Late Thursday, the Dow Jones futures and S&P 500 futures both climbed modestly, boosted by Nike shares. After a solid session for the stock market rise, Nasdaq futures were flat. JPMorgan Chase (JPM), Goldman Sachs (GS), and other large financials passed yearly stress tests, while FedEx (FDX) and Nike (NKE) were notable movers on results overnight.

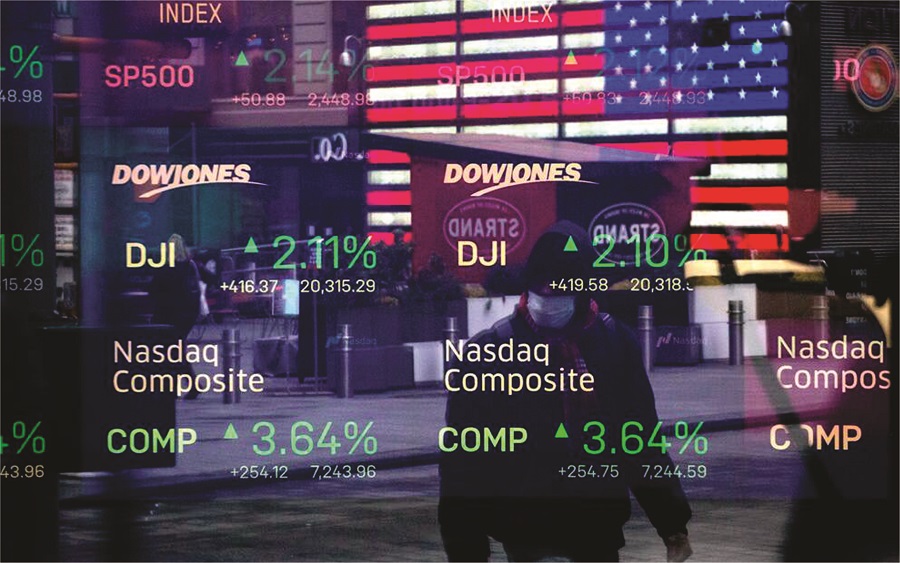

The S&P 500 gained over 1% to close at 4,266.49, retaking its previous high set on June 14 and totally recouping the losses caused by the Federal Reserve’s surprise policy shift. The Dow Jones Industrial Average rose 322.58 points, or 1%, to 34,196.82, putting it within 2.6% of its all-time high. The Nasdaq Composite increased by 0.7% to 14,369.71, a new high.

President Joe Biden has praised the bipartisan plan, which is anticipated to pass Congress alongside a separate bill that will invest trillions more on “human infrastructure,” as he put it. Given the political schisms in the United States, neither bill is certain to gain enough support from a broad range of lawmakers.

Following a week of gains, the benchmark 10-year US Treasury Yield remained barely changed. Investors were unfazed by the latest remarks from Federal Reserve officials, who reaffirmed supportive policies while hinting that extraordinary stimulus would be progressively reduced.

Nike’s fiscal fourth-quarter revenue jumped by 96% to $12.3 billion, erasing a year-earlier loss. Sales in North America increased by 141% to $5.4 billion. Also, despite demands for a boycott and tougher year-over-year comparisons, sales in China increased.

During the Nike earnings call, the Dow Jones powerhouse predicted sales of more than $50 billion for the upcoming fiscal year, much above analysts’ expectations of $48.5 billion.

In overnight trading, Nike stock increased by 12% to almost $150. This indicates a break over a 148.05 purchase target, with the 50-day and 200-day lines soaring.

Bank stocks rose ahead of the Federal Reserve’s annual bank stress test results, which were expected after the bell on Thursday. The test looks at how well banks perform throughout various economic downturns. During the epidemic, banks were forced to halt dividends and stock buybacks. These findings should give them the green light to increase rewards in the future. Goldman Sachs’ stock increased by 2.1%, while JPMorgan gained about 1%.