This Earnings Press Release should be read in conjunction with the Unaudited Financial Statements for the period ended March 31, 2020. The Earnings Press Release and the Unaudited Financial Statements for the period ended March 31, 2020, are available on our website right here.

This analysis is dated April 20th, 2020. Unless otherwise indicated, all amounts are expressed in Nigerian Naira and have been primarily derived from the Group’s Financial Statements, prepared in accordance with the International Financial Reporting Standards (“IFRS”). The accounting policies used in the preparation of these financial statements are consistent with those used in the Group’s Unaudited Financial Statements for the period ended 31 March 2020. Additional information relating to the Group is available on the Group’s website.

Highlights of the result; Statement of Profit or Loss:

- Revenue: N1.92 billion in Q1 2020, compared to N1.45 billion in Q1 2019 (32% YoY Increase)

- Operating Income: N1.89 billion in Q1 2020, compared to N1.35 billion in Q1 2019 (40% YoY Increase)

- Operating expenses: N0.74 billion in Q1 2020, compared to N0.68 billion in Q1 2019 (9% YoY Increase)

- Profit Before Tax: N1.18 billion in Q1 2020, compared to N0.77 billion in Q1 2019 (53% YoY Increase)

- Profit After Tax: N0.99 billion in Q1 2020, compared to N0.64 billion in Q1 2019 (54% YoY Increase)

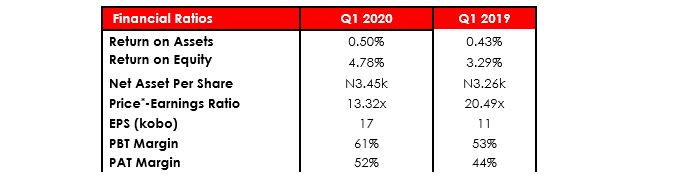

- Earnings per Share: 17 Kobo. (2019: 11kobo)

Statement of financial position

- Total Assets: N197.41 billion, compared to N150.46 billion as at FY 2019 (31% YTD growth)

- Total Liabilities: N176.69 billion, compared to N130.88billion as at FY 2019 (35% YTD growth)

- Shareholders Fund: N20.72 billion, increased by 6% YTD as at FY 2019 N19.59 billion.

Comparing Q1 2020 with Q1 2019, there are a few points to note such as:

− Total Revenue: United Capital Plc’s total revenue increased significantly by 32% year on year, on the back of the company’s 55% increase in fee and commission income and 223% increase in net interest margin as well as a 149% growth in Net trading income.

− Cost-to-Income ratio: This improved significantly, recording 39% in Q1 2020 compared to the 47% recorded in the same period last year, as the Group continues to implement its cost-containment measures.

− PBT Margin: During the period under review, PBT Margin stood at 61% on the back of revenue growth and sustained implementation of cost containment measures.

(READ FURTHER: United Capital Plc announces notification of Board meeting, closed Period)

− PAT Margin: During the period under review, PAT Margin stood at 52% on the back of revenue growth and sustained implementation of cost containment measures.

− Total Assets: Total Assets grew YTD by 31% as a result of the 154% increase in cash and cash equivalent and 2% increase in Trade and other receivables.

− Total Liabilities: This increased by 35% owing to the growth in short term investment by 57.50%, trust funds by 79.17% and sinking funds by 92.25%. In aggregate, the Group’s managed funds grew by 61%.

− Shareholders’ Fund: The Shareholder’s wealth grew by 6% YTD on the back of the increased PAT leading to a 6% growth in retained earnings.

While commenting on the group’s performance, the Group CEO, Mr. Peter Ashade, had this to say:

“Year 2020 has posed a lot of challenges to the Nigerian economy – as we saw decline in oil prices- the operating environment was also impacted negatively, with the exchange rate becoming more volatile, continued fall in rates in the money market as well as bearish sentiments in the capital market. Our business was not immune to these challenges; however, the Group was able to endure the first quarter of the year. Thanks to our well-articulated and diligent implementation of our plans set out last year, we were able to deliver a 32% year on year increase in revenue and 53% increase in PBT. This increase was generated basically from our margin on investments and the 55% YOY increase achieved on our Fees and commission income as well as a 149% growth in net trading income. Our investment income shrank this quarter due to the drop in returns in the money market.

“As we work into the coming quarters, we are constantly reviewing our strategy in light of the current global pandemic in the wake of COVID-19. As a Group, we were able to invoke our business continue framework which has worked immensely well over the past few weeks as we have been able to stay afloat with our work-force working remotely to ensure the continued operations of our business.

“In line with our initial strategy for the 2020 business year, we shall continue to push further our market diversification and cost-optimization initiatives as well as implement phased automation of our business processes whilst upholding our commitment to ensuring a significant improvement in our value delivery to all our stakeholders.”

_____________________

Peter Ashade

Group CEO

COMPANY UPDATE:

Following the release of our Q1 2020 result, we shall be hosting an Investors and Analysts conference call in due course to discuss our performance and overall outlook for the next quarter of 2020. The date and further details with respect to the conference call would be circulated in due course.

Lagos Nigeria – XX April, 2020 – United Capital Plc, (NSE: UCAP, Bloomberg: UCAP:NL, Financial Times: UCAP:LAG) announced its Unaudited Financial Statements for the period ended March 31, 2020. During the period under review, the Group showed significant growth in key indicators despite the challenging global economic climate. Total Revenue in Q1 2020 soared to N1.92bn from N1.45bn in Q1 2019, an increase of 32% while PAT grew by 54% YOY. Total Assets grew by

31%, being well financed by a 35% increase in Liabilities and 6% increase in Shareholder’s fund.

EDITOR’S NOTE: This is a sponsored content.

.gif)

1. Revenue: N92 billion in Q1 2020, compared to N1.45 billion in Q1 2019 (32% YoY Increase)

2. Operating Income: N89 billion in Q1 2020, compared to N1.35 billion in Q1 2019 (40% YoY Increase).

Please recheck the highlights of the results the numbers are not correct

This is a very shabby report. I didn’t expect such from Nairametrics; kindly review and repost. Thanks

Please review as there are many errors in the figures -i.e the Revenue for Q1:2020 being quoted as N92billion whereas it is N1.92billion.