroleum resources (gas) and Heineken Lokpobiri as minister of state for petroleum resources. This would be the first of its kind in the country.

The idea was welcomed by many in the industry, stating that it would create room for both ministers to focus primarily on their respective objectives. For Lokpobiri, it would be to increase the country’s crude oil production, for Ekpo; to transition Nigeria to a gas-based economy.

On the part of the oil sector, it is important to note that since assuming his role as minister of state for petroleum resources, Lokpobiri has engaged in multiple meetings with various stakeholders and investors, aiming to strategize and revitalize Nigeria’s energy sector between August and November 2023.

In August 2023, Lokpobiri conducted visits to the Port Harcourt and Warri refineries, where assurances were given that the Port Harcourt facility would resume operations by December 2023, and the Warri refinery would follow suit by the first quarter of 2024.

Throughout September, a series of pivotal meetings occurred: Lokpobiri held discussions with officials from the Shell Petroleum Development Company (SPDC) and also met with representatives from SINOPEC, emphasizing the strengthening of relations and a commitment to boost local oil production.

Additionally, the Minister took charge of resolving a divestment disagreement between NNPCL and ExxonMobil, aiming to augment the country’s oil and gas output.

Later in September, Lokpobiri convened meetings to enhance partnerships, including talks with Shell’s Executive Vice President. He also highlighted Nigeria’s eagerness to operate under the Petroleum Industry Act (PIA) and aiming to achieve a production milestone of over 2 million barrels of oil per day between December 2023 and early 2024.

The minister also made pledges toward localizing petroleum production by engaging operators in supplying crude to modular refineries to meet local demand.

As October progressed, he met with local oil companies like Oando Plc to fortify their ability to effectively manage assets previously owned by international oil corporations.

In November 2023, Lokpobiri signed an energy cooperation Memorandum of Understanding with Saudi Arabia and had discussions with Daewoo E & C Limited and Seplat Energy, aimed at fortifying Nigeria’s refining capabilities and resolving the NNPCL and ExxonMobil divestment dispute, initiated earlier in September 2023.

Why oil production is still not impressive

Despite action steps taken by Lokpobiri and other stakeholders in the Tinubu-led administration, oil production levels are still not as high as they could be. Note that Nigeria has consistently failed to meet its 1.7 million barrels per day quota assigned by OPEC.

Some analysts are of the opinion that until the government and operators effectively put a stop to crude oil theft and vandalism in the Niger Delta region, investors, both existing and potential, can only make pledges and may not be willing to risk having their assets vandalized in the region.

Note that from May 2023 to the first week of November 2023, weekly data from the Nigerian National Petroleum Company Limited (NNPCL) reviewed by Nairametrics shows that there have been over 5,000 crude oil theft incidents across the oil-producing areas of the country.

The NNPCL keeps providing weekly data on these incidents despite efforts by Nigerian security agencies and third-party partners like the Tompolo-led Tantita Security Agency to curb the menace.

Industry analysts highlight that, apart from the issue of crude oil theft, maintaining consistent transparency within the oil sector holds significant potential to attract more investors.

They advocate for transforming the industry from a closed-off environment to an open and accessible sector, where real-time data on activities like seismic surveys, drilling, and environmental impact assessments are readily available to both investors and the public.

By enhancing transparency and making industry-related information easily accessible, this shift aims to create a more informed and inclusive environment. It is anticipated that such openness will empower potential and current investors to swiftly make informed business decisions.

This proactive decision-making, facilitated by access to comprehensive and up-to-date data, could not only lead to increased oil production but also reshape the Nigerian oil sector’s image.

Oil market analyst, Dan D. Kunle told Nairametrics:

- “The envisioned transparency within the industry would provide investors with a clearer understanding of ongoing activities and potential opportunities. It allows them to gauge the impact of their investments and ensures alignment with industry practices and environmental regulations.

- “This transparency does not only benefit investors; it also allows the public to comprehend the industry’s operations and associated impacts.”

However, in September 2023, the special adviser on energy to President Tinubu, Ms. Olu Verheijen revealed that the administration had secured $13 billion worth of oil and gas investment from Chevron, Total, Shell, NAOC, Exxon Mobil, Seplat, Heirs Holdings, Waltersmith, First E&P, and others. According to her, it is anticipated that the $13.5 billion in short-term investment components, currently in the pipeline, will pave the way for the delivery of 2.1 million barrels per day production by December 2024, barring any unforeseen challenges.

.gif)